Key Moments:

- The KOSPI rose 0.21% on Friday and jumped by nearly 2% for the week.

- Within the chip sector, stock performance was not uniform. Samsung Electronics shed 500 basis points, while SK Hynix gained by 2%.

- Foreign investors purchased 169.4 billion won worth of South Korean shares.

KOSPI Rises Further

South Korean equities ended higher on Friday, extending a multi-week rally. The upward momentum followed US economic data that signaled potential interest rate cuts by the Federal Reserve later this year. This development enhanced investor sentiment and bolstered bets on a more accommodative rate outlook in South Korea as well.

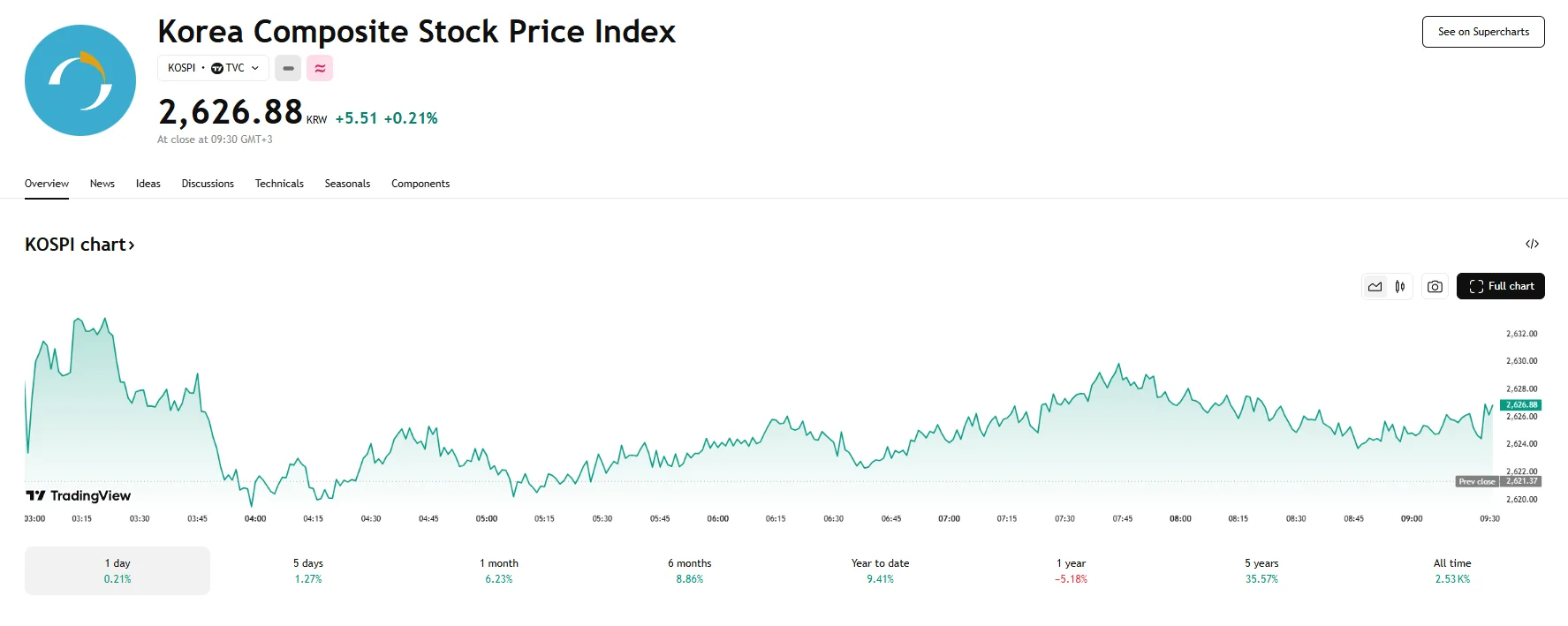

The benchmark KOSPI index finished the trading session with a gain of 5.51 basis points, up 0.21% to 2,626.87. For the week, the index advanced just short of 2%. A total of 316 stocks rose, while 581 saw their share prices drop.

Sector Highlights and Bond Yield Movements

Foreign investors snapped up a total of 169.4 billion won worth of shares. E Investment & Development was the top company on the index, soaring by 20.52%. In contrast, Dongsung Pharmaceutical sank to the lowest position by falling 30% following a recent bankruptcy announcement.

Chip stocks, meanwhile, were mixed during the session. Market giant Samsung Electronics dipped 0.87%, whereas SK Hynix gained 2.00%. However, battery producer LG Energy Solution fell sharply by 5.37%.

Among other notable movers, Hyundai Motor advanced 0.47%, and sibling company Kia Corp rose 0.88%. Steelmaker POSCO Holdings lost 1.00%, while pharmaceutical firm Samsung Biologics edged up 0.40%.

In the bond market, June futures on three-year treasury bonds rose by 0.11 points and settled at 107.66. Yields declined across the curve, with the most liquid three-year treasury bond yield falling by 4.8 basis points to 2.313%. As for the 10-year benchmark yield, it lost 4.0 basis points and fell to 2.690%.