Key Moments:

- The European Central Bank slashed interest rates to 2% as Eurozone inflation eased to 1.9%.

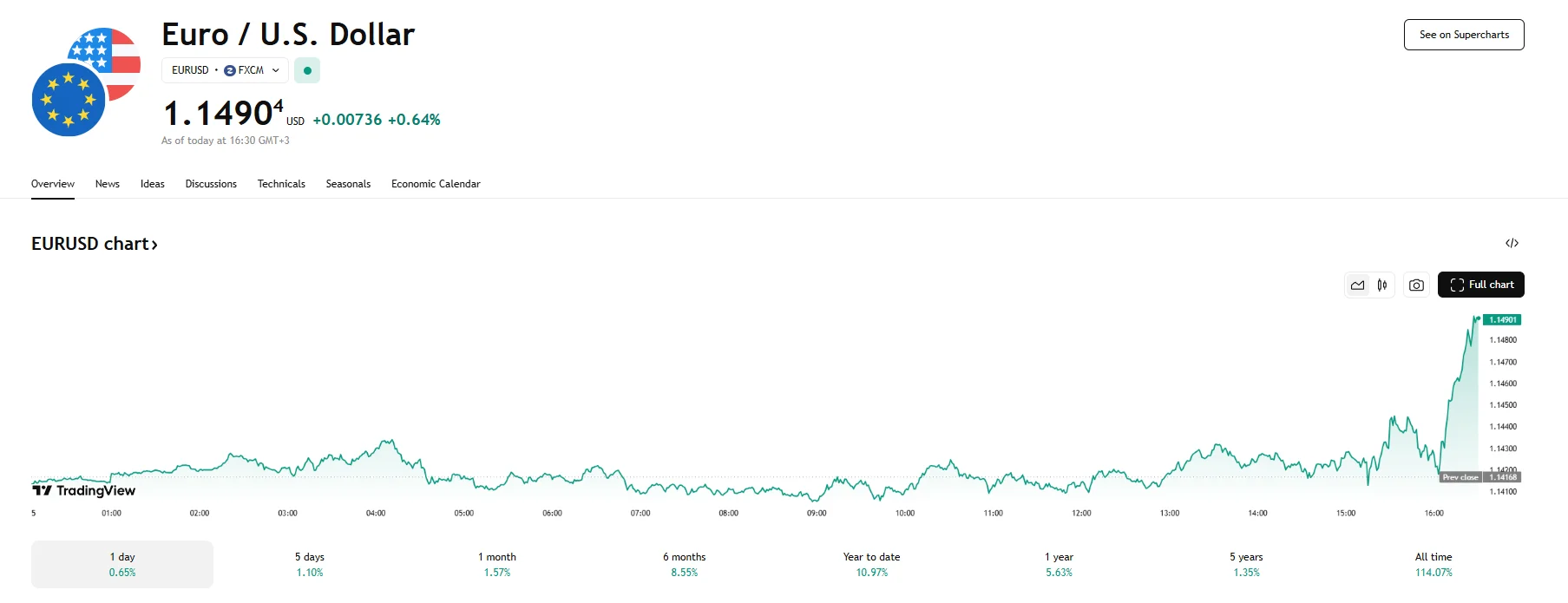

- EUR/USD advanced by 0.64% to 1.1490 shortly after the rate cut was announced.

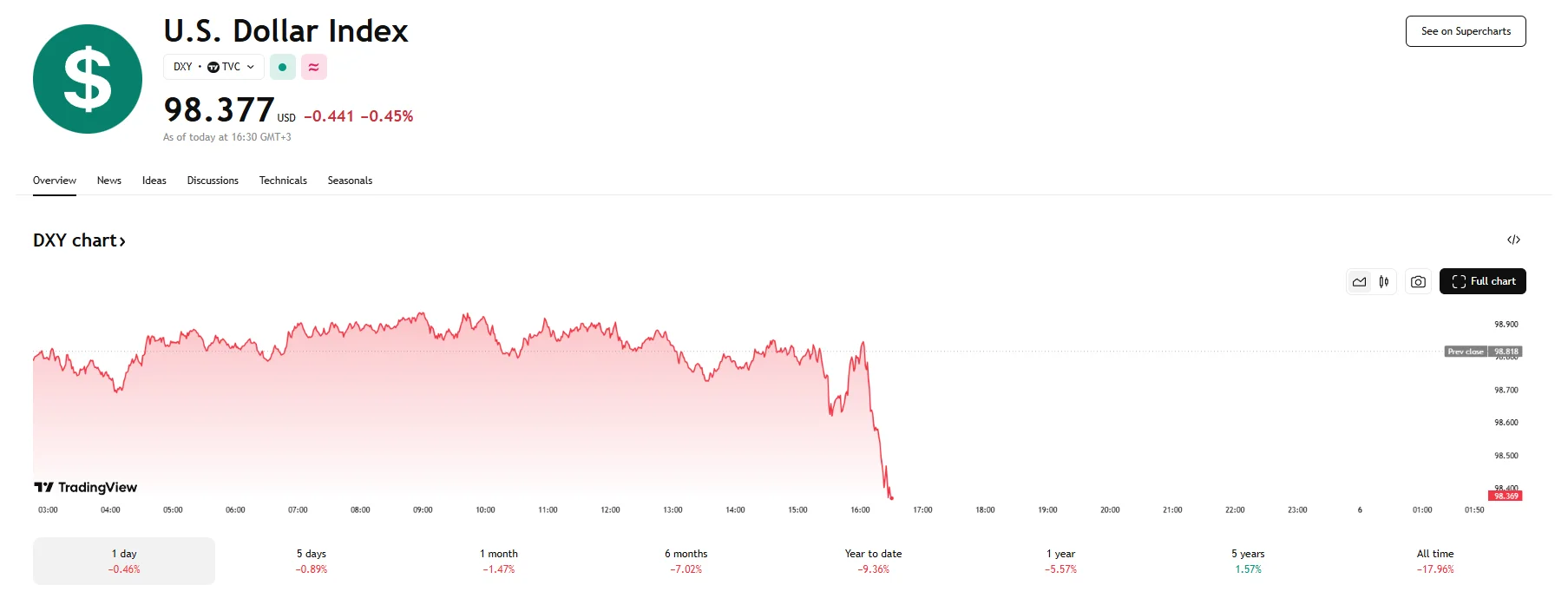

- The US Dollar Index plummeted 0.45% to levels unseen in weeks following a brief recovery on reports of a phone call between Donald Trump and Xi Jinping.

Euro Climbs Amid ECB Easing

The EUR/USD pair advanced 0.64% to 1.1490 after the European Central Bank (ECB) delivered another interest rate cut during its Thursday meeting, reinforcing expectations of a continued, though gradual, easing cycle. The cost of borrowing now stands at 2%, the lowest rate since 2023.

Meanwhile, the US Dollar Index cratered 0.45% to 98.377 as traders assessed the ECB’s decision. A series of economic data releases that stoked investor anxiety over the country’s near-term outlook also exerted pressure on the greenback. The plunge reversed earlier gains that saw the greenback advance thanks to news of a phone call between the US and Chinese presidents.

US Labor Market Shows Signs of Strain, Weighing on the Dollar

New claims for unemployment benefits climbed to 247,000 in the final week of May. This figure came in higher than the anticipated 235,000 and could suggest that conditions in the job market are beginning to deteriorate. Nonfarm productivity among employed Americans, meanwhile, sank by 1.5 in 2025’s first quarter. A contraction of the US trade deficit in April further affected sentiments surrounding US assets. Market focus is now shifting to the Federal Reserve’s possible response and the upcoming nonfarm payrolls report due Friday.

Inflation Softness Supports ECB Moves

Recent inflation data from the Eurozone showed that consumer price growth declined to 1.9%, reaching a 7-month low and falling within the central bank’s 2% target. This cooling inflation has given ECB President Christine Lagarde additional space to stimulate the economy by lowering rates further.

As the ECB continues to ease, a sharp contrast is emerging between Europe and the United States. President Trump recently criticized Federal Reserve Chair Jerome Powell on social media, accusing him of keeping interest rates “too high for too long.” The increasingly contrasting policies, combined with signs of weakness in the US dollar, are supporting bullish sentiment toward the euro.