Key Moments:

- Evercore ISI raised Vertiv’s price target to $150.

- Full-year organic sales growth guidance recently was raised to 18% following stronger-than-expected quarterly revenue.

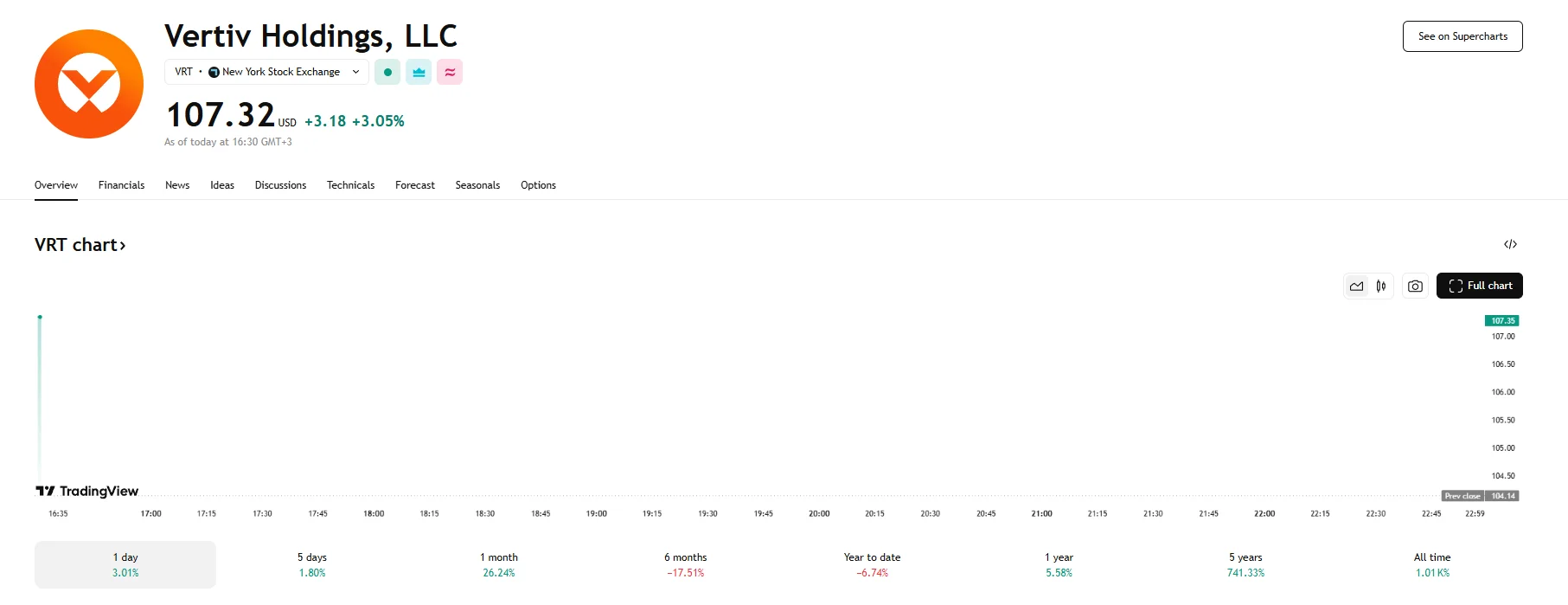

- Vertiv’s shares opened with a 3% gain on Tuesday.

Vertiv Sees Upgraded Outlook Amid AI-Driven Demand

Evercore ISI has raised its price target on Vertiv Holdings, lifting the projection by $50 to $150 while retaining an Outperform rating. Following this revision, Vertiv Holdings’ share price rose by 3% after Tuesday’s markets opened, with the price reaching $107.32.

Vertiv has reported a 20.45% rise in revenue over the past 12 months, prompting increasing investor interest due to surging demand in AI-centric and hyperscale data centers. In its latest financial disclosures, the company posted adjusted diluted EPS of $0.64 for Q1 2025. The figure marked a 49% jump compared to the same period last year and exceeded the $0.61 forecast by analysts. Quarterly revenue also surpassed expectations, reaching $2.04 billion, $0.1 billion higher than market expectations. Following this results beat, Vertiv raised its full-year organic sales growth guidance to 18%.

Vertiv Poised for Growth on Data Center Dominance and Margin Expansion Potential

Evercore ISI notes that while there are near-term concerns surrounding order intake and digestion in hyperscale deployments, the long-term outlook is highly favorable. Analysts at the firm believe Vertiv could exceed $200 per share in the future. They cite anticipated high-teens revenue growth and substantial margin expansion that could produce an EPS compound annual growth rate (CAGR) of around 25%, potentially surpassing $10 by 2029.

Evercore ISI further highlighted Vertiv’s strong positioning as a dependable solutions provider within the data center infrastructure segment. The firm emphasized the ongoing transition toward liquid cooling solutions, as according to current forecasts, they will represent 30% of the total thermal management market within three years.

Beyond thermal solutions, Vertiv is tapping into further opportunities within power management. As AI facilities adopt higher voltage designs and more advanced equipment, Vertiv’s modular and integrated systems are anticipated to drive operating leverage. Evercore ISI projects EBIT margins to rise above 23% by 2028 under its current expectations.