Key Moments:

- During Friday’s trading session, Dutch TTF gas futures rose 0.84% while UK NBP Natural Gas contracts advanced by 1%. However, both benchmarks eventually retreated.

- Norwegian exports increased by 16 mcm/d as operations commenced at two fields following maintenance.

- European gas storage was recorded at 49.9% full, far below last year’s level.

Futures Suffer Volatility as Norwegian Maintenance Limits Supply

European wholesale gas futures fluctuated on Friday, with ongoing maintenance work in Norway continuing to constrain supply. However, as per LSEG data, exports from Norway also rose by 16 million cubic meters per day (mcm/d) to reach 273 mcm/d. The jump occurred after two smaller gas fields came back online.

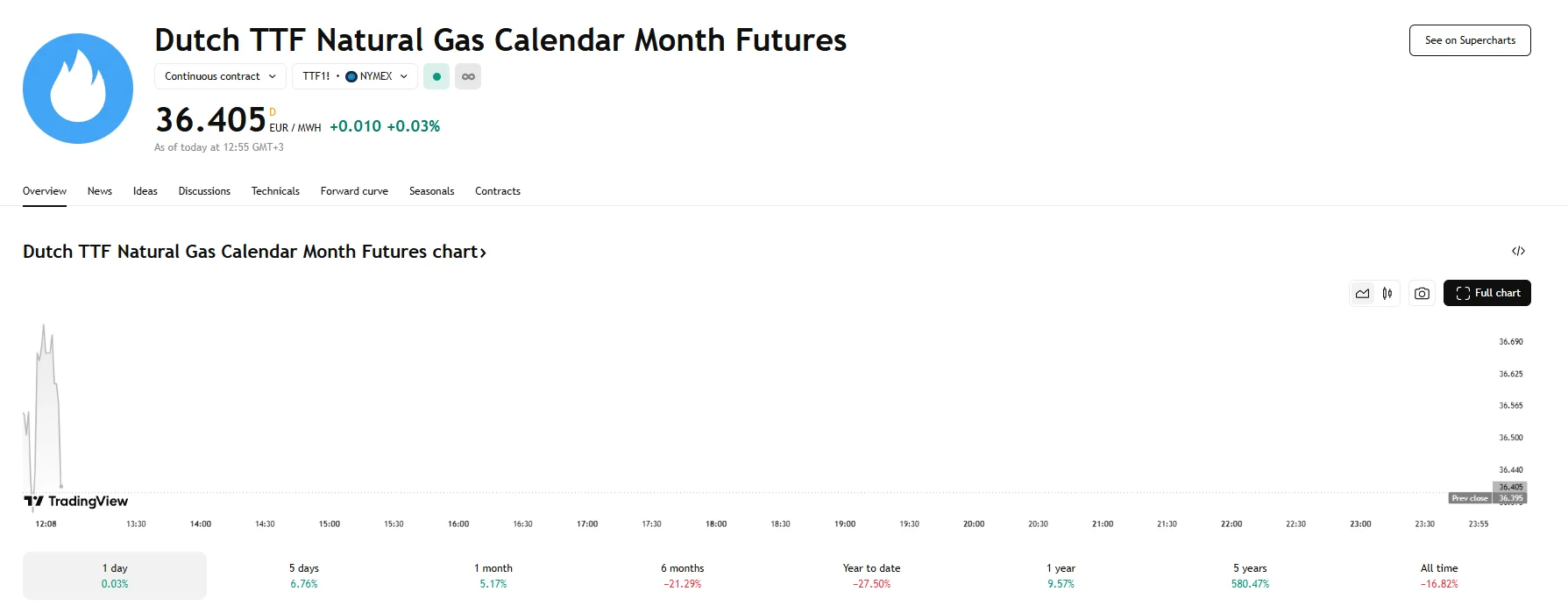

At the TTF hub, the Dutch calendar month natural gas contract increased to €36.7 per megawatt-hour (MWh) and later returned to €36.405. British natural gas futures, meanwhile, advanced even further by climbing 1% to 86.27 GBX but have since dropped below 86.00 GBX.

According to forecasts from LSEG, next week will see rising temperatures in north-west Europe, which may influence demand trends moving forward. Despite current supply restrictions that will continue affecting markets next week, analyst LSEG’s Ulrich Weber anticipates that unless Norwegian maintenance extends further, prices are likely to remain mostly stable.

Storage Levels Lag Behind Previous Year

Concerns about storage replenishment persisted across the market, as Gas Infrastructure Europe (GIE) noted that European gas storage facilities were filled to only 49.9%. Energy Agency analyst Greg Molnar warned that if Europe maintains its current three-year average gas injection rates, storage levels will only reach 84% by early November. This would create a 13-billion-cubic-meter shortfall and potentially lead to fluctuations during the winter months.

Germany’s Uniper recently reported difficulties at its Breitbrunn storage site, as capacity sales have been impeded due to deteriorating market conditions. The site is not expected to achieve an 80% fill rate by the mandated November 1st deadline.