Key Moments:

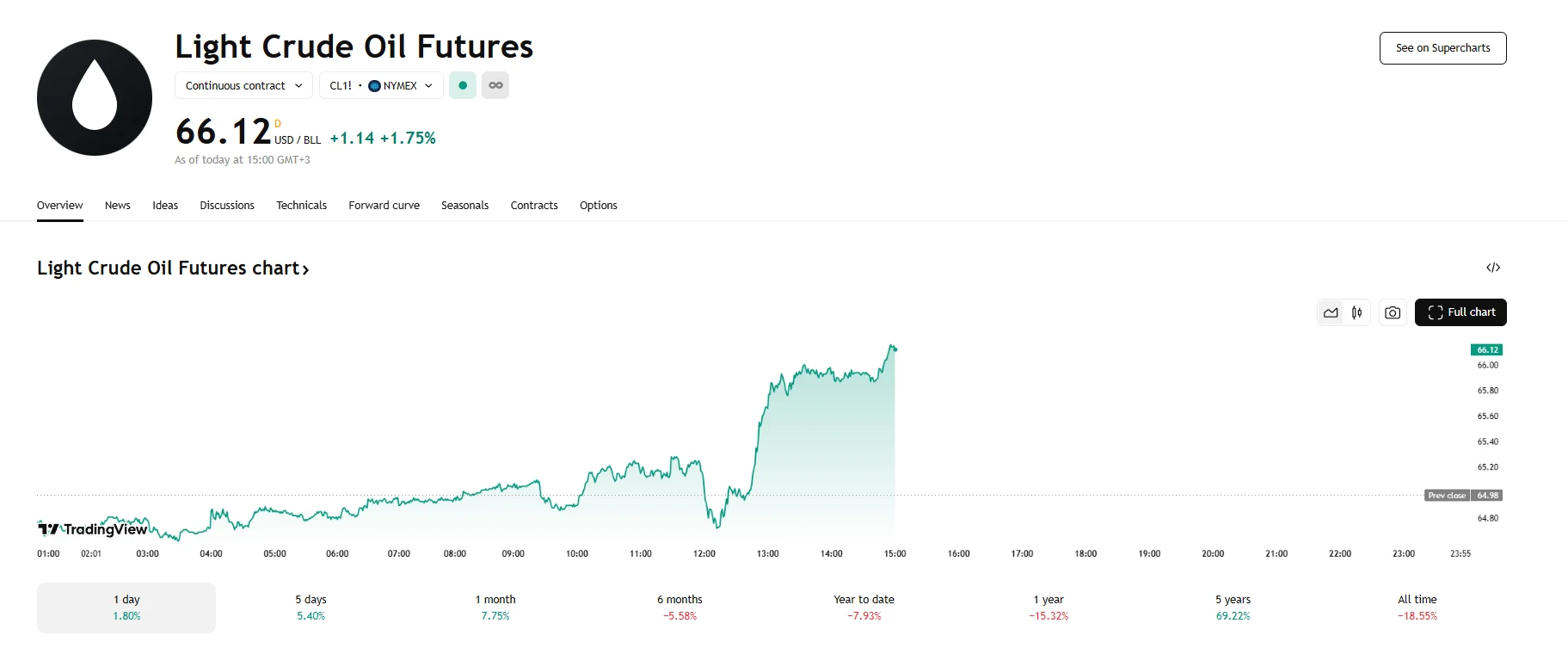

- West Texas Intermediate (WTI) crude futures rose to $66.12 during today’s trading session, climbing $1.14 or 1.75%. Brent surged as well, rising 1.42% to $67.82.

- OPEC+ plans to increase production by 411,000 barrels per day in July.

- According to API data, US oil inventories declined by 370,000 last week.

Crude Oil Extends Gains

WTI futures advanced to $66.12 on Wednesday, a 1.75% gain buoyed by a mix of supply dynamics, improving diplomatic signals, and rising geopolitical risks. Brent crude also gained, climbing 1.42% to $67.82.

Investor confidence grew after trade talks between the United States and China signaled progress. The two economies have reached a preliminary agreement to restore their trade truce and ease restrictions on rare earth exports. Given their status as the world’s two largest oil consumers, reduced trade tensions have alleviated some immediate pressure on demand and, therefore, prices.

Some apprehension remains, however, as highlighted by PVM analyst Tamas Varga. According to Varga, traders remained uncertain about whether this advancement would truly result in stronger economic activity or higher oil demand.

OPEC+ Supply Increase May See Offset from Domestic Consumption, Geopolitical Tensions Add a Risk Premium

July will mark the fourth consecutive month of output boosts by OPEC+, as the organization intends to expand production to 411,000 barrels per day. While news of this nature has historically served to pressure crude prices, analysts suggest that the actual impact on the global supply will be limited. They commented on how domestic demand within member countries could deplete much of the added supply.

Mounting geopolitical concerns also contributed to oil’s rally as US President Trump expressed doubts about Iran’s intentions regarding uranium enrichment. Meanwhile, Iranian officials warned that a failure of diplomatic talks could result in potential strikes on US military bases.

Crude prices could see further upward momentum if official data confirms a reduction in US crude inventories. This anticipation follows preliminary figures from the American Petroleum Institute (API) showing a 370,000-barrel decrease in stockpiles last week. Analysts are also forecasting a 2.4 million barrel reduction in the upcoming US Energy Information Administration (EIA) figures, a key factor for market participants.