Key Moments:

- The Indian economy saw growth of 7.4% in 2025’s first quarter, but the news failed to lift the rupee.

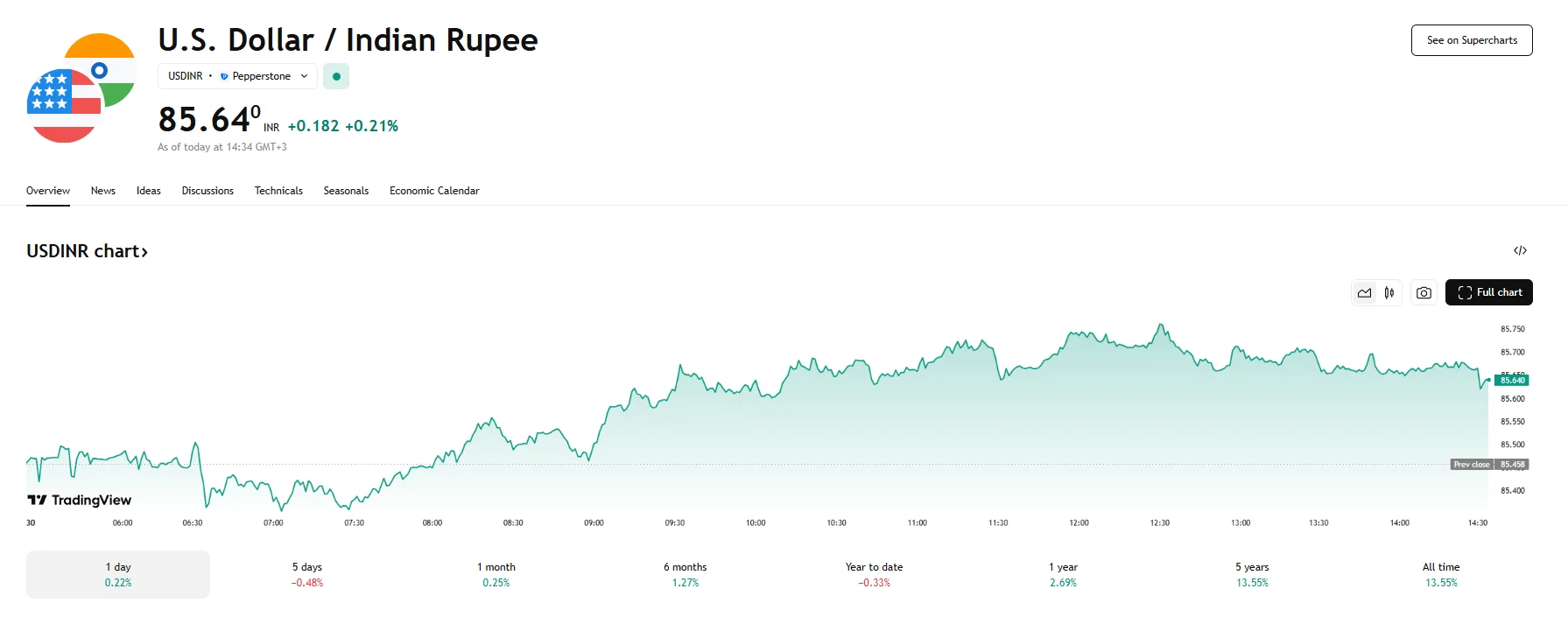

- USD/INR edged 0.21% higher on Friday to hit 85.64.

- The Indian rupee fell around 1% in May after strengthening for two consecutive months.

India Outperforms Economic Growth Forecasts, Rupee Ends Two-Month Rally

India’s economy achieved its fastest growth in a year during the January-March quarter, expanding by 7.4%. This acceleration marks a considerable improvement from the preceding quarter’s upwardly revised growth figure of 6.4%. The impressive data easily surpassed economists’ collective forecast of 6.7% for the March quarter.

Driving this growth is robust domestic demand (particularly rural), along with higher government spending and India’s relative insulation from global trade due to lower export dependence. Additionally, declining subsidy payouts likely enhanced net tax collections.

Today’s economic news failed to aid the rupee, which depreciated 0.21% against the greenback as the USD/INR reached 85.64 on Friday. The Indian currency also closed lower in May, dropping around 1% after advancing over the prior two months. Its latest depreciation occurred amid a mix of geopolitical tensions, dollar demand pressures, and cautious Reserve Bank of India (RBI) actions aimed at managing foreign exchange reserves.

Regional Currency Strength Adds Comparative Pressure, FX Reserve Goals Take Center Stage

Most Asian currencies appreciated over the month, led by gains in the Korean won. The offshore Chinese yuan, another major regional currency, strengthened nearly 1%. These regional moves highlighted the relative softness of the rupee during the same period.

Barclays analysts predict the rupee will likely trail regional rivals going forward because India’s central bank appears committed to increasing reserves rather than allowing further gains in the currency. As of May 16th, India’s foreign exchange reserves were recorded at $685.7 billion, down from the $704.89 billion peak reached nine months earlier.