- Infineon Technologies trimmed its full-year revenue outlook due to concerns relating to global tariffs.

- The forecast cut did not affect investor confidence, as the company’s shares appreciated by 4% on Thursday.

- According to JP Morgan, the updated guidance remained consistent with the expected figures.

Guidance Cut Reflects Tariff-Driven Uncertainty

Infineon Technologies, a major semiconductor manufacturer headquartered in Germany, revised its full-year revenue guidance on Thursday. The company cited persistent ambiguity surrounding global trade tariffs. Although CEO Jochen Hanebeck confirmed that order volumes have remained firm, the company opted to factor in a 10% revenue reduction for the fiscal year quarter that is set to conclude on September 30th.

Infineon generated €15 billion ($17 billion) in revenue during the previous fiscal year. As for 2025, the company had previously anticipated a revenue hike or for the figures to remain broadly unchanged. However, the updated guidance calls for a slight year-over-year decline, and Infineon has also narrowed its operating margin forecast.

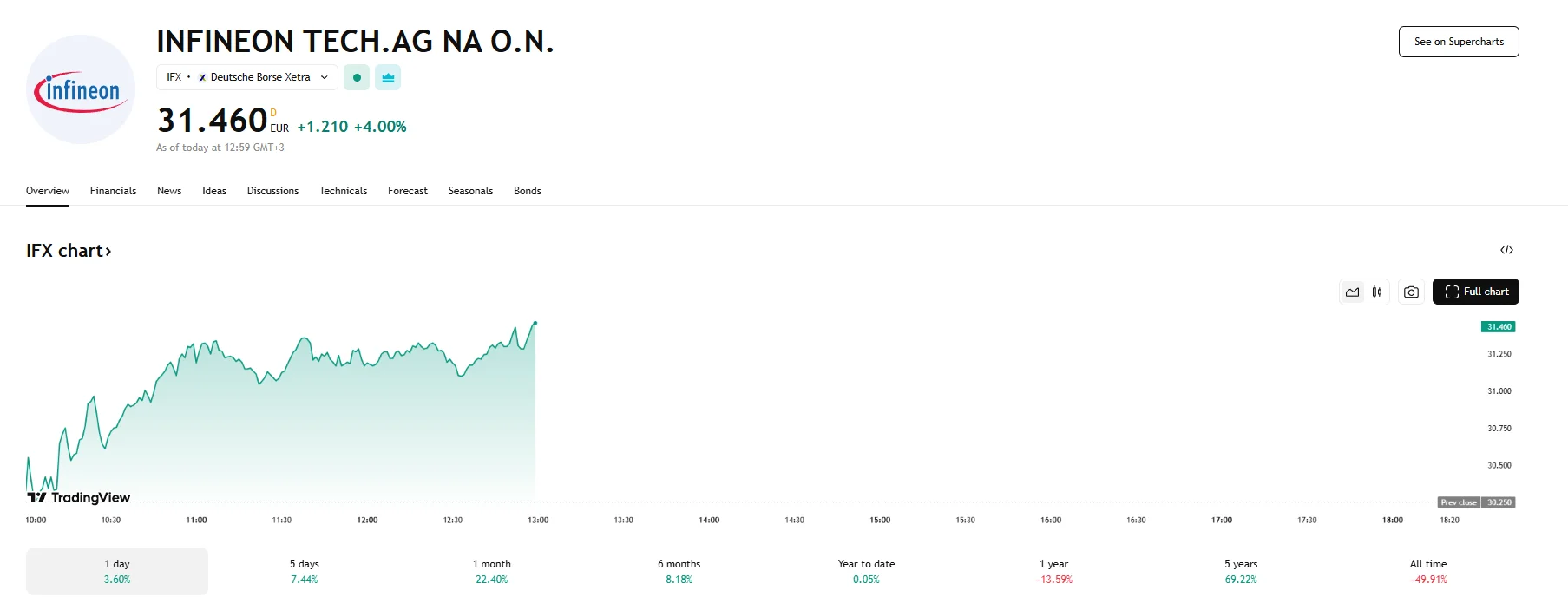

Investor sentiment remained positive in spite of the updated guidance. Shares of Infineon rose by 4% to reach a price of €31.46, making it the leading performer on Germany’s DAX index.

JP Morgan commented that if the market assumed a 2% decline in Infineon’s full-year revenue, then the revised outlook was still within the company’s initial forecast. The investment bank also stated that, while tariff reductions do mitigate some risk associated with the stock, the actual impact of tariffs remains uncertain. JP Morgan continued, claiming that there could be effects on customers as well as further consequences.

Thursday also saw the German government, via its Federal Ministry for Economic Affairs, greenlight financial aid for Infineon Technologies’ ambitious project in Dresden. This enables a €5 billion ($5.6 billion) expansion of the company’s semiconductor fabrication facilities in the region. According to a statement released by Infineon, this substantial capital injection into the Dresden location aims to bolster the manufacturer’s capacity to meet escalating demand from key growth areas.