Key Moments:

- Dow Jones, S&P 500, and Nasdaq 100 futures declined around 0.6% on Wednesday

- The US dollar hit its lowest value in two weeks as investors scrutinized government debt and policy signals.

- Tariff-related concerns continue to fuel bullish outlook.

Futures Slip as Market Optimism Fades

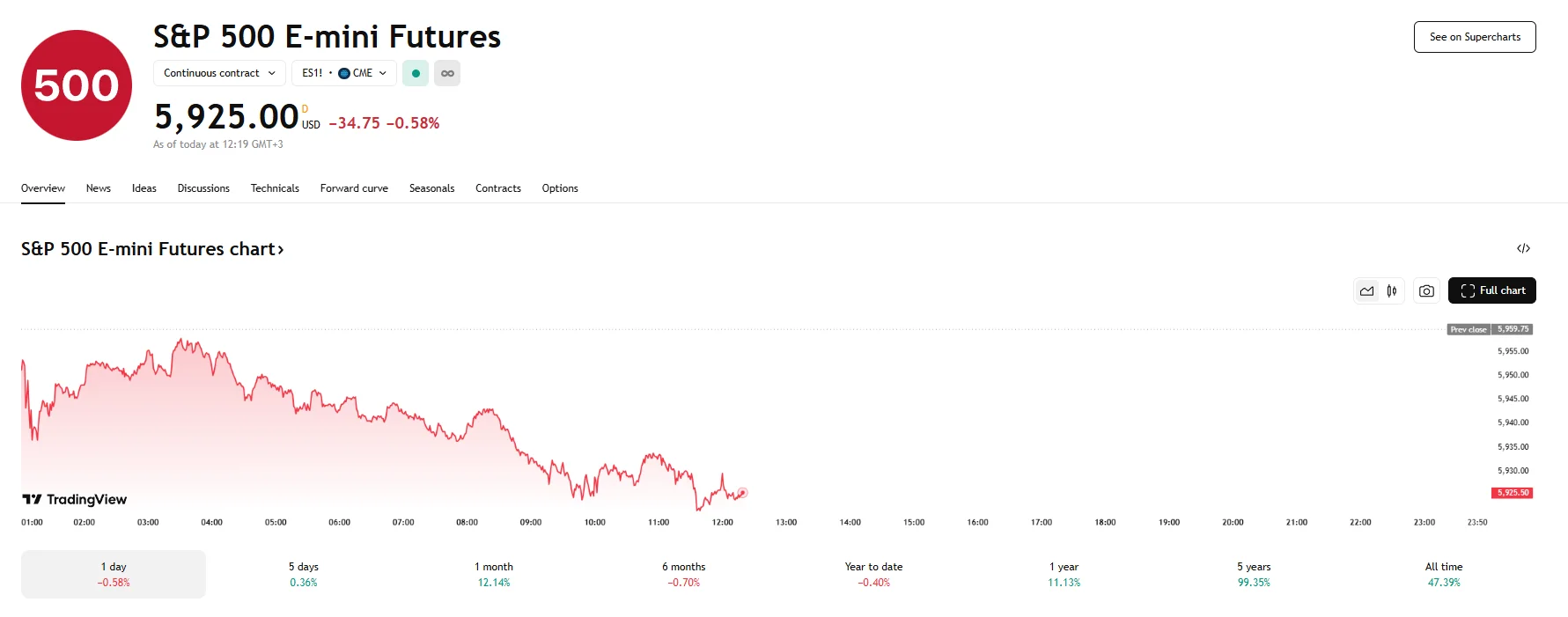

US equity futures were under pressure on Wednesday as investors recalibrated expectations around the economic impact of existing tariffs. Futures linked to the Dow Jones Industrial Average fell by 268 basis points, or 0.63%. Nasdaq 100 e-minis practically mirrored this negative investor sentiment, falling 0.60% to hit 21,319. As for S&P 500 contracts, they dropped by 0.58% to 5,925.

Tariff Uncertainty Stokes Volatility

Tuesday’s pullback in equities came after a six-session winning streak that brought the S&P 500 close to record territory. The retreat followed renewed concerns that existing tariffs would continue to constrain economic growth. Moreover, despite the recent agreement between the US and China to pause some new duties, market anxieties resurfaced due to recent tensions tied to AI chip exports.

Strategists are increasingly cautioning against overly bullish sentiment linked to these temporary trade truce headlines. Gregory Daco, Chief Economist at EY, asserted on Tuesday that equity markets had responded with excessive optimism and had failed to acknowledge the ongoing economic burden created by high tariffs.

Dollar Struggles Below 100,00, Retail Sector in Focus as Prices Rise

Further highlighting broader risk, the US dollar sank to its lowest levels in two weeks, and is trading below the 100.00 mark today. Market participants are now tracking the ongoing G-7 meeting in Banff, Canada, for clues on whether the administration may favor a weaker dollar. Broader concerns about the federal budget deficit and possible tax policy changes have further lowered investor confidence.

Corporate earnings have become a major battleground for interpreting the economic outlook, with retailers standing at the forefront of this conversation. Last week, Walmart warned consumers should brace for higher prices due to tariffs. In contrast, yesterday saw Home Depot vow not to raise its prices despite similar cost pressures.