Key Moments:

- Honda has withdrawn its 2030 target of EVs making up 30% of its global sales.

- The company has cut its electrification investment plan by 3 trillion yen ($21 billion).

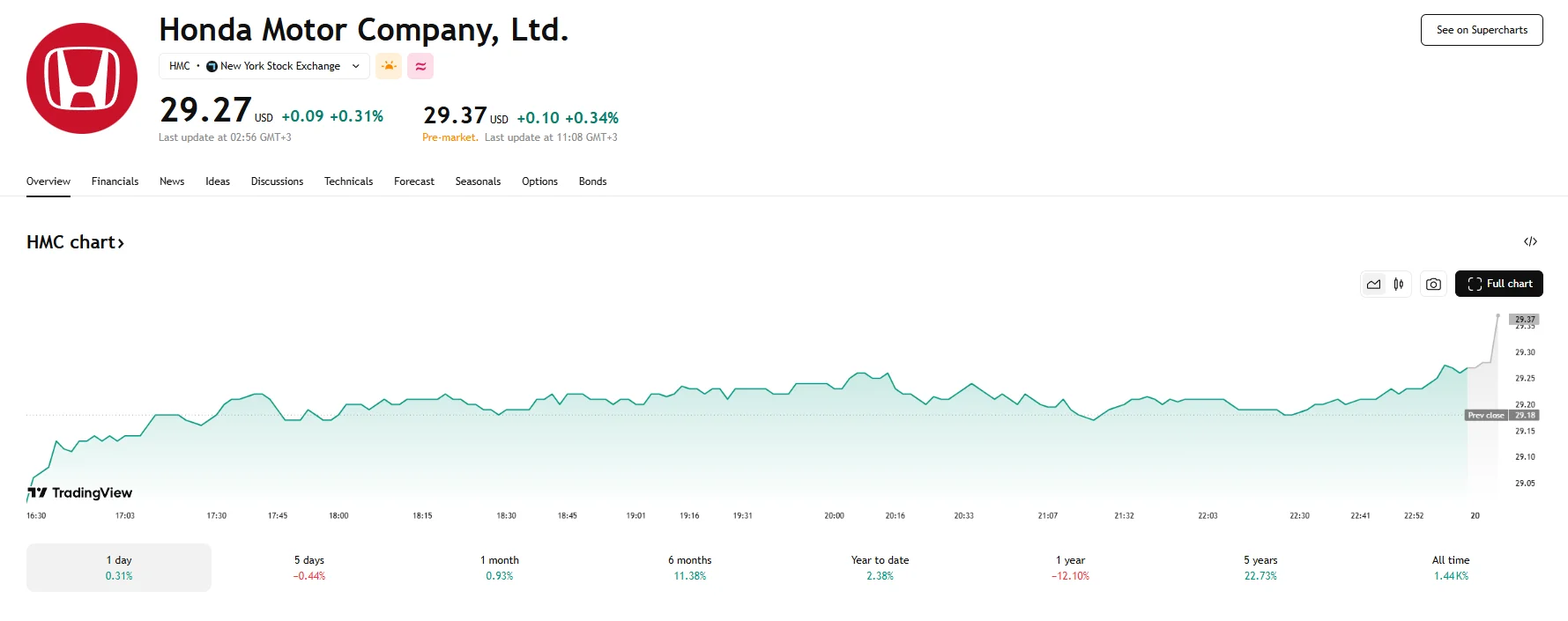

- Honda’s US shares rose 0.34% to $29.37 during pre-market hours.

Honda is Scaling Down Its EV Investments as Sales Headwinds Alter Strategic Spending Plans

Honda has revised its electrification roadmap due to a drop in electric vehicle sales across the US. Now, Honda is planning on investing a total of 7 trillion yen ($48 billion) in its EV operations, 3 trillion yen ($21B) lower than the previous 10 trillion yen ($69 billion) target. The company had also planned for EVs to make up 30% of global vehicle sales by 2030, but it is no longer pursuing such figures.

Following the announcement, Honda’s shares on the New York Stock Exchange ticked higher by 34% and hit $29.37 in the pre-market trading session.

According to Chief Executive Toshihiro Mibe, the company’s long-term commitment to electrification remains intact, albeit with a delayed timeline. He also indicated a strategic pivot toward hybrid vehicles as a more immediate focus. The revised direction will result in Honda’s Marysville auto plant being equipped to manufacture both hybrids and EVs.

In a statement published on May 20th, Honda cited numerous contributing factors to the delay, including evolving environmental regulations and broader uncertainty in the automotive sector. The company also affirmed its commitment to maintaining competitiveness and continuing to inspire customers, declaring that it needs to innovate through electrification and intelligent technologies, and make these innovations broadly accessible.

Industry Headwinds and Global Market Considerations

Policies linked to tariffs and a tepid stance on EV adoption have caused Japanese automakers to reassess their strategies. Honda’s leadership continues to view its motorcycle division as a stronghold, citing ongoing growth in India and an expanding share of the global market. The company’s efforts in digital technology were also highlighted, particularly systems concerning safety, as Honda plans on reducing traffic-related casualties to zero.

The company is also continuing discussions with Nissan Motor and Mitsubishi Motors regarding joint work on technological development. The three vehicle manufacturers had also been working toward forging a deeper alliance through a merger, but the deal hit a roadblock in 2025.