Key Moments:

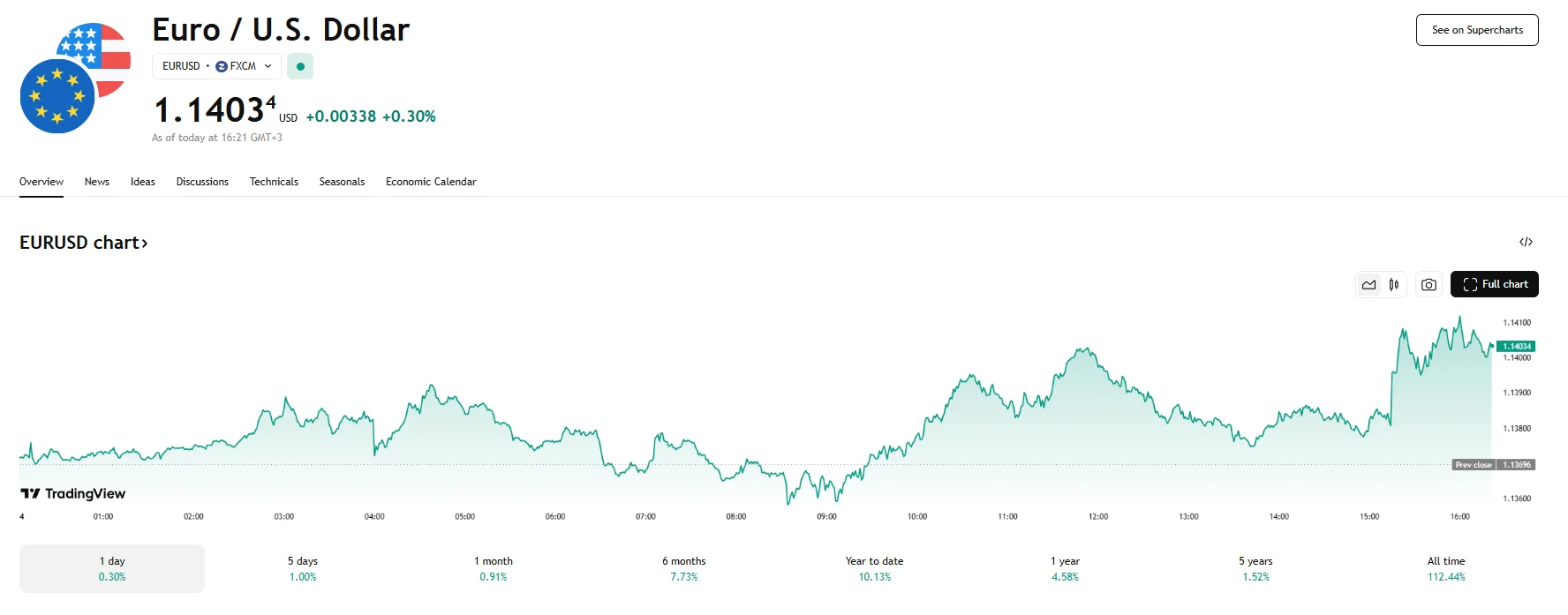

- A 0.3% climb pushed the EUR/USD pair to 1.1403 on June 4th.

- May’s Eurozone Composite PMI has been revised and now stands at 50.2.

- The latest US ADP report showed that 37,000 private-sector jobs were added in May, far below expectations.

Euro Strengthens on Positive PMI Data

EUR/USD ticked higher today as updated economic data provided support for the euro. The pair gained ground and moved 0.3% higher, which allowed it to breach the 1.1400 mark.

The final Eurozone Composite PMI for May was revised from 49.5 to 50.2 by the Hamburg Commercial Bank, putting it just below the 50.4 reported in April. May thus become the fifth month in a row that saw the PMI expand.

Growth was largely driven by manufacturing, which served to prevent the first contraction in services since November from having a stronger impact on the index. Both Italy and Spain posted strong gains, and France remained stable. Germany’s PMI, meanwhile, fell to 48.5, marking yet another decline.

Dollar Retreats

The greenback lost traction against most of its major peers early Wednesday, with the exception of a slight advance against the Japanese yen. Although the US Dollar Index saw an earlier surge toward 99.400, it stayed firmly below the 100.00 mark, which it slipped from in late May.

Weighing on the dollar was employment data, as the ADP Employment Change report revealed only 37,000 private sector jobs were created in May. This marked a significant miss from the 115,000 forecast. The unexpected weakness came on the heels of a more upbeat JOLTS Job Openings report from Tuesday, which had shown an increase in vacancies. The disappointing ADP data helped drag the dollar lower and lifted the EUR/USD pair.