Key Moments:

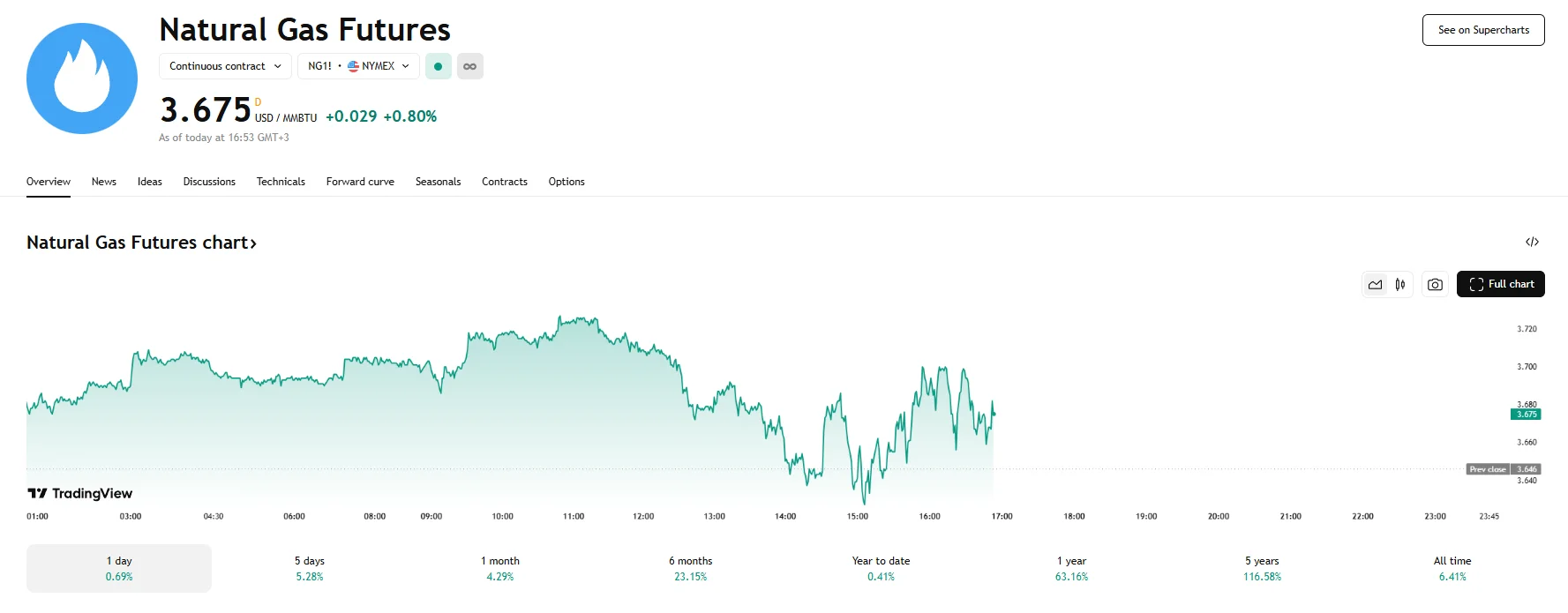

- Natural gas futures moved above $3.67/MMBtu on Tuesday, approaching a one-month high of $3.8 reached on May 9th.

- Lower 48 natural gas production declined to 103.7 bcfd in May, down from April’s record 105.8 bcfd

- LNG feedgas demand dropped to 15.1 bcfd, attributed to maintenance at major US export terminals.

Market Overview

US natural gas futures hit $3.675 per million British thermal units (MMBtu), nearing the one-month high of $3.8/MMBtu that was recorded earlier this month. The upward move reflected a combination of factors, including reduced output, changing seasonal demand expectations, and geopolitical developments.

Production and Supply Dynamics

Natural gas production in the Lower 48 states declined in May to 103.7 billion cubic feet per day (bcfd). This marked an easing from the record level of 105.8 bcfd seen last month. Despite supply levels being relatively high still, this drop in output contributed to the recent price appreciation.

Commodity Market Sentiment and Trade Policy

Broader energy markets also showed strength following new developments in US-China trade policy. The White House announced a reduction in tariffs on Chinese goods for the next three months. China has also cut the duties imposed on US goods. These decisions helped alleviate concerns over a prolonged trade conflict and supported positive sentiment across commodities. Brent and WTI crude oil futures, in particular, both rose over 1% on Tuesday.

LNG Feedgas and Terminal Maintenance

Liquefied natural gas (LNG) feedgas demand fell to 15.1 bcfd, retreating from the record 16.0 bcfd level posted in April. The decline was driven by maintenance activities at major export hubs, including terminals based in Cameron, Corpus Christi, and Freeport.