Key Moments:

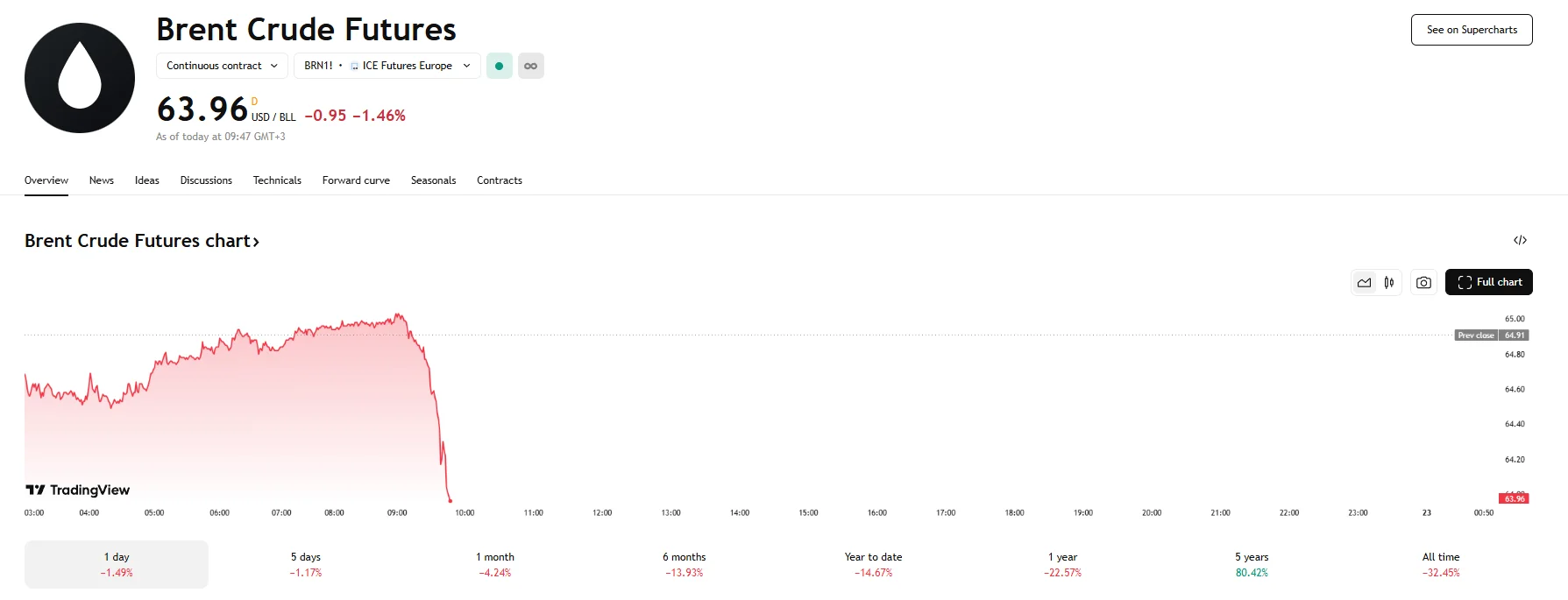

- Brent crude futures declined below $64 on Thursday.

- WTI also lost ground, with its contracts hitting $60.69.

- An unexpected 1.3 million barrels were added to US crude inventories last week.

Oil Craters on Major US Stock Build

Crude oil futures plummeted on Thursday, weighed down by a notable rise in US crude and fuel inventories that surprised market participants and stoked worries over softening demand. Traders were also closely watching developments of the latest nuclear negotiations between the US and Iran.

Brent crude futures eased by 1.46%, falling to $63.96 per barrel. The West Texas Intermediate futures fell as well, sinking 1.43% and below $61.

Inventory Data Reverses Price Gains

Oil benchmarks had already closed with losses in the previous trading sessions, but today’s decline followed inventory data released by the US Energy Information Administration (EIA) on Wednesday. According to the report, crude stockpiles jumped by 1.3 million barrels last week, with inventories totalling 443.2 million barrels. This came in contrast to the forecasts of analysts polled by Reuters, who had predicted a decline of the same magnitude. The EIA also disclosed that crude imports into the US had reached a six-week peak, which coincided with declining demand for both gasoline and distillates.

LSEG Oil Research senior analyst Emril Jamil stated that the unexpected increases in stock would have exerted downward pressure on crude oil, particularly on WTI prices. Higher inventory levels may encourage the export of US crude oil to Europe and Asia, he added.

Geopolitical Tensions and Investor Caution

Traders were also reacting to geopolitical signals that could influence supply dynamics. On Wednesday, both Brent and WTI ended 0.7% lower following news of upcoming US-Iran nuclear talks. According to Oman’s foreign minister, negotiations are set for Friday and will take place in Rome. Uncertainty surrounding the outcome of those discussions has kept markets on edge.

Sentiment was further complicated when CNN reported that Israel was potentially planning on attacking Iran’s nuclear facilities. CNN cited sources tied to US intelligence. The news heightened concerns over potential supply disruptions as Iran ranks as the third-largest oil producer in the OPEC organization.

Elsewhere, traders were also factoring in developments surrounding Russian oil exports. Phillip Nova’s Priyanka Sachdeva noted that Ukraine had indicated it would pursue stricter sanctions against Russia from the EU, a move that could further impede the delivery of Russian oil to international markets. The seizure of Russian assets and the imposition of sanctions on certain purchasers of Russian oil were among the recommendations proposed by Ukraine.