Key Moments:

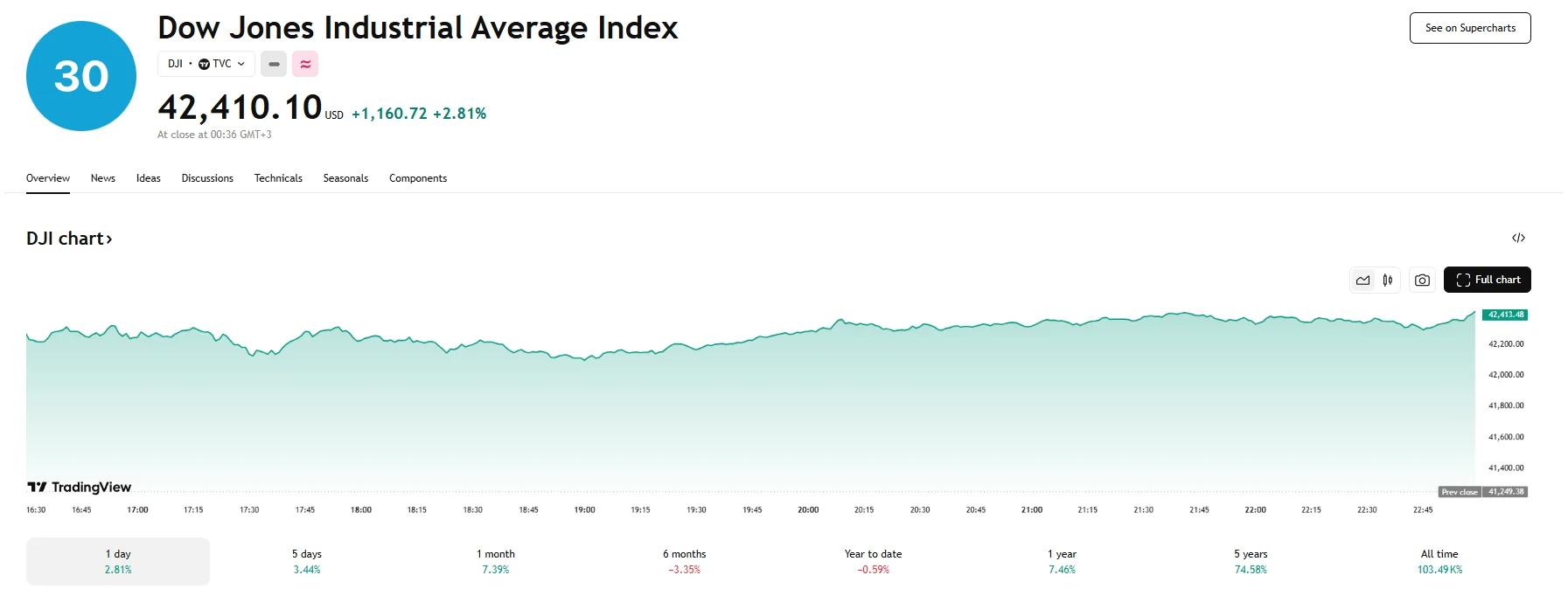

- Monday saw major Wall Street indices skyrocket, with the Dow Jones rising over 1,100 basis points, the Nasdaq 100 jumping 4.02%, and the S&P 500 росе 3.26%.

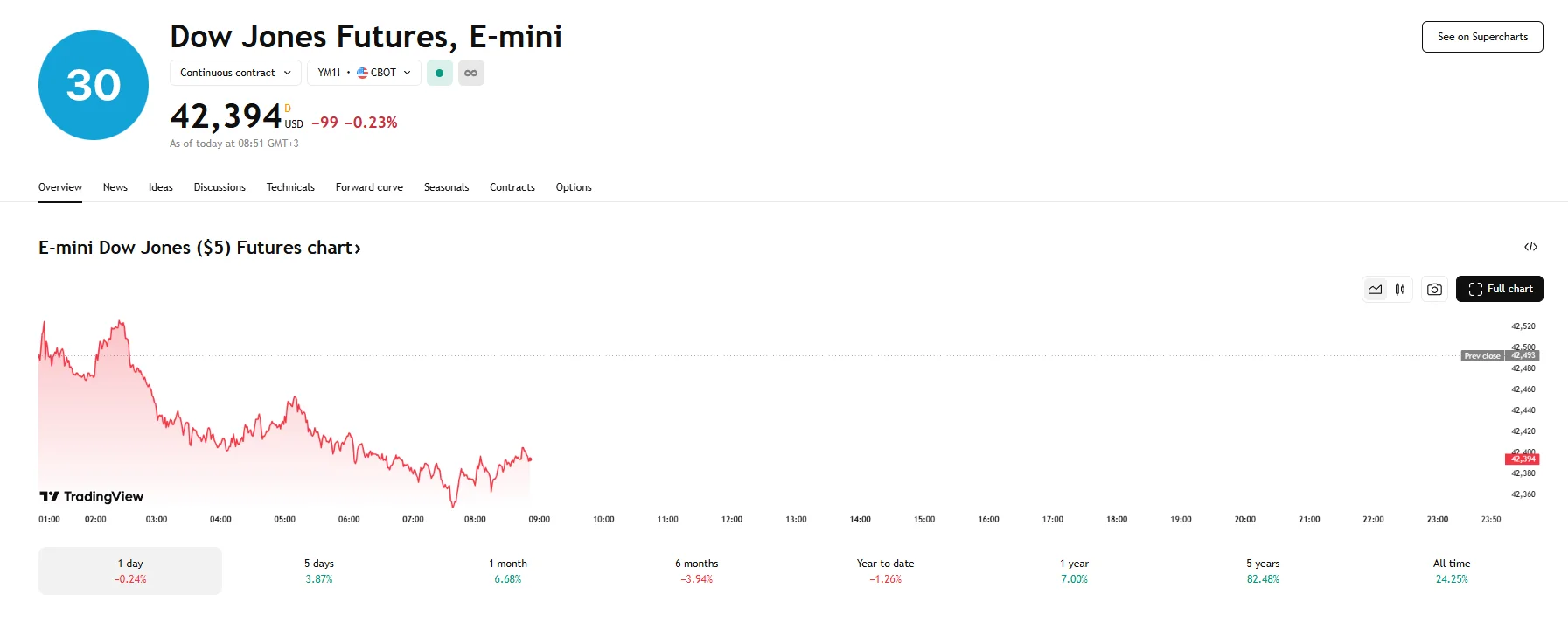

- The rally did not extend into Tuesday, as Dow and Nasdaq 100 futures shed almost 100 points, while S&P 500 e-minis dropped 0.35%.

- The consumer price index for April is predicted to hold steady at 2.4% year-over-year.

Market Snapshot Ahead of CPI Release

US equity futures declined during pre-market hours, pausing a major equity rally as investors brace for an upcoming inflation reading set to be released later today. E-mini futures tied to the Dow Jones Industrial Average dropped 0.23% to 42,394, and those for the S&P 500 500 fell 0.35% to 5,844.50. Meanwhile, Nasdaq 100 futures shed 92 basis points amid a 0.44% decline to 20,856.75.

These movements contrast with yesterday’s market enthusiasm over the US-China tariff rollback, which saw the Dow Jones close with a substantial rise of 1,160.72 basis points. The S&P 500 and Nasdaq 100 indices also enjoyed major gains, soaring 3.26% and 4.02%, respectively. The figures marked Wall Street’s best day in over a month, with investors cheering the agreement between Washington and Beijing to lower tariffs by 115% for 90 days.

Inflation Figures in Focus

Based on Dow Jones analyst forecasts, the upcoming consumer price index (CPI) will likely show an annual increase of 2.4% for April, unchanged from the previous month. Core CPI, which does not include volatile food and energy costs, will also remain steady at a 2.8% year-over-year rate according to current estimates.

Northwestern Mutual Wealth Management’s CIO, Brent Schutte, said that the data will be thoroughly examined. He explained that this analysis aimed to determine whether the slower pace observed in March had persisted and if the increased costs reported by some businesses in recent surveys had led to higher prices for consumers.