Key Moments:

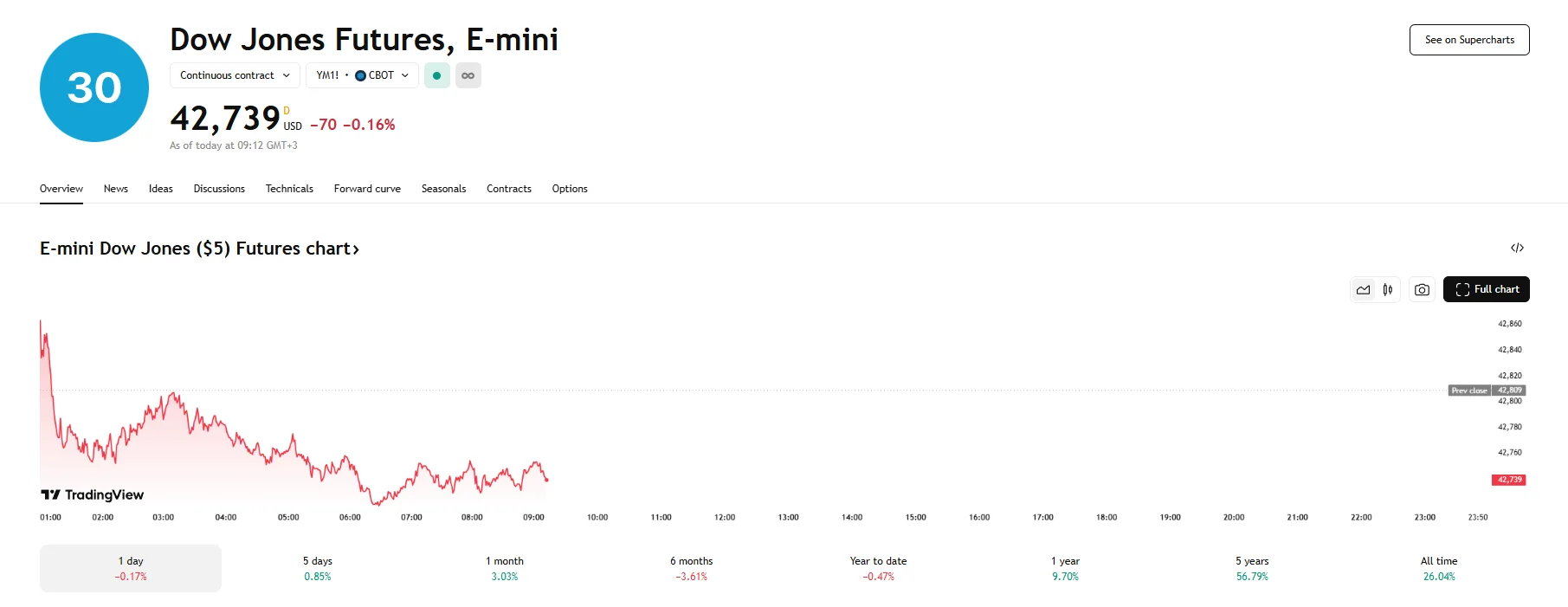

- Dow Jones futures slipped by 70 points as markets awaited key economic data and trade developments.

- S&P 500 and Nasdaq e-minis slipped 0.17% and 0.24%, respectively, after last week’s impressive performance.

- US-China trade negotiations are set to restart in London.

Equity Futures Decline Ahead of Critical Economic Updates

US stock index futures were under slight pressure as the markets braced for pivotal developments on trade discussions and upcoming inflation announcements later in the week. The Dow Jones Industrial Average futures dropped by 70 basis points, reflecting a 1.16% decline. S&P 500 contracts, meanwhile, edged 0.17% lower to 5,996.50. As for futures tied to the tech-heavy Nasdaq 100, they declined by 51.75 basis points.

Pullback Contrasts Last Week’s Rally

Today’s market movements follow a successful Friday trading session, which saw all three major indices achieve gains on news of a restart of US-China negotiations. The Dow Jones closed 1% higher, as it accumulated around 443 basis points and closed at 42,762.87. Notable components include Salesforce, Amazon, UnitedHealth Group, Chevron, Cisco Systems, and American Express, all of which leaped by over 2%.

S&P 500 also rallied 1% and managed to hit the 6,000.36 mark, and its top-performing stock was Palantir Technologies, which rose 6.51% to $127.72. Moderna was not behind with its 5.13% gain. Last but not least, the Nasdaq 100’s 214.36-basis-point climb saw its end the session at 21,761.79. Palantir was once again the stock that advanced the highest, while Shopify was a close second and jumped 6.07% to $111.41. Marvell Technology was another impressive performer that soared by 4.90%, while Tesla, Alphabet, and Starbucks were among the corporations whose stocks rose by over 3%.

Trade Talks Boost Investor Focus

Attention turned to the upcoming meeting between the US and China, officials which are scheduled to resume in London. US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng will helm their respective delegations in the talks, positioning discussions as a continuation of prior negotiations held in May. Investors are hoping for signs of breakthroughs that could ease tension and bolster global economic stability.

Communication between the two countries appears constructive, as President Donald Trump has stated that he had “a very good phone call with President Xi Jinping” during which they discussed details regarding a recently signed deal. According to Trump, the call had lasted around an hour and a half and “resulted in a very positive conclusion for both countries.”