Key Moments:

- Nvidia’s stock rose 3.53% after US markets opened, as chipmakers in America and China

- Nvidia is part of a broader rally as investors cheered today’s surprise tariff rollback announcement. Dow soared by 100 points, while the Nasdaq Composite rose by 3.14%.

- The tariff on Chinese goods was reduced from 125% to 10% for a 90-day period during ongoing negotiations

Tariff Deal Boosts Nvidia Shares

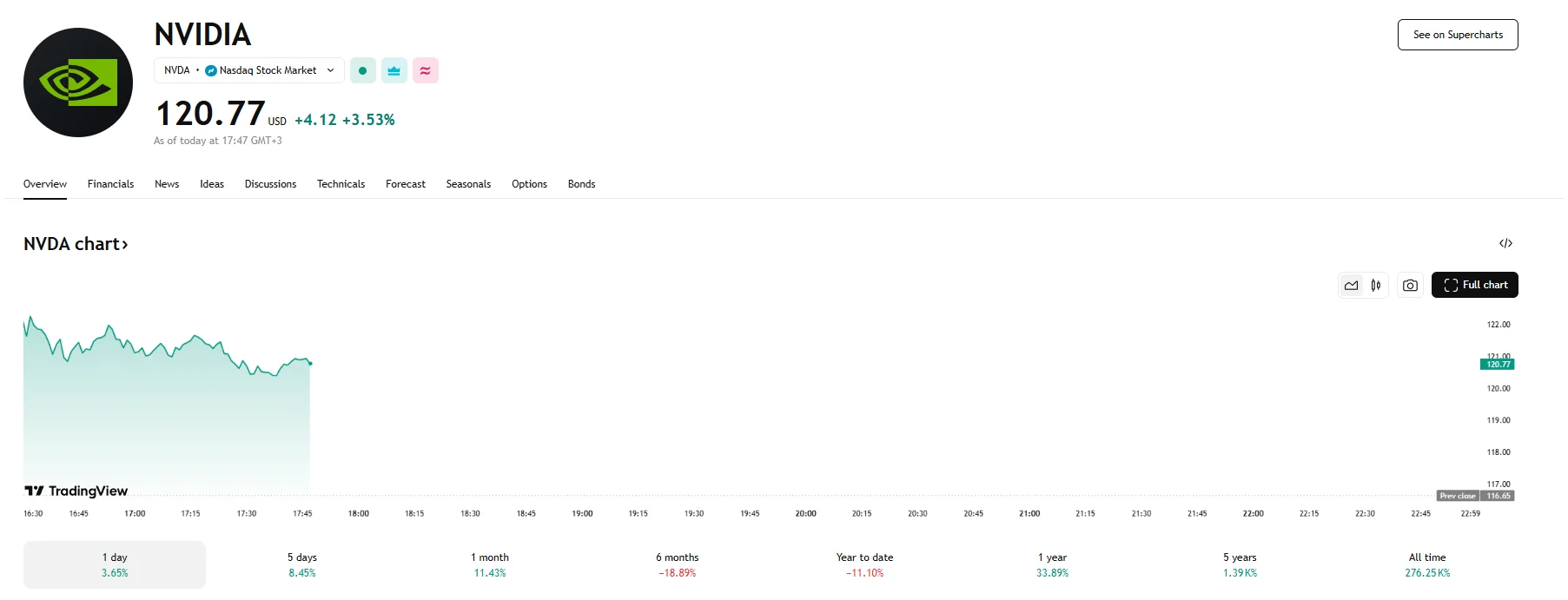

Nvidia’s stock value experienced a 3.53% surge to $120.77 on Monday after the United States and China reached a deal to significantly ease tariffs on each other’s goods. The breakthrough followed discussions in Geneva over the weekend, culminating in a Monday announcement that tariffs will decline by 115%. The decrease is set to last 90 days starting May 14th.

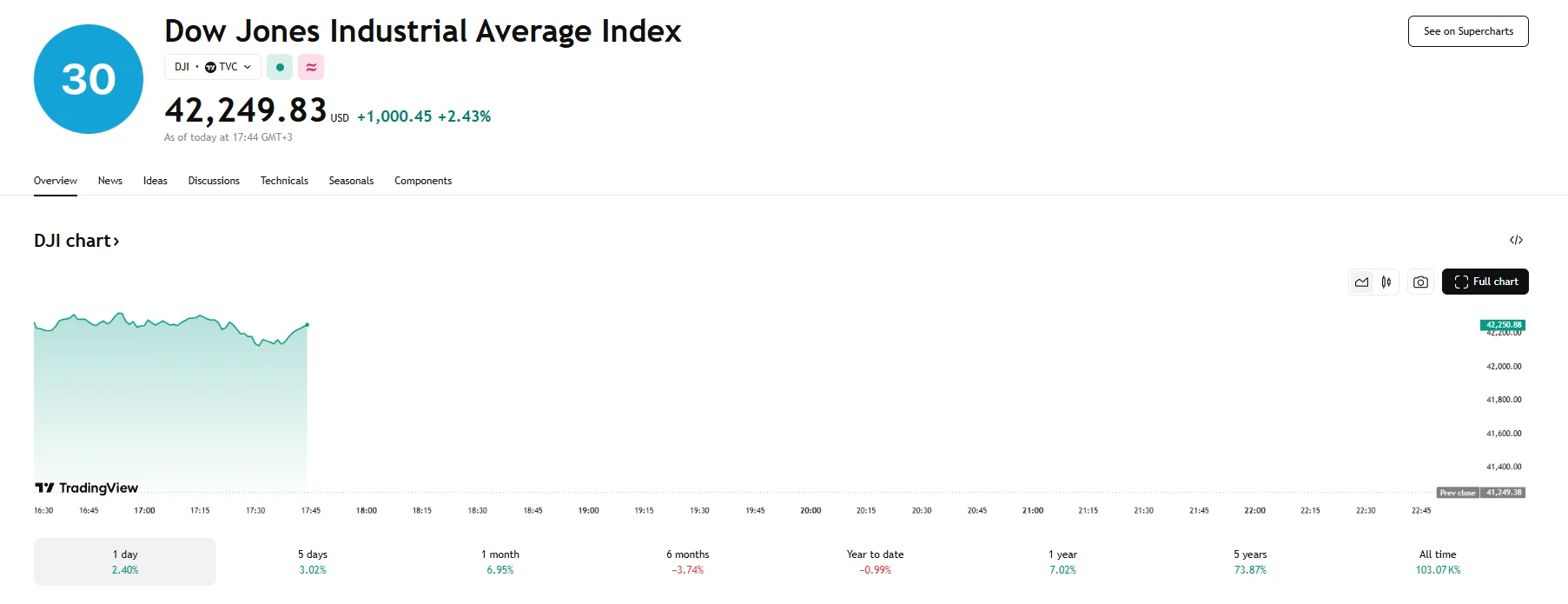

Nvidia’s rally was not isolated. In the broader market, the Nasdaq Composite soared 3.14%, marking a climb of more than 500 basis points, while the Dow Industrial Average skyrocketed by 1000 basis points. The pace and scale of the tariff easing surprised investors, leading to widespread optimism on Wall Street.

Moreover, various stocks across the chip manufacturing industry mirrored Nvidia’s performance, with one such company being Taiwan Semiconductor Manufacturing, as its share price climbed 5.47% to $186.17. Although chipmakers were not directly targeted by previous tariffs, the broader industry had been caught in the crossfire of the simmering US-China trade tensions ignited earlier this year by the Trump administration.

Many semiconductors are exported to China for final assembly into tech equipment. These finished products were often the ones facing import duties when entering the US, impacting the industry’s outlook. The temporary 90-day window thus provides breathing room for manufacturers, with the potential for additional talks raising hopes among market participants that more permanent relief may be on the horizon for the global technology supply chain.