Key Moments:

- The US Transportation Department has determined that electric vehicles were incorrectly factored into the previous fuel economy rule’s target setting.

- EVs will be excluded from credit calculations.

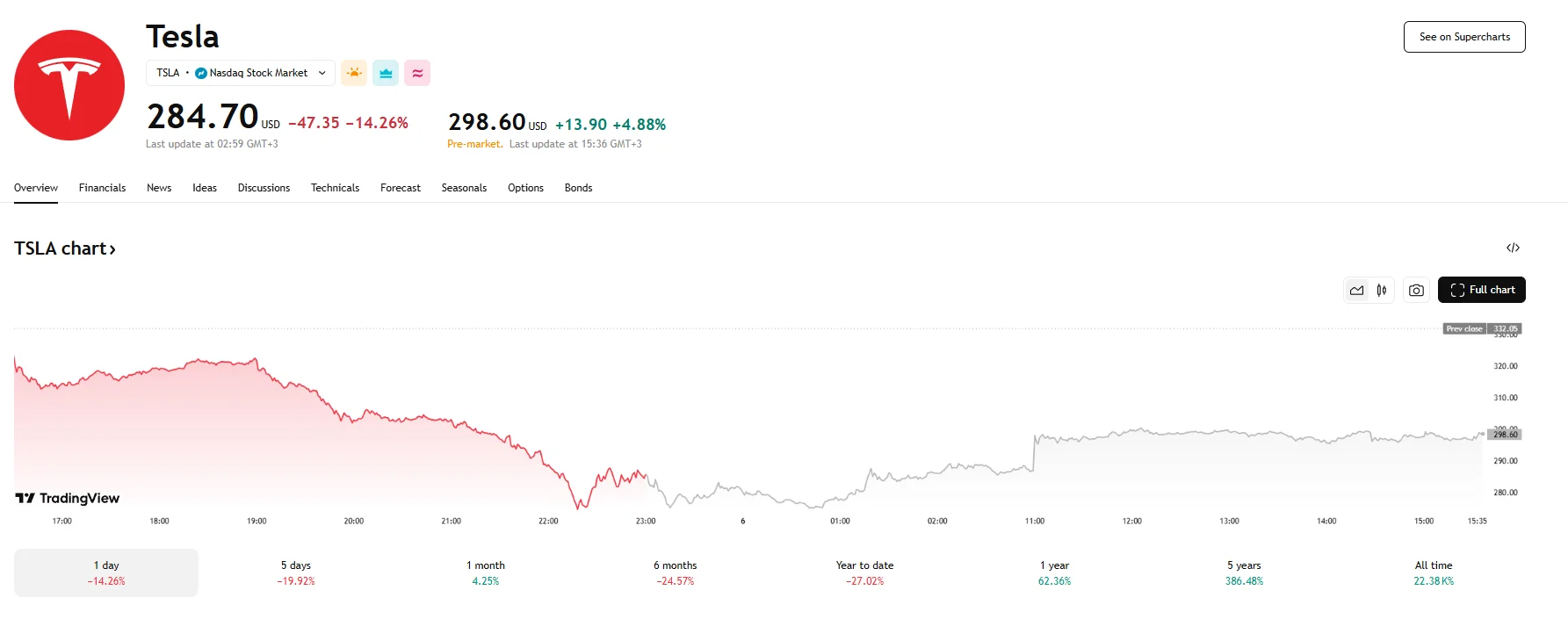

- Telsa’s shares rose over 4% during pre-market hours after yesterday’s 14.26% slump.

Regulatory Reversal on EV Standards, Tesla Stock Soars

According to a US Transportation Department announcement issued on Friday, the Biden administration’s fuel efficiency regulations went beyond legal authority by factoring in electric vehicles in their targets. The news was followed by a boost in interest when it came to Tesla shares, which had fallen over 14% by the end of the previous trading session due to a dispute between owner Elon Musk and US President Donald Trump over a Republican budget proposal.

Dispute With Trump Shakes Investor Confidence

The fallout from the clash cut more than $150 billion off Tesla’s market capitalization, knocking the company below the $1 trillion mark once again. The turmoil added to investor concerns that were already heightened by lagging sales performance earlier in the week.

This week saw Musk vocally oppose the budget bill backed by Trump, who in turn expressed disappointment with Musk’s stance and claimed the Tesla CEO was reacting to proposed spending cuts affecting EVs and solar energy. The initiatives, he stressed, were previously enacted under former US President Joe Biden. As a result of the back-and-forth, Tesla’s stock suffered declines.

Tesla’s Stock Price Hits $298.60

After tensions between Musk and Trump cooled, confidence in Tesla rebounded by over 4.8% to $298.60 during pre-marking trading on Friday as investors assessed the US Transportation Department’s revised stance and the issuing of the rule dubbed “Resetting the Corporate Average Fuel Economy Program.”

By removing electric vehicles from eligibility in calculating credits and compliance metrics, fuel economy requirements could now be adjusted downward. An additional rule update is anticipated from the White House. It is expected to address and modify the actual numeric fuel economy standards.

Besides regulatory updates, market participants also anticipate Tesla’s planned rollout of its robotaxi service in Austin, Texas. Scheduled sometime in June, the initiative could serve as a potential turning point for the stock.