Key Moments:

- GATX Corporation agreed to acquire about 105,000 railcars for $4.4 billion from Wells Fargo.

- The company will start with a 30% stake, with rights to increase its ownership to 100%.

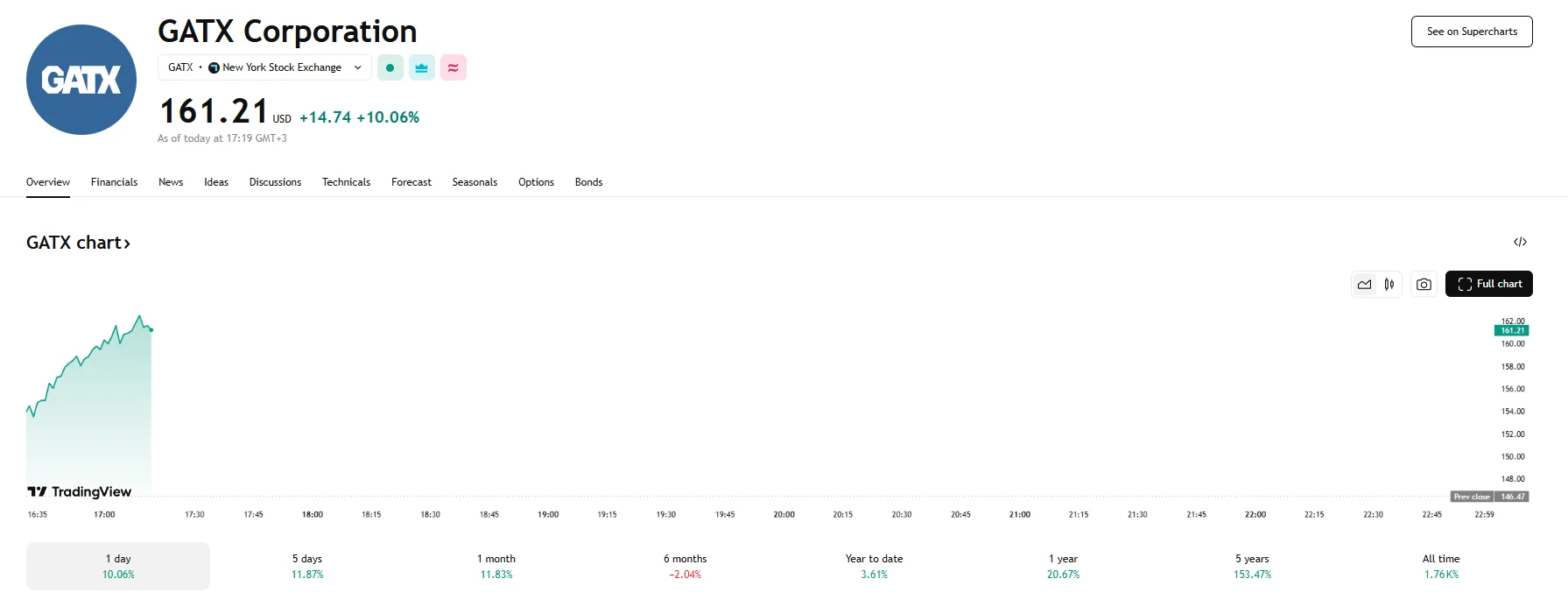

- GATX’s stock rallied on Friday, climbing 10.06% to hit $161.21.

Strategic Expansion Through Joint Venture

New York-based GATX Corporation has announced a definitive agreement to purchase approximately 105,000 railcars from Wells Fargo. The $4.4 billion acquisition will be executed in collaboration with Brookfield Infrastructure Partners. Under the terms of the agreement, GATX’s share in the venture will stand at 30%. The company will retain the option to increase its ownership to 100% over time.

The news was well received by investors, as GATX saw its share price jump substantially after Friday’s opening bell, with the stock reaching $161.21 amid a climb of around 10%.

The transaction, which remains subject to standard regulatory approvals and customary closing conditions, is scheduled to close during 2026’s Q1. According to GATX’s forecasts, the deal will result in a marginal boost to GATX’s earnings per share in the first full year post-completion.

Robert C. Lyons, GATX’s president and CEO, described the acquisition as “an outstanding opportunity” to expand the company’s leading North American operations. He explained that GATX’s over 125 years of experience in asset, commercial, and operational expertise positioned them well to integrate this new fleet.

Lyons also emphasized that this acquisition method would preserve GATX’s financial flexibility for continued business growth while capitalizing on the acquired assets’ inherent value-creation opportunities. He further indicated that GATX planned to collaborate closely with customers to ensure a seamless transition to their commercial and operational platform.