Key Moments:

- Foxconn’s Q1 net profit surged 91% YoY, reaching T$42.12 billion ($1.39 billion).

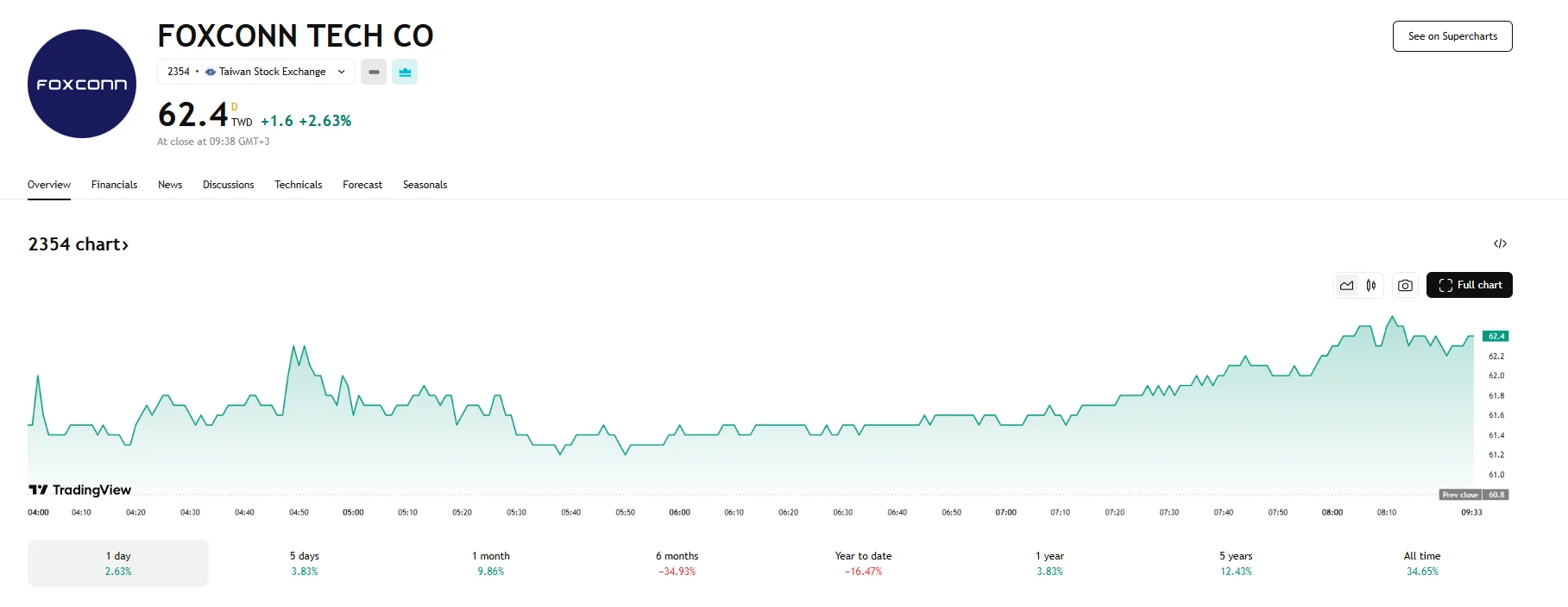

- Its stock rose by 2.63% on Wednesday.

- The company projected high double-digit growth for AI server sales in Q2.

Record Q1 Profit Beats Expectations

Nvidia partner Foxconn, officially known as Hon Hai Precision Industry, reported a dramatic 91% increase in net profit for the first quarter. This figure was driven by surging demand for artificial intelligence servers. For the first three months of 2025, the company achieved a net income of T$42.12 billion ($1.39 billion), outperforming the average T$37.8 billion forecasted by analysts according to LSEG data. The company’s stock price jumped, climbing by 2.63% to close at T$62.4.

The above figure follows a recently published revenue disclosure, according to which Foxconn’s Q1 revenue surged 24.2% YoY thanks to high interest in the company’s AI servers. Moreover, in its quarterly earnings report, the electronics manufacturing giant projected significant YoY growth for the second quarter. It highlighted notable double-digit gains expected in AI server revenue, which will be driven by an increase in production.

Company Tones Down Full-Year Outlook

While Foxconn remained optimistic about near-term momentum, it adopted a more cautious stance on its outlook for full-year revenue. The company now expects “strong” growth for 2025, revising down its previous projection of “significantly strong” growth.

Moreover, although China and the US recently announced a 115% cut to their tariff duties, the deal is temporary and set to last for 90 days. Thus, there is still a degree of uncertainty over long-term tariff policies, and a potential reigniting of tensions could impact Foxconn’s manufacturing operations as the company is heavily reliant on its Chinese facilities.

Looking beyond electronics, Foxconn continues to target growth in the electric vehicle sector. Its subsidiary, Foxtron Vehicle Technologies, recently inked a memorandum of understanding with Mitsubishi Motors regarding the provision of an electric vehicle model. Earlier, Foxconn had indicated a potential interest in acquiring a stake in Nissan, which is seeking to streamline operations amid challenges in China and the US.