Key Moments:

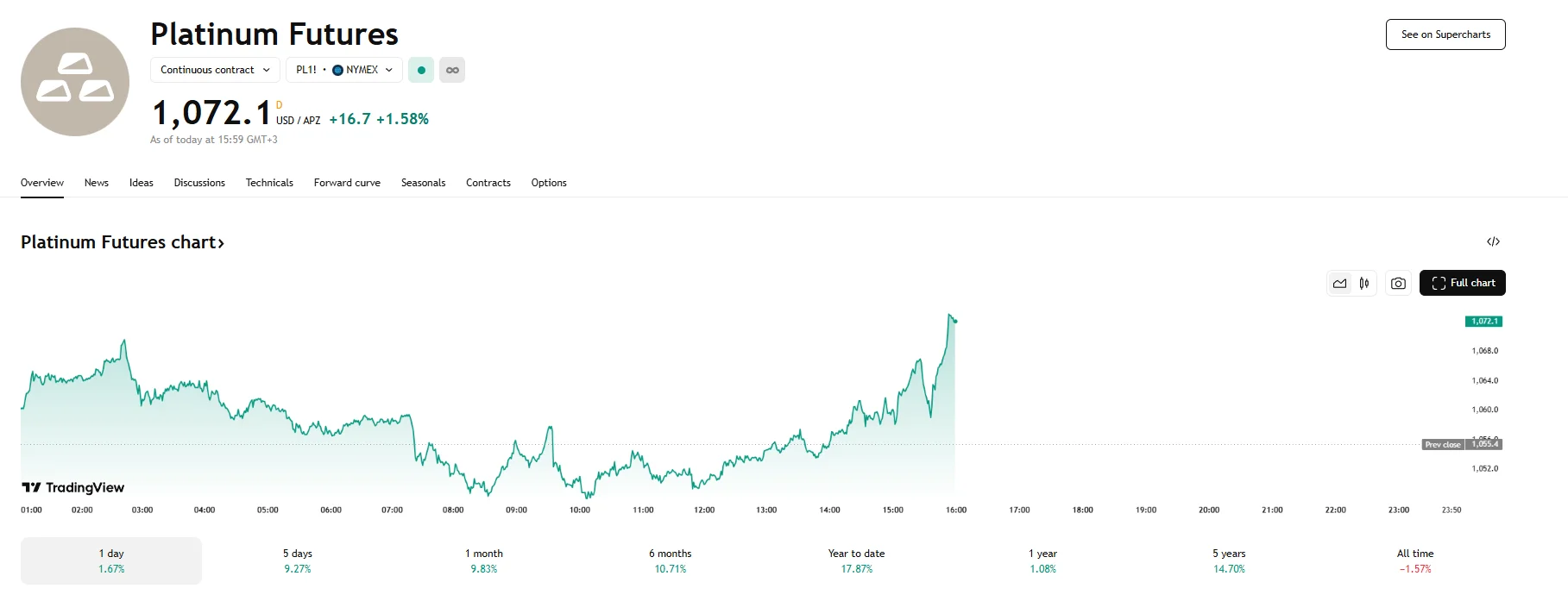

- Platinum futures climbed to $1,072 t.oz., marking their highest level in 51 weeks.

- Chinese platinum imports in April reached a 12-month peak of 11.5 metric tonnes.

- Shenzhen-based Shuibei saw platinum retail outlets increase by 300% in a single month.

Breakout Above $1,000 as Bullish Momentum Builds

Platinum futures surged beyond the key $1,000 mark on Wednesday after newly released data highlighted a notable increase in Chinese imports of the metal. The rally pushed prices to $1,072 per troy ounce, the highest level in almost 12 months.

Jewelry Sector Spurs Demand Shift

The recent upswing has been fueled by heightened interest from the jewelry industry, particularly in China, where traditional gold buyers are increasingly turning to platinum due to more favorable pricing and lower volatility. As a result, demand has accelerated, further solidifying China’s already dominant position as the world’s top platinum consumer.

In April, platinum imports into China rose sharply and reached 11.5 metric tonnes. This surge underscores the expanding role of platinum across industrial and consumer markets.

Retail Growth and Industrial Uses Strengthen Market Support

Major jewelry trading center Shuibei has experienced rapid growth in platinum retail outlets. Over the span of a month, the number of sellers has tripled, driven by shifting consumer behavior and relative affordability compared to gold.

Beyond jewelry, platinum remains an essential component in several industrial applications, including catalytic converters for diesel engines, electronics, and laboratory apparatus, reinforcing its versatility and demand profile.

Investor sentiment has been further lifted by a new report from the World Platinum Investment Council, which projects ongoing deficits in the platinum market. The report anticipates that 2025 will witness yet another year of undersupply, with losses nearing 1 million ounces.