Key Moments:

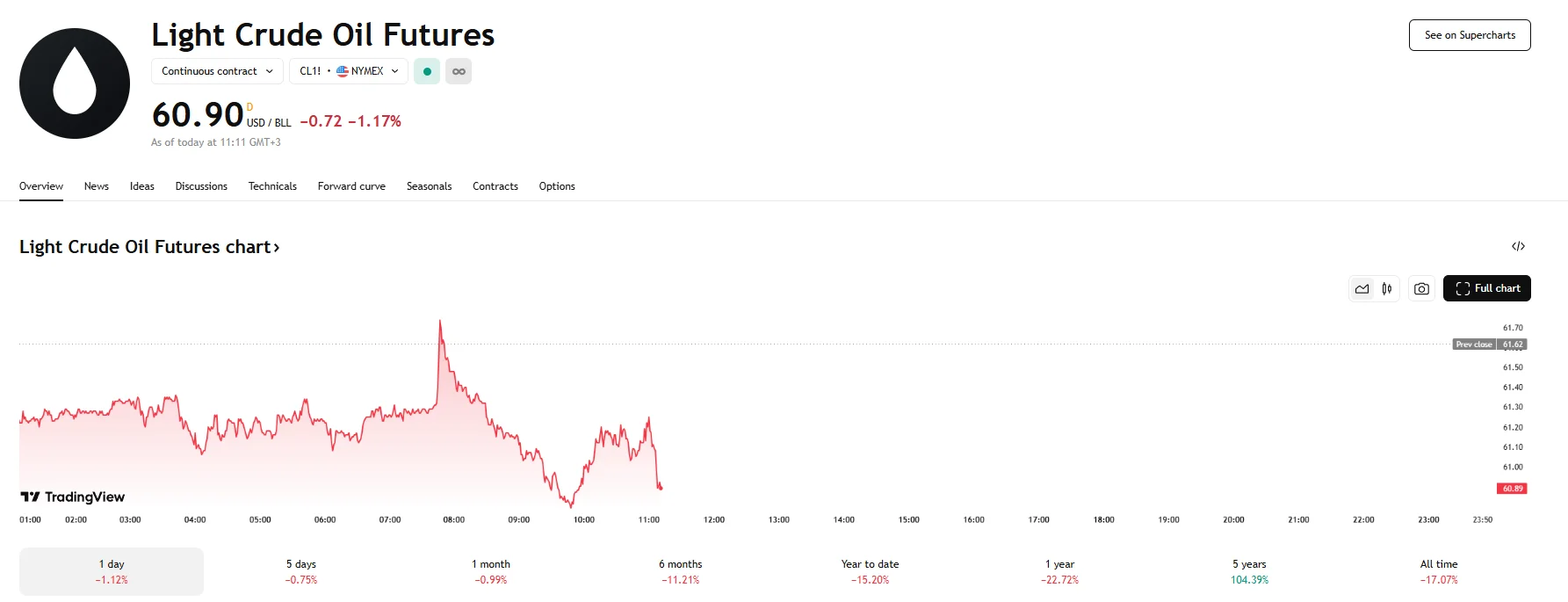

- West Texas Intermediate (WTI) futures hit $60.90 on Friday.

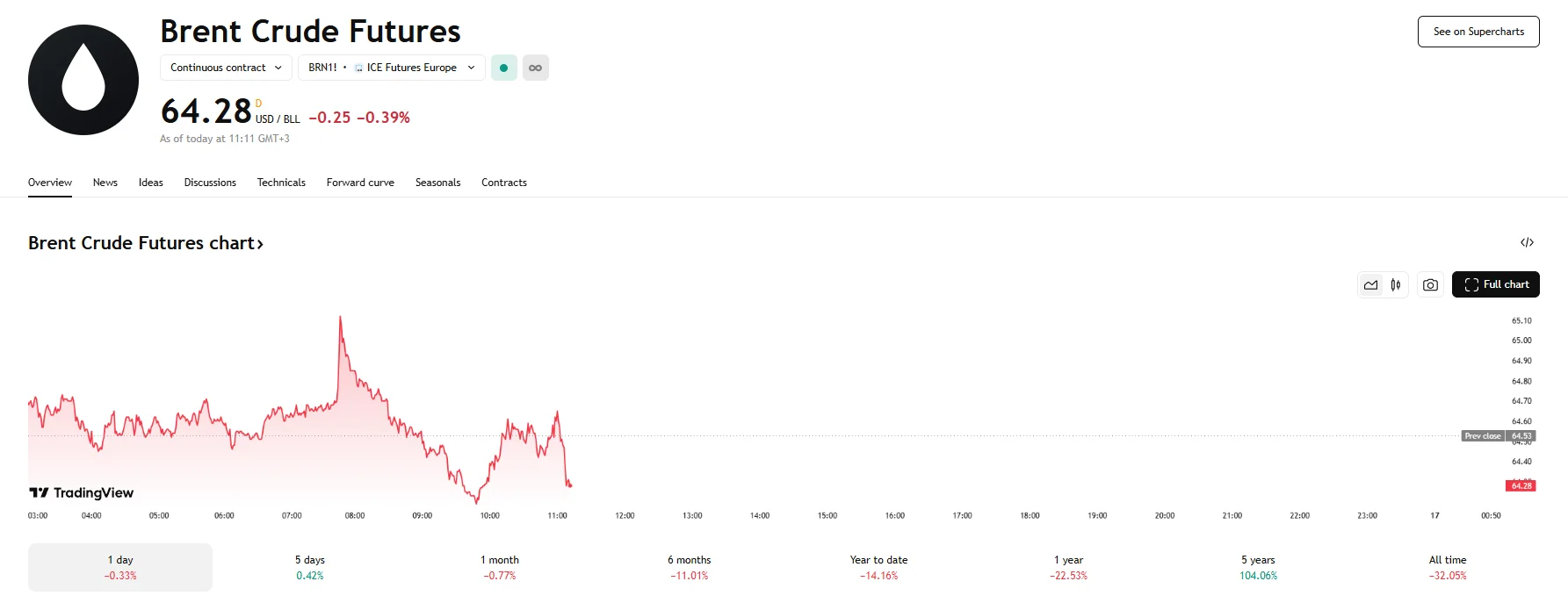

- Brent futures contracts slipped below the $65 mark.

- Crude oil prices are still on course to climb in terms of their weekly performance amid support by the US-China trade agreement that helped ease demand concerns.

Trade Progress Supports Crude

WTI crude oil futures fell to around $60.90 per barrel on May 16th amid yet another daily drop. Brent also depreciated, dropping 0.4% to $64.28. In spite of these declines, both benchmarks are on track to post a modest gain for the week.

The underlying driver was renewed optimism surrounding trade relations between the world’s two largest energy consumers, which offered a reprieve to demand concerns that have weighed on the market. Namely, Washington and Beijing reached a preliminary trade accord, and under the agreement, the US has cut tariffs on Chinese imports to 30%. China also reduced duties on products sourced from America, and the levies now stand at 10%. In total, each country reduced its respective tariff duties by 115%.

Supply Concerns and Geopolitics Limit Upside

Despite the boost from trade developments, crude oil’s rally faced resistance due to a range of supply-side headwinds. Central among these was speculation around a potential US-Iran nuclear agreement. US President Donald Trump commented earlier this week that the US was nearing a deal, but there is still uncertainty surrounding key aspects and problems tied to the deal.

As reported by Reuters, analysts at ING expect a resolution on the nuclear front to reduce geopolitical risk and enable Iran to expand oil production. That could inject as much as 400,000 barrels per day into the already abundant global supply.

Crude prices were also dragged by a surprising build in US stockpiles. Adding to concerns, the International Energy Agency (IEA) revised its projection for worldwide oil supply due to higher output from Saudi Arabia and other OPEC+ members. According to the IEA, crude oil inventories could grow by an estimated 380,000 barrels per day.