Key Moments:

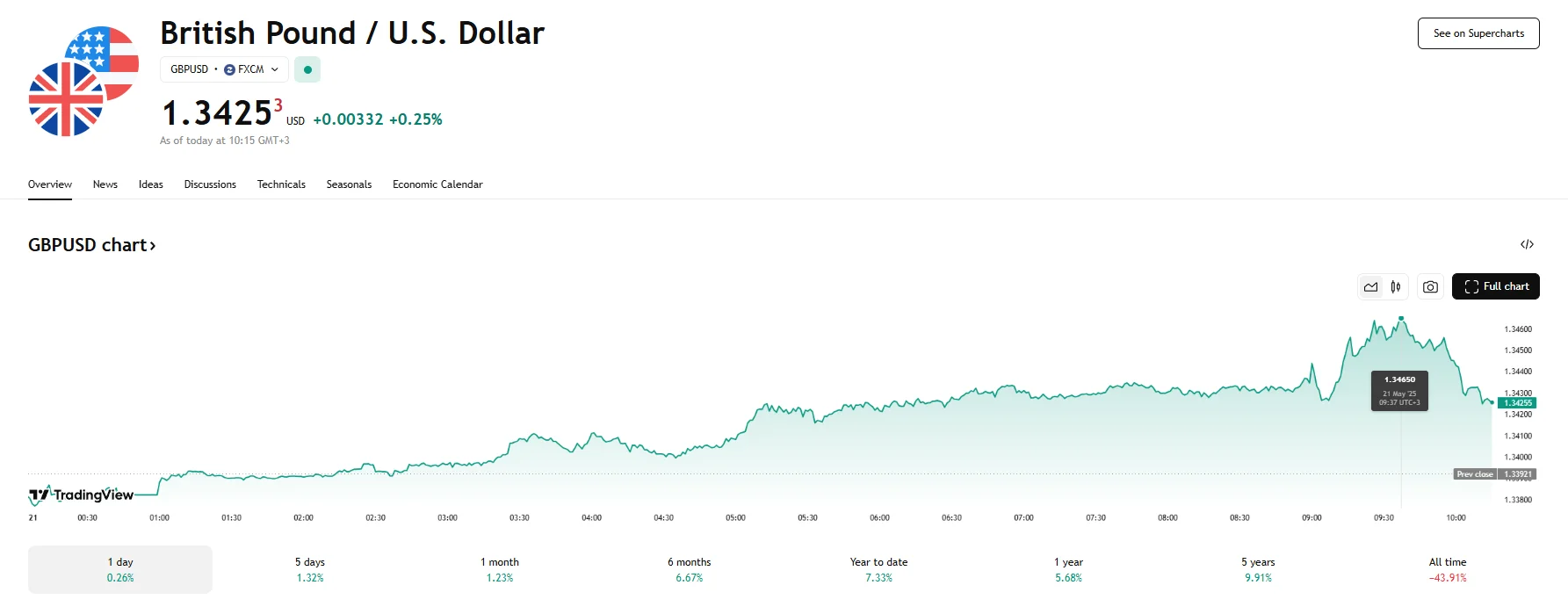

- The British pound advanced toward 1.35 on Wednesday.

- Annual inflation in the UK came in at 3.5%, exceeding expectations and curbing BoE rate cut likelihood.

- The US Dollar Index dropped below the 100 threshold as trade tensions between Washington and Beijing continued to pressure the greenback.

Sterling Rallies After Inflation Surge

The British pound has strengthened against the US dollar on Wednesday, advancing toward 1.35, a high last seen in February 2022. The gains followed inflation data that came in hotter than expected, prompting investors to reassess the path of monetary policy by the Bank of England.

Inflation Exceeds Forecasts, Undermines Easing Prospects

According to the latest data, the UK’s annual consumer inflation jumped to 3.5%. The figure outpaced both the 3.3% analyst consensus and the BoE’s own 3.4% estimate, marking a one-year peak. Energy and gas price hikes were among the factors that contributed to the increase, keeping headline inflation far higher than the central bank’s target of 2%.

Of particular concern was the rise in services inflation, a key component closely watched by central bankers, which jumped 0.7% to 5.4%. The reading points to enduring structural inflation and raises questions about the scope for further monetary easing. In response to the inflationary surprise, traders now forecast a single 25bp interest rate cut to be imposed by the end of 2025.

Dollar Index Sinks Below 100

Meanwhile, the US dollar has experienced a broad weakening, pushing the Dollar Index (DXY) below the psychological 100 mark. The dollar’s persistent struggle can also be traced back to several factors, starting with the recent credit rating downgrade to Aa1 by Moody’s. Compounding the pressure on the US dollar are domestic fiscal anxieties and market expectations for further borrowing cost reductions by the Federal Reserve.

Adding to the dollar’s woes are escalating tensions in the critical technology sector between the United States and China. Initial optimism surrounding a temporary truce has quickly dissipated following recent US advisories cautioning companies against utilizing advanced AI chips from Chinese manufacturers, specifically naming Huawei’s Ascend series. This has reignited concerns about a deteriorating trade relationship between the world’s two largest economies, negatively impacting investor sentiment.

In a recent development highlighting the friction in the tech sphere, Nvidia CEO Jensen Huang openly criticized US export curbs on artificial intelligence chips meant to be sent to China. Speaking on Wednesday, Huang reportedly described these controls as a “failure,” asserting that the assumptions underpinning the initial AI diffusion rules were “fundamentally flawed.”