Key Moments:

- Aston Martin shares advanced 13.86% after the anticipated US-UK trade deal reduced tariffs on British-made vehicles.

- Rolls-Royce Holdings stock also rose, climbing 3.66% as its aerospace exports were exempted from US levies.

- The agreement capped a 10% tariff on the first 100,000 UK cars exported to the United States annually.

Market Reaction to Revised US-UK Trade Terms

UK heavyweights in the automotive and engineering industries saw significant share price appreciation following the announcement of a revised trade agreement between US President Donald Trump and Prime Minister Sir Keir Starmer. Trade negotiations established more favorable terms on British goods exported to the US, particularly when it comes to automotives and certain metals.

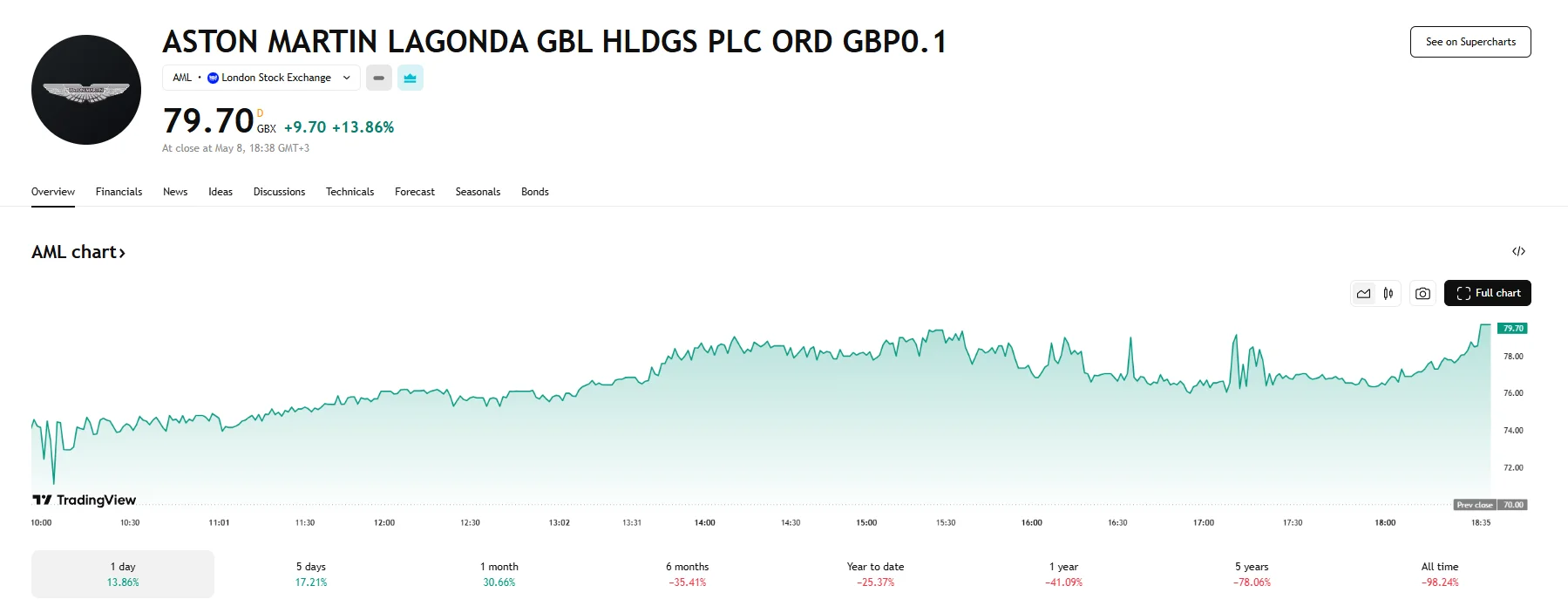

Shares of Aston Martin surged nearly 14% to 79.70 GBX after US and UK officials disclosed details regarding the agreement. Over a third of Aston Martin’s revenue is sourced from the US, and the previous tariffs were set to impact the company negatively and force it to curb US-bound shipments.

Aerospace engine manufacturer Rolls-Royce Holdings also enjoyed gains. Its stock rose 3.66% on Thursday to close at 784 GBX.

New Tariff Structure for British Car Exports

Under the terms of the trade deal, the US will impose a 10% tariff on the first 100,000 vehicles exported annually from the UK, significantly reduced from the prior 27.5% rate. The clause will concern companies like Jaguar Land Rover and Rolls-Royce Motors.

Equity analyst at Morningstar Rella Suskin observed that the cap of 100,000 cars annually implied that Jaguar could not gain any market share due to a “preferential” tariff in comparison to European car manufacturers. She added that while the deal preserves current conditions for these British manufacturers, it could allow BMW, which produces vehicles domestically within the US, to expand its market position.

Broader Industry Impact

Elsewhere in the market, UK engineering firms such as Melrose Industries PLC and Weir Group PLC saw their stocks experience gains driven by news of a future US-UK collaboration in aerospace technology, along with the removal of tariffs on steel and aluminium sourced from the UK.

The aerospace sector received a direct boost through comments made by US Commerce Secretary Howard Lutnick, who stated they had agreed to allow Rolls-Royce engines and similar aircraft parts to be imported without tariffs.

Despite strong performances in select sectors, however, the FTSE 100 closed with losses of 0.33%, while the FTSE 350 index shed around 10 basis points.