Key Moments:

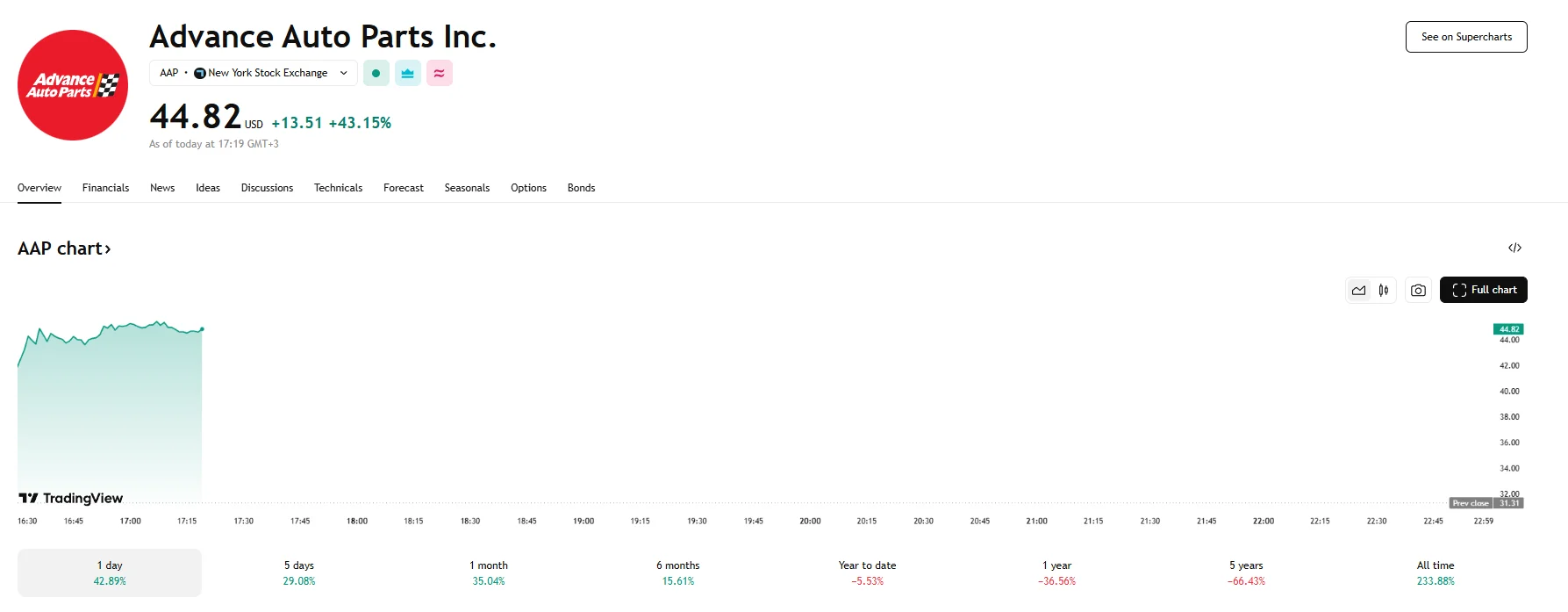

- Advance Auto Parts (AAP) shares jumped 43.15% after Thursday’s opening bell

- The company reported an adjusted first-quarter loss of $0.22 per share, significantly outperforming analysts’ expectation of a $0.78 loss.

- Advance Auto Parts maintained a full-year EPS forecast of $1.50-2.50. Total revenue is expected to range from $8.4 billion to $8.6 billion.

Stock Surges on Stronger-Than-Expected Results

Shares of Advance Auto Parts surged by 43.15% during the early hours of Thursday’s trading session, with the stock price hitting $44.92. This jump followed the publication of the retailer’s quarterly financials, which showed a smaller-than-expected Q1 loss. Advance Auto Parts also opted to reaffirm its full-year financial projections despite facing headwinds from tariffs.

For the first quarter, the company’s earnings per share were at a negative $0.22. This data came well ahead of Visible Alpha analysts’ expectations of a steeper loss at $0.78 per share. Net sales declined by 7% from last year, but the $2.58 billion was still higher than what analysts had forecast.

Advance Auto Parts Stands Firm on 2025 Outlook

Advance Auto Parts reiterated its 2025 financial guidance, projecting adjusted earnings per share between $1.50 and $2.50. Net sales are also expected to top market participant’s expectations and range from $8.4 billion to $8.6 billion.

The company noted that the guidance assumes that current tariffs will stay in place throughout 2025, which is crucial given Advance Auto Parts’s reliance on importing automotive components from tariff-hit nations like China, Canada, and Mexico.

According to Shane O’Kelly, CEO of Advance Auto Parts, the company decided to uphold its outlook due to its performance thus far, the anticipated advancement of its strategic initiatives for the rest of the year, and its planned measures to counteract the tariffs currently in place.