Key Moments:

- Japanese equities recorded a historic $11.8 billion in outflows during the week ending May 28th.

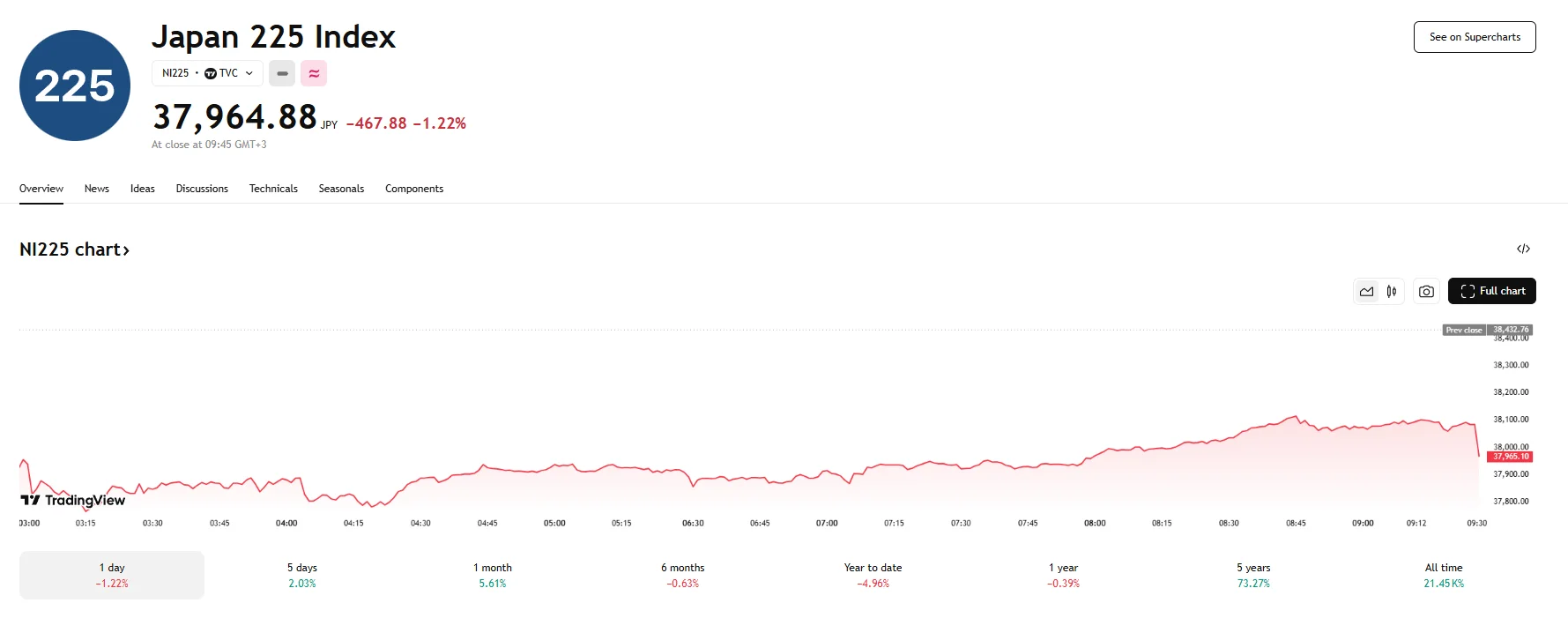

- The Nikkei 225 index dropped 1.22% on Friday.

- Markets across Asia suffered declines, with the Hang Seng sliding by 1.2%, the KOSPI shedding almost 23 basis points, and the SSE Composite slipping 0.47%.

Record-Level Equity Outflows in Japan

Japanese stock markets faced unprecedented pressure amid a record $11.8 billion in outflows, as reported by Bank of America Global Research. The data, based on figures from EPFR and published on Friday, reflected growing unease over Japan’s long-term fiscal position, which has pushed long-dated government bond yields to new highs.

The broader global equity landscape also experienced turbulence, with investors pulling $9.5 billion from global stock funds in the week ending Wednesday, marking the steepest weekly outflow in 2025 thus far.

Asian Equities Falter

The Nikkei 225 lost over 460 basis points on Friday, with its 1.22% drop resulting in a closing figure of 37,964.88. Disco Corporation fell the sharpest by 5.63%, while stocks like Tokyo Electron, Lasertec Corp, Sony Group, and Nintendo all sank by at least 4%. On the other end of the spectrum, Otsuka Holdings managed to climb by almost 7% and was the best performer on the index.

Friday’s slump contrasts gains achieved earlier this week, which followed a federal court ruling to limit the scope of President Donald Trump’s trade duties. However, sentiment soured after the tariff suspension was temporarily halted by a US appeal court. Investors were also reacting to fresh government data showing Tokyo’s core CPI beating expectations and rising to 3.6% in May, leading some market participants to anticipate a potential rate hike by the Bank of Japan in the near future.

Elsewhere in the region, Hong Kong’s Hang Seng Index was not far behind the Nikkei 225 in terms of losses, as it shed around 284 basis points and fell 1.20%. In Mainland China, the SSE Composite fell 0.47% and ended the session with a valuation of 3,347.4873. Korean shares declined as well, with the broad KOSPI index dipping 0.84%.