Key Moments:

- Moody’s recently lowered the US credit rating to Aa1, citing rising deficits and refinancing risks.

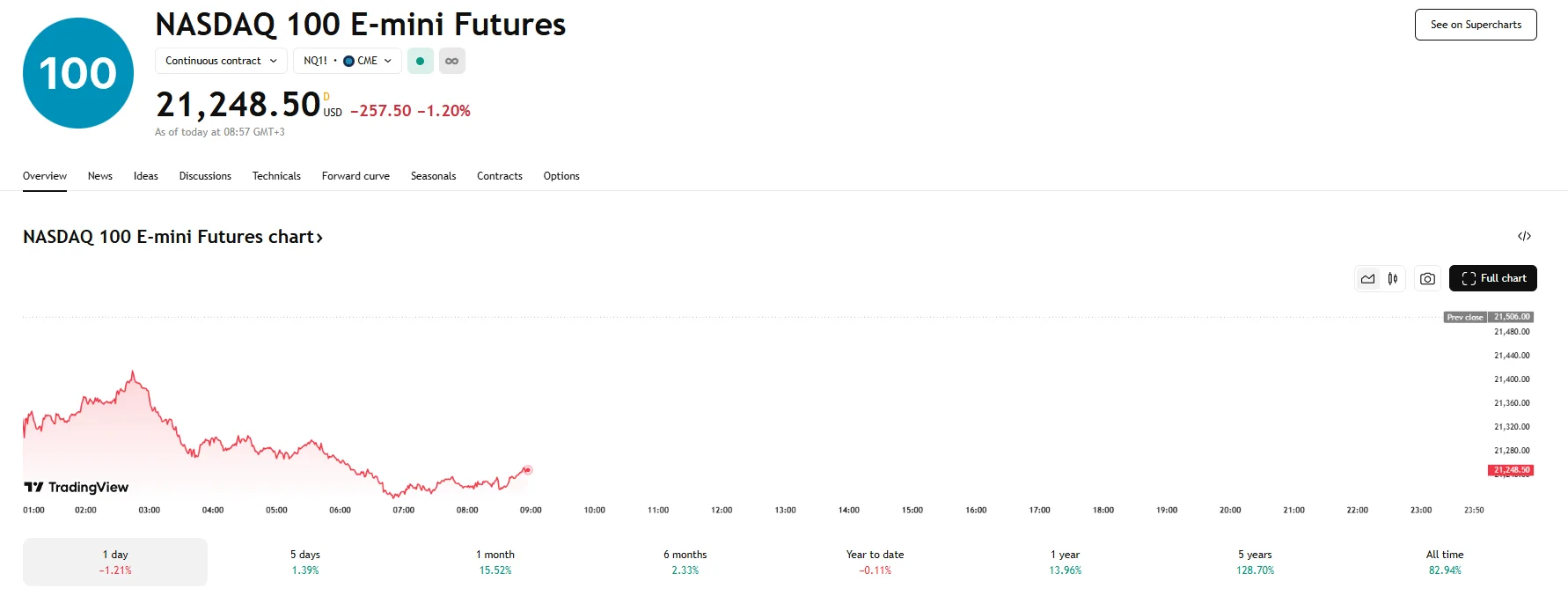

- Futures for major indexes declined on Monday, with Nasdaq 100 futures down 1.20%.

- The decline in futures on Monday contrasts with the robust market performance of the preceding week.

Credit Downgrade Sparks Broad Market Pullback

Monday saw US markets suffer a decline, with Nasdaq 100 e-minis falling the sharpest by 1.20%. Dow Jones futures also fell, slipping by over 300 basis points to hit 42,419, while S&P 500 contracts fell almost 1%.

This drop in investor confidence was a reaction to a significant downgrade of the United States’ creditworthiness by Moody’s, which lowered its US sovereign credit rating from Aaa to Aa1. In terms of reasoning, the agency pointed to the increasing fiscal burden of the federal budget deficit and concerns around the high costs of refinancing existing debt during a period of elevated interest rates. The downgrade placed Moody’s assessment in line with the other major credit rating firms.

The cut to the credit rating comes amid already heightened economic uncertainty driven by evolving US trade policy. Bleakley Financial Group’s Peter Boockvar stated that the core problem of diminished foreign demand, coupled with the expanding volume of debt needing continuous refinancing, was unlikely to be resolved. According to Boockvar, Moody’s downgrade was symbolic because a significant rating agency was drawing attention to the US’s considerable debts and deficits.

Monday’s decline in futures follows a strong performance in the prior week that was attributed to news of a 90-day trade agreement between China and the US. Despite last week’s optimism, investors are now watching for possible fallout from renewed tensions sparked by trade-related rhetoric and Moody’s credit rating cut.

Market participants are also turning their focus to upcoming public comments from several Federal Reserve officials, including Raphael Bostic, John Williams, and Lorie Logan. Their remarks could offer fresh insights into the central bank’s outlook on monetary policy.