Key Moments:

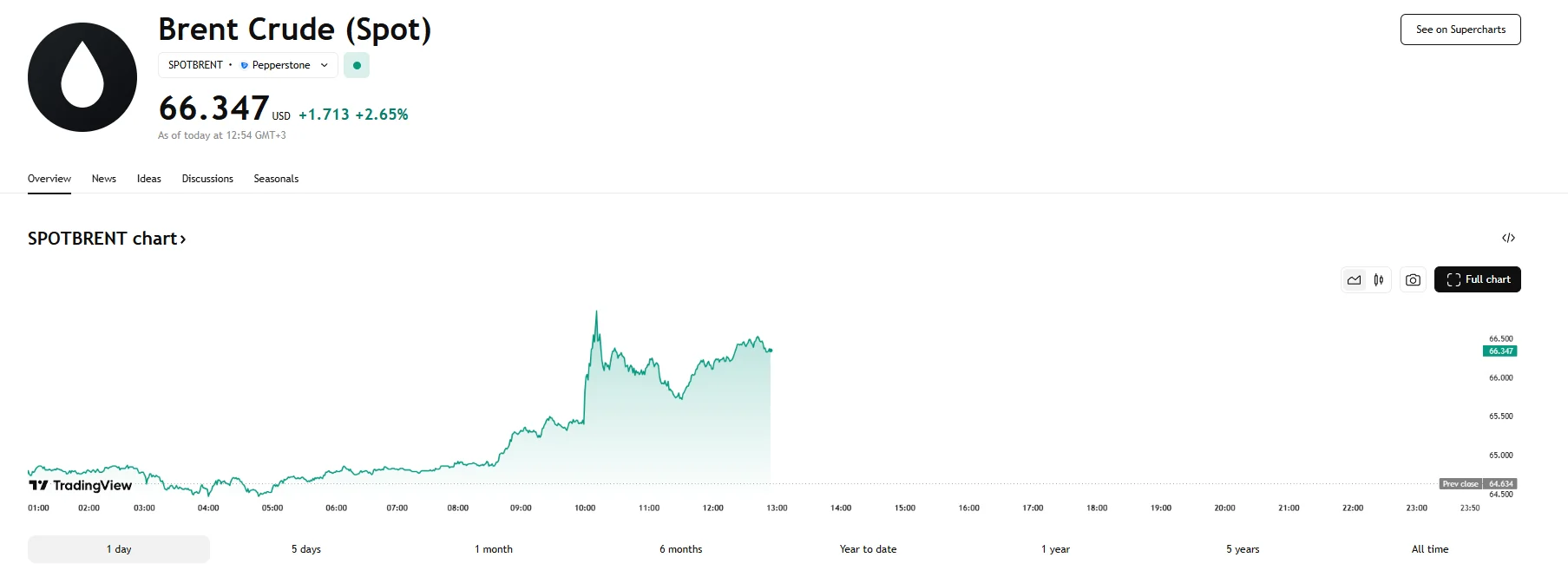

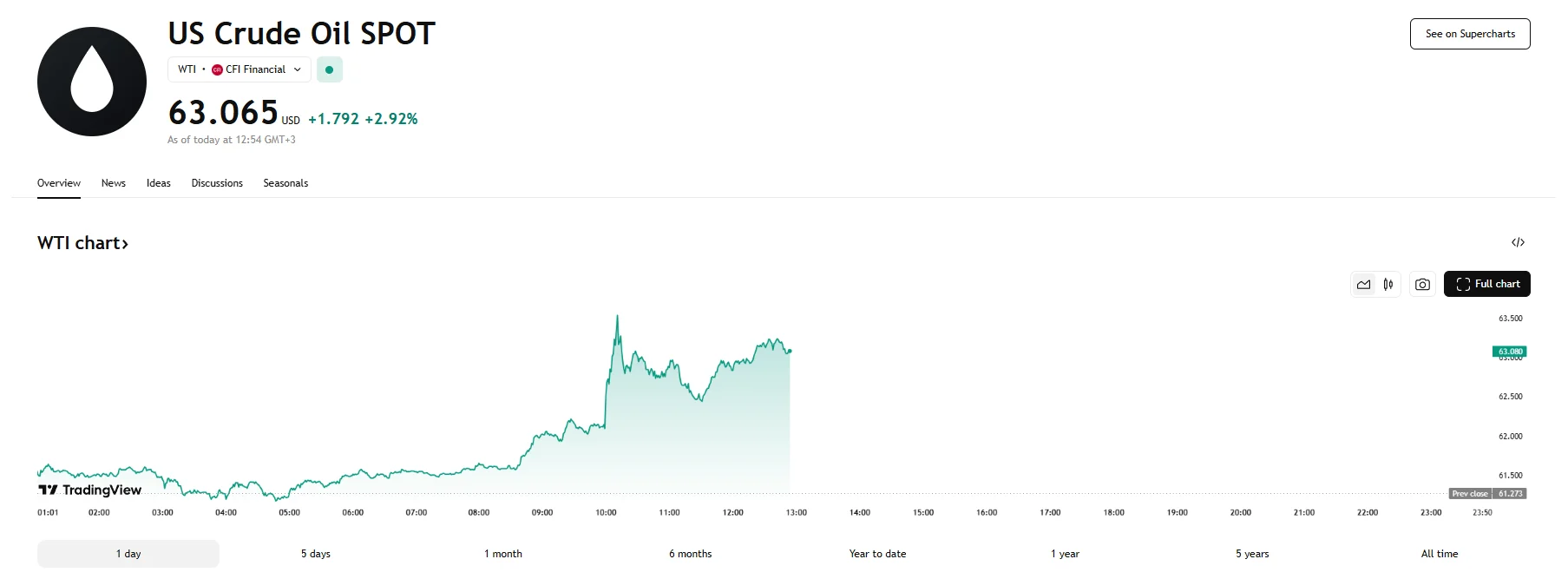

- Brent crude spot prices rose 2.65% to $66.34 per barrel, while WTI gained 2.92% to $63.065 per barrel on Monday.

- China and the US have agreed to lower reciprocal tariffs by 115% for a 90-day period.

- OPEC’s plans to increase output in May and June limited the extent of oil price gains.

Tariff Truce Sparks Oil Price Jump

Oil markets surged Monday as news broke that the United States and China have reached a temporary agreement to significantly reduce tariffs on each other’s products. The move, aimed at de-escalating long-standing trade tensions, fueled investor optimism about future global economic growth and served to boost crude oil prices.

Brent crude advanced 2.65%, with its price reaching $66.34 per barrel. West Texas Intermediate, the US crude oil benchmark, also saw its spot figures climb by 2.92% to $63.065 per barrel as markets responded to the easing in trade hostilities between the world’s two largest economies.

The agreement, reached after high-level discussions in Switzerland, signals a significant softening in bilateral trade relations. Under the newly reached understanding, reciprocal tariffs between the US and China will be lowered by 115% for a 90-day period. This will translate to US tariffs on Chinese exports falling from 145% to 30% in total, while levies on American products will decline from 125% to 10%. The duties on goods shipped from China remain at 30% due to the still-in-effect 20% tariff on imports tied to fentanyl.

US Treasury Secretary Scott Bessent said that the talks had been “very productive” and that they had “added great equanimity to what was a very positive process” when addressing the media following Sunday’s negotiations. The tariff freeze is set to begin May 14th, with Washington and Beijing stating they will carry on with discussions focused on broader economic and trade policies.

Today’s announcement follows earlier progress in US-UK trade talks, which had already improved market sentiment. Still, analysts have noted that oil price increases were restrained by plans from OPEC to ramp up production in May and June.