Key Moments:

- Coinbase has agreed to acquire Deribit in a $2.9 billion deal combining cash and stock.

- Coinbase aims to strengthen its global reach in the crypto derivatives space.

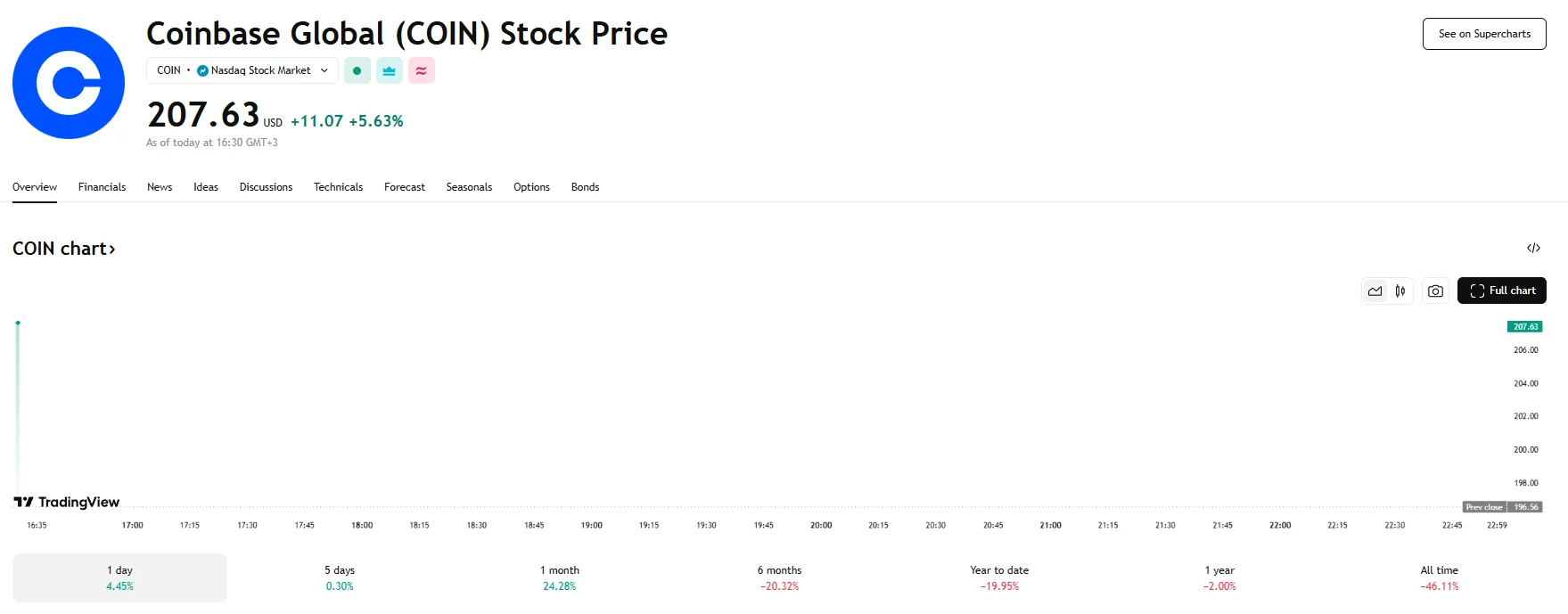

- The crypto giant’s shares rose sharply following the disclosure, jumping 5.63% on Thursday.

Coinbase Sets Sights on Offshore Derivatives Expansion

Coinbase Global has agreed to purchase crypto options and futures exchange Deribit in a transaction valued at approximately $2.9 billion, as revealed by The Wall Street Journal. The deal structure includes $700 million in cash and 11 million shares of Coinbase Class A common stock. According to Coinbase, the goal of this decision has to do with advancing the company’s derivatives business and positioning it as the leading global platform in crypto derivatives.

The acquisition is set to make Deribit the largest purchase in Coinbase’s corporate history, and is seen as a major step toward expanding in the crypto derivatives sector, which has become the dominant segment in daily trading volumes worldwide.

Deribit, which secured a full Virtual Assets Regulatory Authority (VARA) license near the start of 2025, achieved a trading volume of about $1.2 trillion over the course of 2024. This figure underscores its importance in the global derivatives ecosystem.

Coinbase, meanwhile, has steadily developed its derivatives offerings through previous initiatives such as the purchase of FairX and the launch of the Coinbase International Exchange. Deribit serves as Coinbase’s latest efforts to broaden its derivatives business, particularly when it comes to the company’s offshore capabilities. It should be noted that the deal is not yet finalized, however, as it is currently awaiting approval from the relevant supervisory bodies.

Investors were enthusiastic about the acquisition. Pre-hours trading saw Coinbase’s stock climb by a substantial amount, and the share price achieved a 5.63% increase to $207.63 once markets opened.