Key Moments:

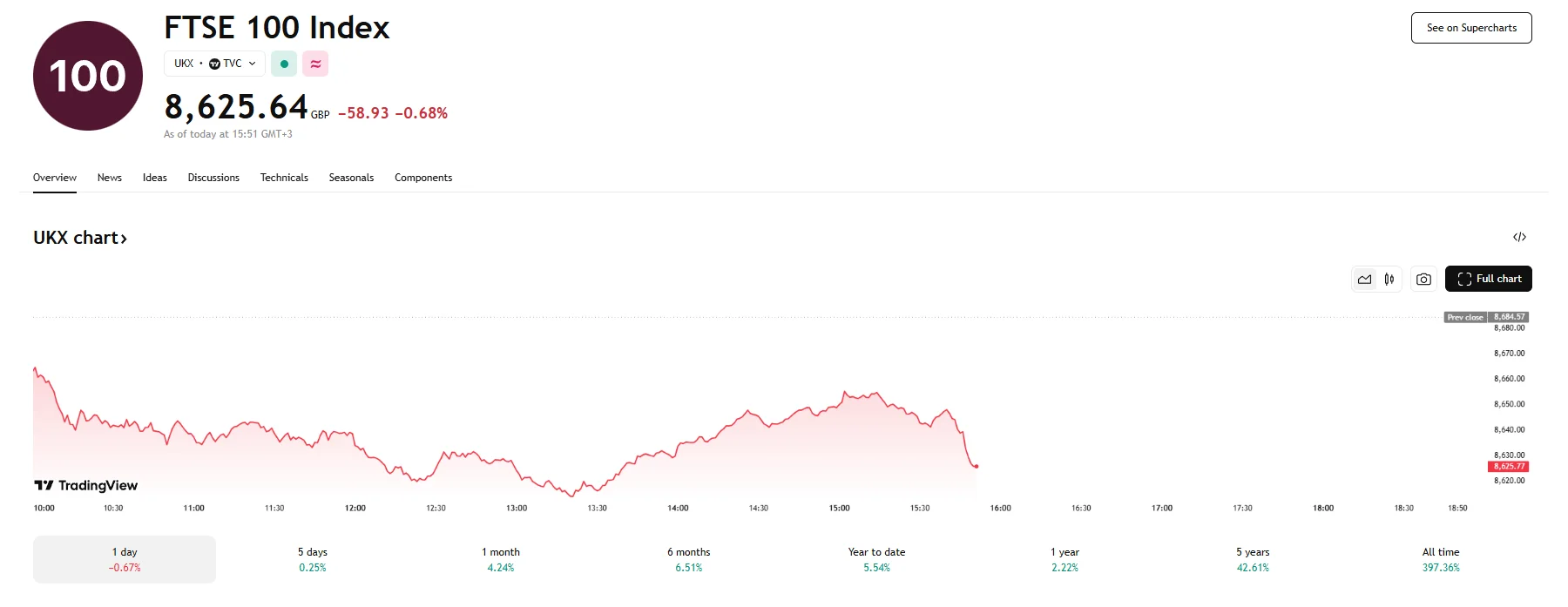

- The FTSE 100 slipped by 0.7% on Monday.

- A UK-EU post-Brexit deal was finalized, covering food checks and fishing rights through 2038.

- The decision of Moody’s to remove the US’s last triple-A credit rating outweighed positive sentiment from the UK-EU trade deal.

Markets React to Credit Rating Downgrade and UK-EU Pact

UK equities opened the week on a weak footing, following declines across Europe and Asia as investors absorbed the implications of a US sovereign credit rating downgrade by Moody’s. Simultaneously, negotiations between the United Kingdom and the European Union moved toward resolution, reducing some political uncertainty in the region.

London’s FTSE 100 fell 0.7%, with notable decliners in the index being Pershing Square Holdings, which lost 3%, Scottish Mortgage Investment Trust (down 2.12%), and asset manager St James’s Place, which saw its stock decline by over 1%.

The market softness was not limited to the UK. In Germany, the DAX edged down 0.1% before returning to flat levels, while France’s CAC 40 lost 0.74%. The broader STOXX 600, which tracks leading European companies, also declined by 0.6%.

US equity futures declined in tandem after Moody’s removed the final triple-A rating for the country on concerns over the long-term sustainability of America’s budget deficit and debt levels. The downgrade sparked renewed anxieties over fiscal stability across global markets.

UK and EU Reach Post-Brexit Agreement

UK and EU leaders announced a major breakthrough in their negotiations, culminating in a newly agreed partnership designed to replace the current arrangement set to expire in 2026. EU diplomatic sources confirmed that the new agreement will run through 2038.

Fishing rights had remained a sticking point throughout the latest round of talks but have largely been resolved, clearing a path for broader cooperation. The 12-year fishing arrangement grants EU vessels access to UK waters. It also includes corresponding benefits for British exporters of food and agricultural goods to the European Union.

Additional elements of the agreement include removing a significant number of customs checks on food and drink exports from the UK to the EU. In exchange, the UK agreed to abide by selected European food standards. According to UK officials, this move is expected to lower food prices and contribute £9 billion to the UK economy.

Downing Street characterized the agreement as a significant economic win, emphasizing the benefits to UK households through reduced food costs. UK Prime Minister Sir Keir Starmer echoed these remarks, noting that the agreement illustrates how two “natural partners” could collaborate on the international scene.