Key Moments:

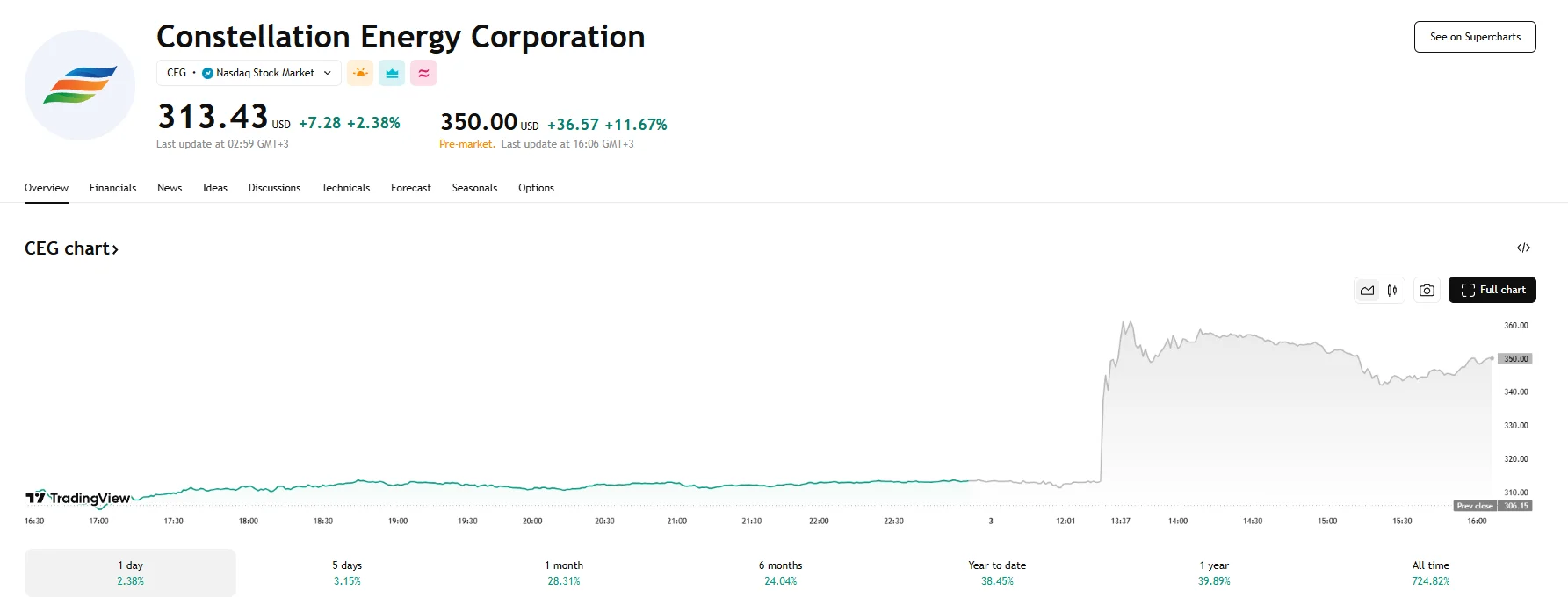

- Constellation Energy’s stock climbed 11.67% and hit $350 during pre-market trading on June 3rd.

- Shares surged following the announcement of a partnership with Meta that is set to last 20 years.

- A Calpine acquisition is expected to enhance operational scale and align with clean energy and AI infrastructure priorities.

Meta Deal Powers Stock Surge

Constellation Energy saw its share price rise 11.67% to $350 on Tuesday after it was announced that the company has entered a two-decade agreement with Meta to source nuclear-generated electricity. This collaboration represents a growing trend among leading technology firms to secure clean energy solutions for their rapidly expanding data infrastructure.

Meta will acquire approximately 1.1 gigawatts of power from Constellation Energy starting June 2027, representing the full capacity of the single nuclear reactor at Constellation’s Illinois-headquartered Clinton Clean Energy Center.

The Clinton plant faced a potential shutdown upon the expiration of its zero-emissions credit, a vital financial support mechanism it has depended on for around eight years. However, the deal with Meta provides the necessary stability for the plant to remain a key contributor in the sphere of carbon-free electricity.

Market Confidence Rises on Operational Strength

Investor sentiment toward Constellation Energy also reflected the company’s recent performance, particularly its Q1 2025 financials, which revealed an EPS of $2.14 ($0.32 higher than last year). Broader confidence in the firm’s infrastructure and its ability to meet the energy demands spurred by AI-driven applications also served to aid sentiment.

To further support its strategic growth, Constellation is also moving toward the acquisition of Calpine. The deal is positioned to improve Constellation’s market standing amid evolving energy needs. The company’s direction appears aligned with emerging government goals around artificial intelligence and clean energy technology development.

Constellation CEO Joe Dominguez has highlighted the crucial role reliable power plays in supporting AI. He stated that Constellation was diligently working to meet customers’ energy needs nationwide, including those for new AI technologies that are increasingly integrated into daily life and used by businesses and governments to improve products and services.