Spot Gold was on course for its second consecutive weekly advance ahead of the delayed September PCE inflation report, which may provide more clues on the Federal Reserve’s monetary policy trajectory.

Traders were still weighing the latest US private payrolls numbers, which cemented expectations of an interest rate cut by the Fed next week.

Employers in the US private sector cut 32,000 jobs in November, which has been the largest drop in payrolls since March 2023. The ADP figures heightened concerns over a cooling US labor market and also aligned with dovish remarks by Fed officials.

Markets are now pricing in about an 87% chance of a 25 basis point Fed rate cut in December, compared to an 85% chance a week earlier.

Markets are also pricing in three additional rate cuts by the end of 2026.

Lower interest rates tend to reduce the opportunity cost of holding Gold, which pays no interest.

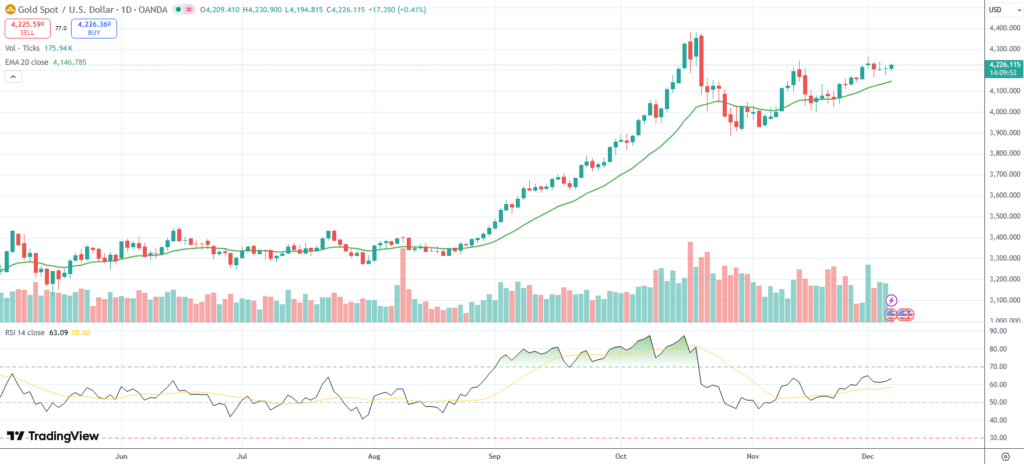

Spot Gold was last up 0.41% on the day to trade at $4,226.11 per troy ounce.

The precious metal has risen 0.25% so far this week.

Strong central bank buying, US tariff policies, potential rate cuts by the Federal Reserve, robust ETF inflows and geopolitical uncertainty have fueled Gold’s rally to a series of record highs this year. Its current all-time high stands at $4,381.21/oz.