Key Moments:

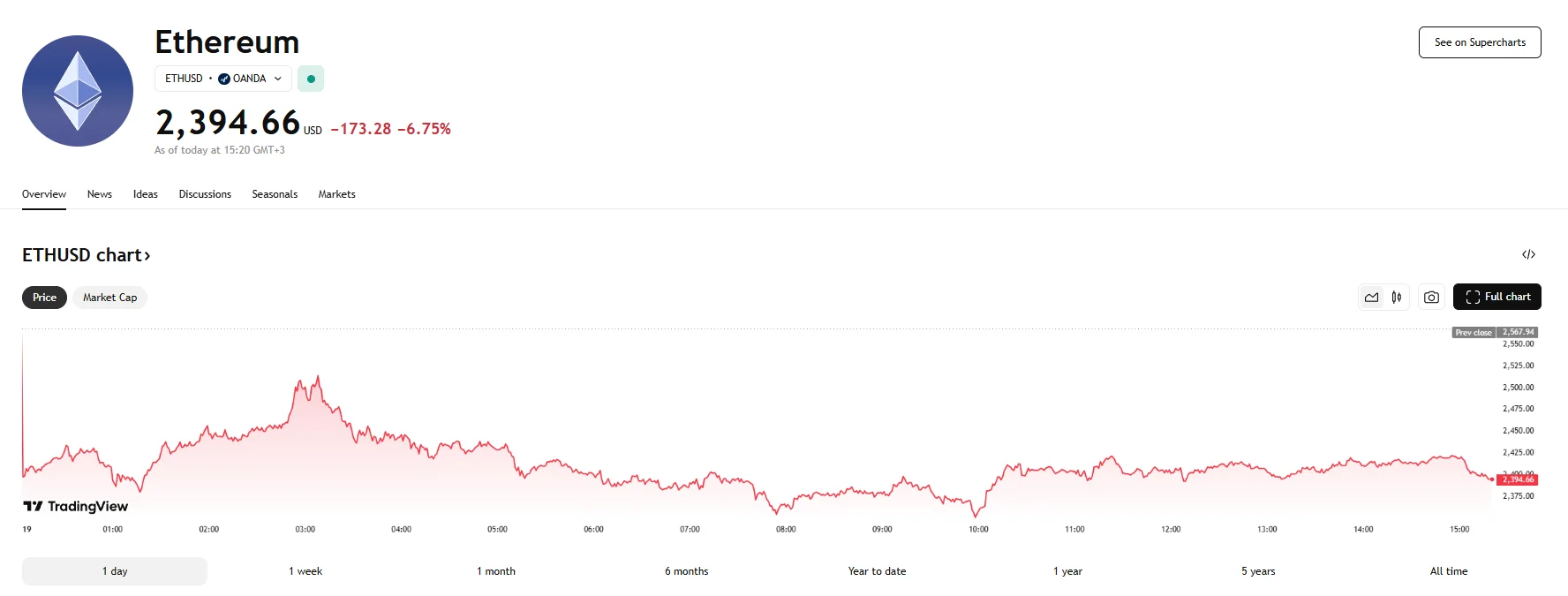

- Ethereum dropped over 6.75% to around 2,395 amid a surge in trading volume and market-wide weakness.

- More than $200 million in long positions were liquidated, contributing to sharp price declines for ETH.

- The total value of the cryptocurrency market decreased by approximately 1.40%, settling at $3.25 trillion.

Market-Wide Risk Sentiment Sparks ETH Downturn

Monday witnessed Ethereum’s price plunge more than 6%, reaching approximately 2,395. The decline followed a broader pullback across digital assets, as the crypto market capitalization declined by around 1.40% to $3.25 trillion.

ETH touched an intraday low of $2,353 after peaking at $2,587 on May 18th. Daily trading volume jumped by over 100% to around $30.4 billion, underscoring increased sell-side momentum.

Downgrade of US Sovereign Rating Fuels Risk Aversion

The deteriorating sentiment followed a notable development over the weekend, when the United States lost the triple-A credit rating granted by Moody’s. The announcement marked Moody’s first US downgrade in over a century and sent ripples through markets. The financial services firm made this decision due to the United States’ $36 trillion national debt, along with other factors such as increasing interest costs and notable fiscal deficits.

In response, Treasury yields surged, signaling a shift toward pessimistic market sentiment. Concerns about borrowing costs and the Federal Reserve’s policy path, currently expected to lower rates just twice by the end of the year, as per the CME FedWatch Tool, compounded the pressure on speculative assets like cryptocurrencies.

Leverage Washout Exacerbates Declines

A wave of long position liquidations amplified Ethereum’s steep drop. Over the past 24 hours, more than $255 million in ETH derivatives positions were liquidated. Crucially, 78% of those ($200 million) stemmed from long-sided bets. These forced liquidations occur when leveraged traders are unable to meet margin requirements, prompting exchanges to automatically sell their assets, which intensifies downward price action. The broader crypto space experienced a shakeout of $665 million in terms of liquidations.