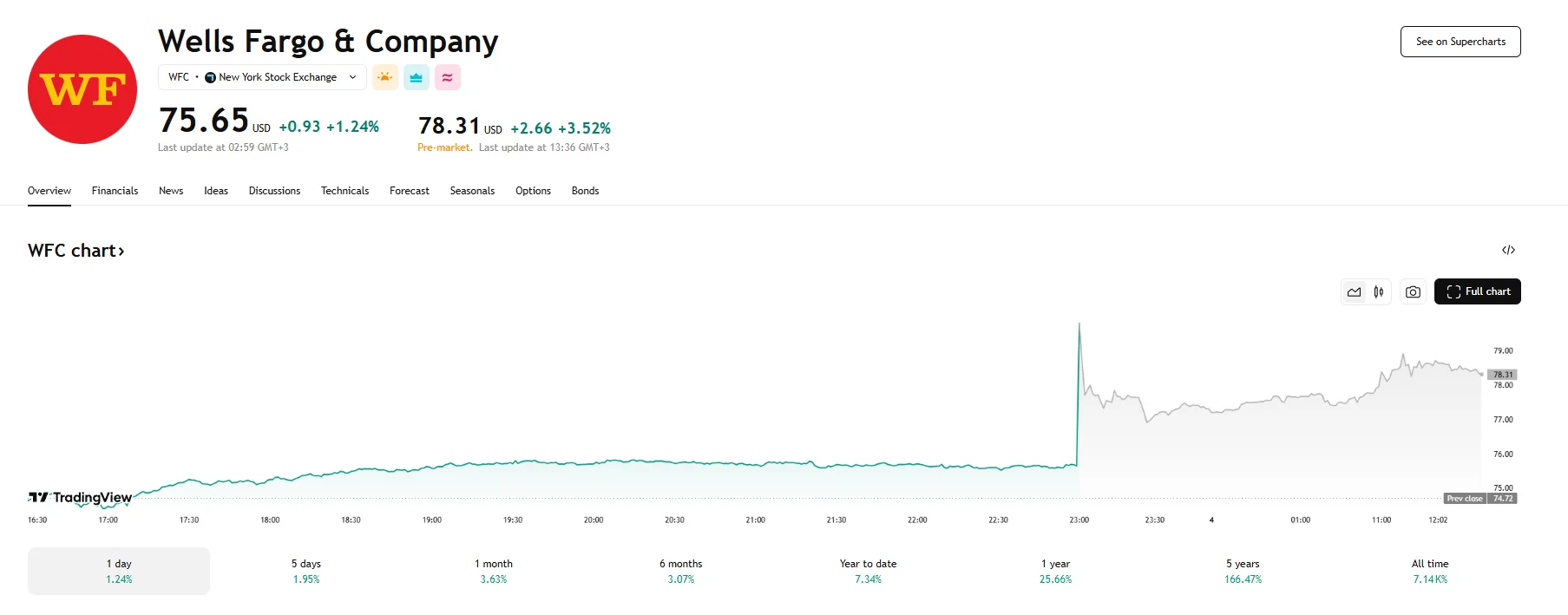

Key Moments:

- June 4th saw Wells Fargo stocks rise 3.5% to $78.31 in pre-market trading.

- The Federal Reserve recently removed restrictions on the bank’s asset growth.

- The bank fulfilled all the stipulations detailed in the consent decree signed in 2018.

Federal Reserve Clears Wells Fargo for Expansion

Wells Fargo shares climbed 3.5% before Wednesday’s opening bell after the bank confirmed that the Federal Reserve had officially removed the growth cap on its total assets. The restriction had been in place for around seven years following enforcement action linked to the bank’s past sales practices.

Regulatory Milestone Reached

The restriction was initially enacted in response to findings that employers might have created up to 3.5 million unauthorized accounts between 2009 and 2016. As part of the sanction, Wells Fargo was prohibited from growing its balance sheet beyond its $1.95 trillion level recorded in 2017.

Now, the Federal Reserve has concluded that Wells Fargo satisfied all the required conditions specified in the original consent order. These included demonstrating enhancements to board governance and establishing stronger compliance and operational risk controls. The bank also underwent an independent assessment verifying the steps taken to meet regulatory expectations.

In a statement, Fed governor Michael Barr stated that the decision to lift the asset cap indicated that the firm had met the required remediation standards. He credited this success to focused leadership from management, strong oversight from the board, and strict supervision that ensured the firm’s accountability. Barr also asserted that these three components would need to persist if the firm aimed for a sustainable operational approach.

CEO Applauds Progress

CEO Charlie Scharf, who took the reins in 2019, commented that the Federal Reserve’s choice to remove the asset limitation represented a key achievement in Wells Fargo’s ongoing overhaul. He added that the firm was now a distinct and much more resilient organization because of the efforts they had undertaken.

With the cap removed, Wells Fargo now has the ability to expand its asset base for the first time in years. The development signals fresh strategic opportunities for growth after a prolonged period of regulatory constraint. Moving forward, the bank will remain under close regulatory observation to ensure its compliance and governance enhancements are sustained.