Key Moments:

- China may finalize an Airbus aircraft order as soon as next month.

- Discussions have involved potential purchases of up to 500 aircraft units.

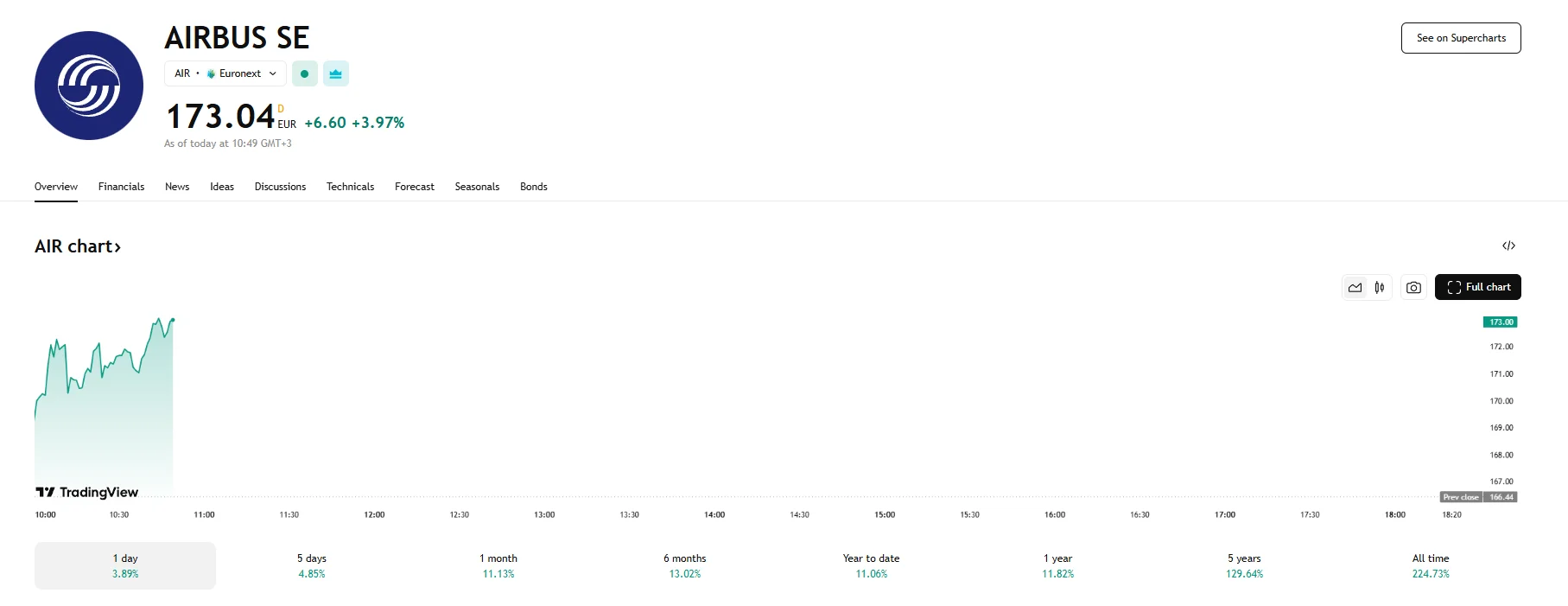

- Airbus’ share price advanced by 4% to €173.04 on Wednesday.

Potential Mega Deal Lifts Airbus Stock

China is reportedly in talks to make a significant purchase of Airbus SE aircraft, with the deal potentially aligning with upcoming visits by European leaders to Beijing next month. Sources familiar with the matter told media giant Bloomberg that the transaction could include between 200 and 500 jets, with the prospective deal spanning both narrowbody and widebody categories. If finalized, the order could rank among the largest in global aviation history and be China’s largest to date.

The news triggered a jump in Airbus stock value. The company’s share price rose by around 4% on Wednesday and hit an intraday peak of around €173.

Negotiations Underway

Ongoing discussions between Chinese carriers and authorities are said to be dynamic, with no final agreement in place. Sources cautioned that talks could either collapse or face delays. Airbus has refused to comment on the matter, while China’s Civil Aviation Administration has yet to respond to inquiries.

The anticipated order could align with scheduled trips by French President Emmanuel Macron and German Chancellor Friedrich Merz. Both leaders are anticipated in Beijing to commemorate five decades of diplomatic ties between China and the European Union. France and Germany are major stakeholders in Airbus, making the potential deal politically symbolic.

Boeing Left on the Sidelines

While a resolution to China-US trade tensions could open the door for Boeing’s recovery in the region, the American aerospace firm has suffered setbacks. After Beijing advised airlines to halt deliveries of Boeing aircraft in April, Airbus has gained a stronger foothold in a market once largely shared by the two manufacturers. Moreover, the company’s challenges in China date back several years, as it has been around eight years since the country’s last significant order.

Tensions related to the 737 Max and broader geopolitical disputes have further hindered Boeing’s performance in Chinese markets. Airbus, on the other hand, appears poised to benefit further, especially in the widebody segment where its A330neo could attract buyer interest.