Key Moments:

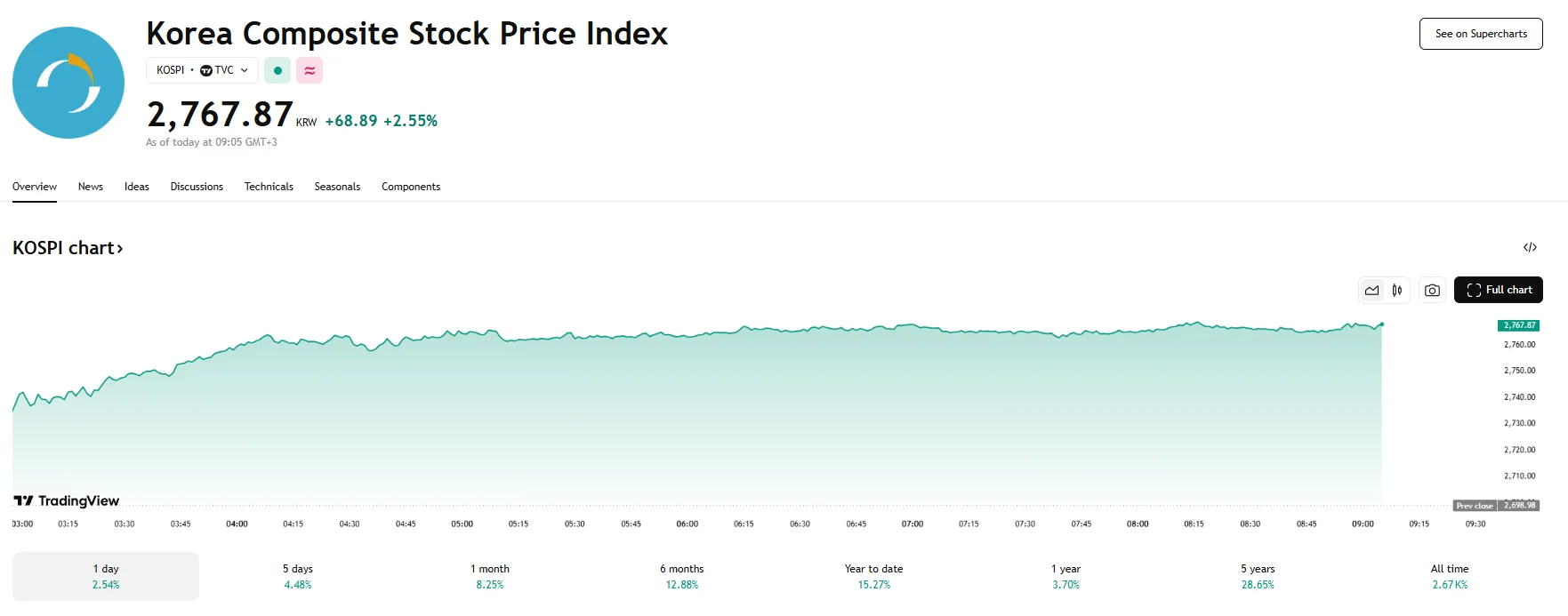

- South Korea’s KOSPI surged over 2% to 2,767.87, reaching levels last seen in August 2024. Other Asian indices also achieved gains.

- A rumored phone call between Trump and Xi Jinping stayed in focus.

- New US steel and aluminum tariffs took effect, doubling to 50%

Asian Equities Rise on Technology Strength and Political Optimism

Stock markets across Asia moved higher on Wednesday, lifted by gains in the technology sector and strong sentiment in South Korea following the presidential election victory of liberal candidate Lee Jae-myung. His win sparked optimism around potential economic stimulus and policy reforms.

Following the election’s results, the benchmark KOSPI index surged by 2.55%. As a result, it managed to hit 2,767.87, a peak unseen in around ten months. The Taiwanese market was not far behind, as it advanced on the back of AI powerhouse Nvidia’s strong performance on the Nasdaq on Tuesday. In Japan, shares surged by around 0.96%. The SSE Composite also rose, with its 0.38% climb translating to a gain of around 12.67 basis points, while the blue-chip CSI 300 index was up 0.5%. Gains were also registered in Hong Kong, where the Hang Seng jumped by 0.66%.

Trade Tensions Remain in Spotlight

Market participants continued to monitor developments in the global trade dispute, with the main focus being on the possibility that Donald Trump and Chinese President Xi Jinping will hold a phone call later this week. Caution persisted as investors were skeptical that a comprehensive deal would be reached, according to Saxo Singapore Chief Investment Strategist Charu Chanana. She added that any signs of escalation could trigger risk aversion.

In addition, trade concerns intensified as Wednesday was the final deadline for US allies to hand over their “best” trade proposals to the Trump administration. The potential deals would concern President Trump’s “Liberation Day” tariffs, which are set to take effect on July 8th.

Starting Wednesday, the US also enforced new tariff rates on steel and aluminum imports. The duties now stand at 50%, twice the previous levies. This move, initially announced last week, underscored the administration’s increasingly aggressive trade posture.