Key Moments:

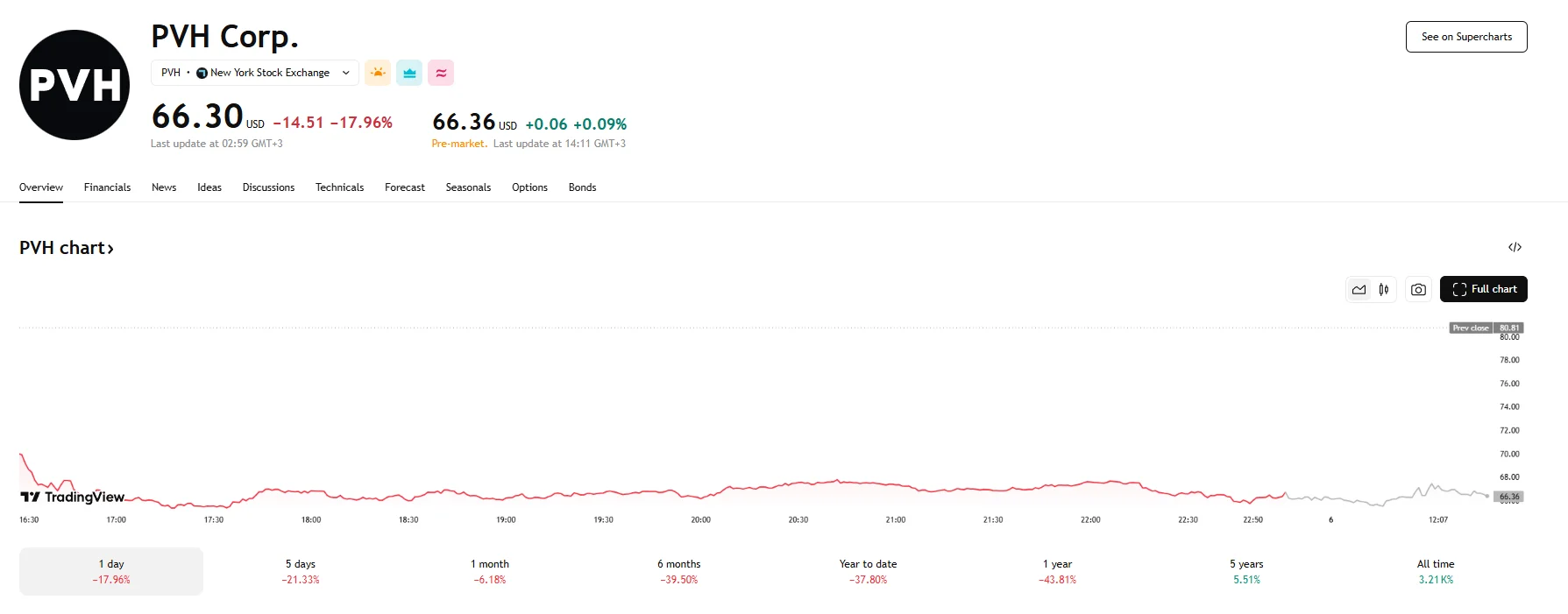

- PVH’s stock dropped more than 18% to close at $66.30 on Thursday.

- Q1 EPS reached $2.30, up from the anticipated $2.23, while revenue increased 2% to $1.98 billion.

- The updated fiscal 2026 EPS forecast of $10.75 to $11 failed to meet expectations and stands well below prior guidance.

Market Reaction to Forecast Overhaul

PVH Corp. saw its stock plummet by the time markets closed on Thursday, with its price sinking 18% to end the session at $66.30. The stock shows little signs of recovery during Friday’s pre-market hours and remains below $66.60 at press time.

Market confidence sank after the Calvin Klein owner published its quarterly financial report. Although the Q1 results showed robust growth that surpassed estimates, the company’s sharp downward revision of its 2026 guidance was not well-received by investors. It was also the primary factor behind Jefferies analysts’ decision to revise their PVH price target to $95, around 9.5% lower than the investment bank’s previous assessment of PVH stock. Market experts at Needham also slashed $15 of the original $115 price target.

Q1 Performance Outpaces Expectations

For its latest quarter, PVH reported earnings per share of $2.30. The figure outperformed the $2.23 EPS projected by analysts. The company’s revenue managed to $1.98 billion, reflecting a year-over-year jump of 2% that was in line with market consensus.

PVH now anticipates earnings for fiscal 2026 to range between $10.75 and $11 per share. This outlook served to stir investor anxiety as earlier estimates pointed to an EPS of $12.40 to $12.75. This new range also undercuts analysts’ forecast of $12.51 by almost 8%. PVH management attributed their updated outlook to ongoing macroeconomic concerns along with reduced consumer demand.

Regional Sales and Strategic Moves

Regionally, the company experienced revenue gains in both Europe and the US during 2025’s first quarter. Chinese sales, meanwhile, suffered a drop of 13%.

When examining individual brand performance, Tommy Hilfiger led by posting a 3% YoY increase in sales. Calvin Klein’s figures, however, remained stagnant.

PVH noted it is working on strategic initiatives intended to gain traction in the second half of the year and achieve double-digit margins. It is also aiming to introduce initiatives that should cut costs when it comes to its Calvin Klein business.