- Jump to:

- Main features of the best DMA Forex brokers

- Direct Market Access

- How Does It Works

- Direct Market Access CFDs

- Key Features

- Advantages and Disadvantages

DMA stands for Direct Market Access and refers to a type of trading that allows clients to trade directly with large banks, market makers, and liquidity providers. Trading in this manner enables traders to obtain the best possible prices without using a dealing desk.

Plus500 USThis content applies only to Plus500 US and clients from the United States. Trading futures involves the risk of loss.

Plus500 USThis content applies only to Plus500 US and clients from the United States. Trading futures involves the risk of loss. eToro50% of retail investor accounts lose money

eToro50% of retail investor accounts lose money Fusion Markets74-89% of retail's CFD accounts lose money

Fusion Markets74-89% of retail's CFD accounts lose money FP Markets73.85% of retail investor accounts lose money

FP Markets73.85% of retail investor accounts lose money Global Prime74-89% of retail CFD accounts lose money

Global Prime74-89% of retail CFD accounts lose money Pepperstone72.9% of retail investor accounts lose money

Pepperstone72.9% of retail investor accounts lose money

Below is a comparison table of Forex brokers that offer Direct Market Access (DMA) trading. We rank them according to several factors, including regulation, spreads and commissions, Trustpilot ratings, trading instruments, trading platforms, and deposit and withdrawal methods.

Our team has thoroughly evaluated all brokers listed below using TradingPedia’s exclusive methodology.

Main Features of the Best DMA Forex Brokers

- Brand

- Trading platforms

- Minimum deposit

- Regulations

- Trading instruments

- Spreads

- Leverage for Forex CFDs

- Leverage for Crypto CFDs

- Leverage for Indices CFDs

- Deposit methods

- Withdrawal Methods

- Commission per Lot

- Contact details

Normally, Forex and stock brokers offer DMA accounts only to institutional, professional, or VIP clients. Many Forex brokers do not provide DMA order execution at all; instead, they operate through a dealing desk and are also known as market makers. However, an increasing number of brokerages have decided to offer retail traders Direct Market Access, working directly with major banks operating in the interbank market. This is how they ensure their clients can get the best prices possible.

What Is Direct Market Access?

Direct Market Access, or DMA, is a term you will often encounter in trading and financial markets. It describes a method of electronic securities trading that allows investors to trade financial instruments and interact directly with the order book—the list of orders and prices—of an exchange or another market, without intermediaries.

Usually, this type of trading—on the order book—is restricted to members of the exchange, including market makers, sell-side firms, and broker-dealers. However, by utilizing DMA, investment companies (or buy-side firms) and private traders can take advantage of the sophisticated technology infrastructure of sell-side firms such as investment banks and the market access those firms have.

This may sound complicated, but the emergence of fully digital, internet-based trading systems has made DMA more accessible than ever. Direct Market Access is also used in Forex trading and is a type of order execution that offers traders direct access to the market. This enables them to place trading orders with liquidity providers such as other brokers, major foreign-exchange banks, and market makers.

How Does Direct Market Access Work?

In Forex trading, Direct Market Access operates through sophisticated technology infrastructure, usually owned by sell-side firms. DMA brokers deal directly with the banking institutions trading on the interbank market—these banks provide liquidity and handle huge volumes of foreign currencies. Brokers aggregate bid-ask prices from these liquidity providers and transmit them to their clients, allowing traders to see actual market prices rather than quotes from the broker.

Traditionally, brokers would make the market for their clients; they would take the other side of a trade, effectively trading against the client. They provide both a buy and a sell quote, making a profit from the spread—the difference between the buy and sell price. This structure is called a dealing desk, and it is the most common brokerage model. DMA brokers, on the other hand, do not pass their clients’ orders through a dealing desk, which is why they are also known as No Dealing Desk (NDD) brokers, a term that has already been discussed in this guide.

When clients work with DMA brokers, they receive several quotes and choose a particular bid-ask price from one of the liquidity providers. The broker then sends the order directly to the interbank market for execution; the transaction is immediate. Along with bid and ask prices, clients can also see the so-called market depth—who is buying or selling at a particular price and how much trading volume the other party is looking to trade at that price.

Since DMA brokers are also NDD brokers, some traders believe that DMA is the same as STP or ECN, the two NDD models. These abbreviations refer to Electronic Communication Network (ECN) and Straight Through Processing (STP). However, ECN brokers are not the same as DMA brokers—although both display market depth and show prices from the interbank market, ECN or ECN+STP brokers may send their clients’ orders to prime brokers rather than directly to liquidity providers. True DMA offers only market execution (as opposed to instant execution), variable spreads, five-digit pricing, and optional depth-of-market access.

Direct Market Access CFDs

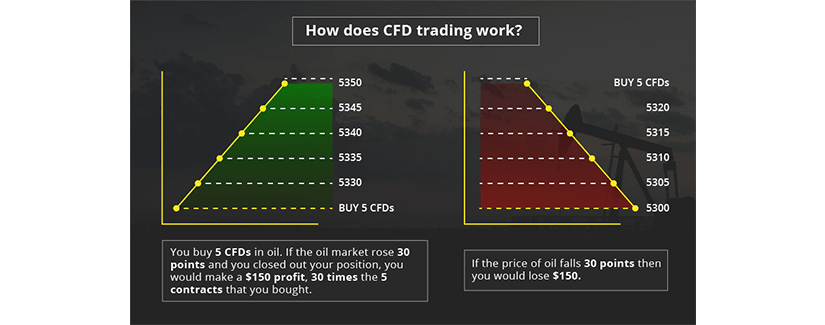

It is also important for traders to understand the concept of DMA contracts for difference (CFDs). Many DMA brokers offer CFD trading, a type of derivative trading in which traders speculate on the rising or falling prices of fast-moving markets and instruments such as foreign currencies. In most countries, CFDs are an over-the-counter (OTC) product and are usually traded using the Direct Market Access model.

The idea is slightly confusing, though, since OTC means there is no actual market to have direct access to. Traders may see a DMA offering for a CFD instrument on their computer, but when they trade it, they do not buy or sell the actual currency or another type of CFD. Instead, they enter into a contract for difference, or CFD, with the price provider at the price shown. The provider then hedges the price by placing a cash order into the order book on its own behalf.

Many traders prefer this type of trading because the CFD price is based on the underlying market price for the instrument rather than a price quoted by the provider. There are often higher fees for this service compared with non-DMA CFD services, but the overall costs for traders remain lower due to the tighter spreads.

Key Features of DMA Forex Brokers

As we have mentioned above, DMA Forex brokers usually work directly with liquidity providers and are able to offer their clients faster order execution and better prices. These brokerages are typically larger firms with years of experience in financial markets, properly obtained licenses, and an overall good reputation in the industry. There are many other key features of DMA Forex brokers and DMA trading as a whole that every trader should be aware of:

- DMA offers lower transaction costs because traders pay only for the technology behind the process. Fees are either a fixed markup to the client’s dealing price or a small commission.

- Orders are handled directly by the price provider but are facilitated by agency brokers. DMA brokers are not market makers or liquidity providers on the DMA platform they offer their clients.

- There is no information leakage.

- DMA allows the trader to ‘trade the spread’ of the stock.

- DMA Forex brokers offer market execution with no requotes.

- DMA Forex brokers provide a trading environment where traders can privately execute trades at neutral prices influenced solely by global Forex market conditions, most notably supply and demand. Market volume and volatility also affect prices.

- There is no conflict of interest in DMA trading, mostly because of the lack of a dealing desk and intermediaries in the trade. DMA brokers are not market makers.

- With this type of trading, retail clients access true market depth and have equal access to the order book.

- Forex DMA market structures display variable spreads rather than fixed spreads, which are indicative of dealer platforms.

Advantages and Disadvantages of DMA in Forex

Using DMA in Forex trading offers many advantages, but there are also certain risks that should be taken into account. Traders who are new to this type of trading or are just entering the world of Forex need to remember that any investment involves a degree of risk when real money is at stake. The type of execution and the specific access to the market are irrelevant in this sense. Still, there are a few advantages and disadvantages of using Direct Market Access in Forex trading.

The prices shown in DMA structures are streamed directly from the liquidity providers, which are committed to their bid/ask offers. This means there will be no rate rejections, requotes, or partial fills. However, most DMA brokers add a small fixed markup to their spreads. The good news is that there is no additional commission.

Another obvious advantage of using DMA over market makers is that orders are executed more quickly because they do not have to go through an intermediary. Of course, traders benefit from full market transparency since they can see actual orders and prices in the interbank market. In traditional trading, clients simply receive quotes from their brokers without any information on how these prices have been formed (supply and demand, traded volumes, economic news, etc.).

Direct Market Access comes with a few drawbacks as well. First, prices are not necessarily better than those offered on the over-the-counter market. Because there are no fixed spreads in DMA trading, clients may end up paying more with dynamic spreads. Forex brokers usually charge substantial fees if a DMA account stays inactive for a long time.

Second, the minimum deposit requirements for opening a DMA account are often higher since these accounts are typically designed for institutional and professional traders. Moreover, some brokers levy penalties for clients who do not trade often enough.

If you are interested in trying brokers that use DMA, below you will find a list of some of the largest and most respected firms on the internet. As these brokers have years of experience, they are trustworthy and provide professional services to their clients:

- Hot Forex

- FXOpen

- FX Pro

- FXCC

- NORD FX