Key Moments:

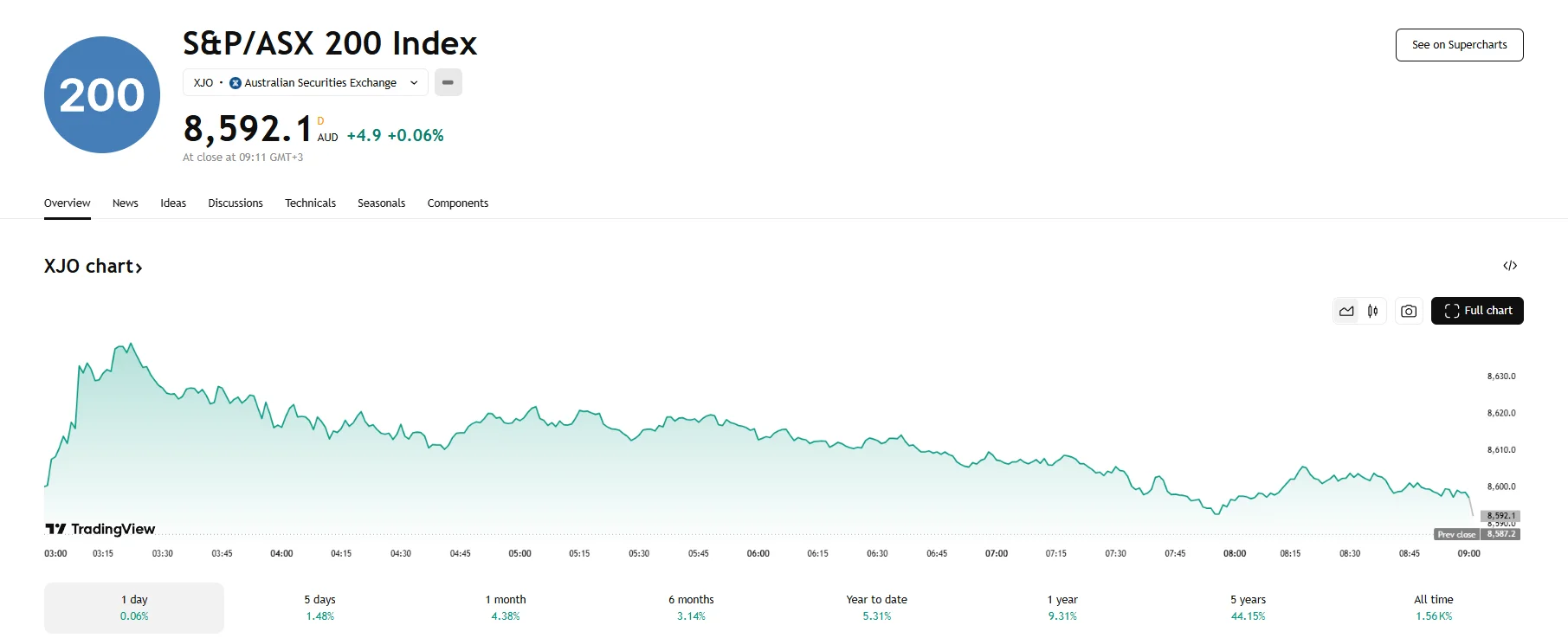

- The S&P/ASX 200 closed 0.1% higher at 8,592 on June 11th, holding near four-month highs.

- The World Bank reduced its global GDP growth outlook to 2.3%

- Market participants are almost certain that the RBA will move forward with a 25-bp rate cut in July.

ASX 200 Holds Strong Near Four-Month Peak

Australia’s benchmark S&P/ASX 200 index added 0.06% to settle at 8,592 on Wednesday, maintaining its position near a four-month high of around 8.639 despite trimming its earlier advances. Investor sentiment remained cautious as the final stages of a proposed US-China trade agreement await approval from each country’s leadership. Both sides are working toward a framework to reduce long-running trade tensions.

Compounding investor hesitation, a US federal appeals court permitted the continuation of broad tariffs while it reviewed whether presidential authority was exceeded. This decision added complexity to the global trade landscape and sparked further market apprehension.

Mining and Energy Stocks Lead, Banks Underperform

Sector performance was mixed, with resource-related stocks lifting the index. BHP Group rose 1.5%, Fortescue climbed 3.5%, and Northern Star advanced 0.8%. Financials lagged the broader market as Commonwealth Bank of Australia (CBA) and National Australia Bank (NAB) each dipped 0.3%.

Zip Co Limited outperformed all other components amid a 15.45% rally that followed the update of the company’s 2025 guidance. Fletcher Building also achieved double-digit gains as it closed 10% higher at A$3.08. In terms of losses, Lynas Rare Earths sank 8.22% to A$8.60 by the time the trading session ended. Beach Energy Limited and Perseus Mining Limited also fell by 7.49% and 5.97%, respectively.

World Bank Growth Downgrade Adds to Pressure, Markets Anticipate RBA Easing Cycle

The World Bank downgraded its global GDP forecast and now projects growth of just 2.3%. The revision reflected ongoing concerns over global tariffs and escalating risk factors impacting economies worldwide.

Interest rate expectations, meanwhile, have shifted sharply in domestic markets. According to traders, there is now a 97% likelihood that the Reserve Bank of Australia will slash rates by 25 basis points next month. Moreover, projections indicate total policy easing could bring the cash rate down to 3.1% by the end of the year.