Key Moments:

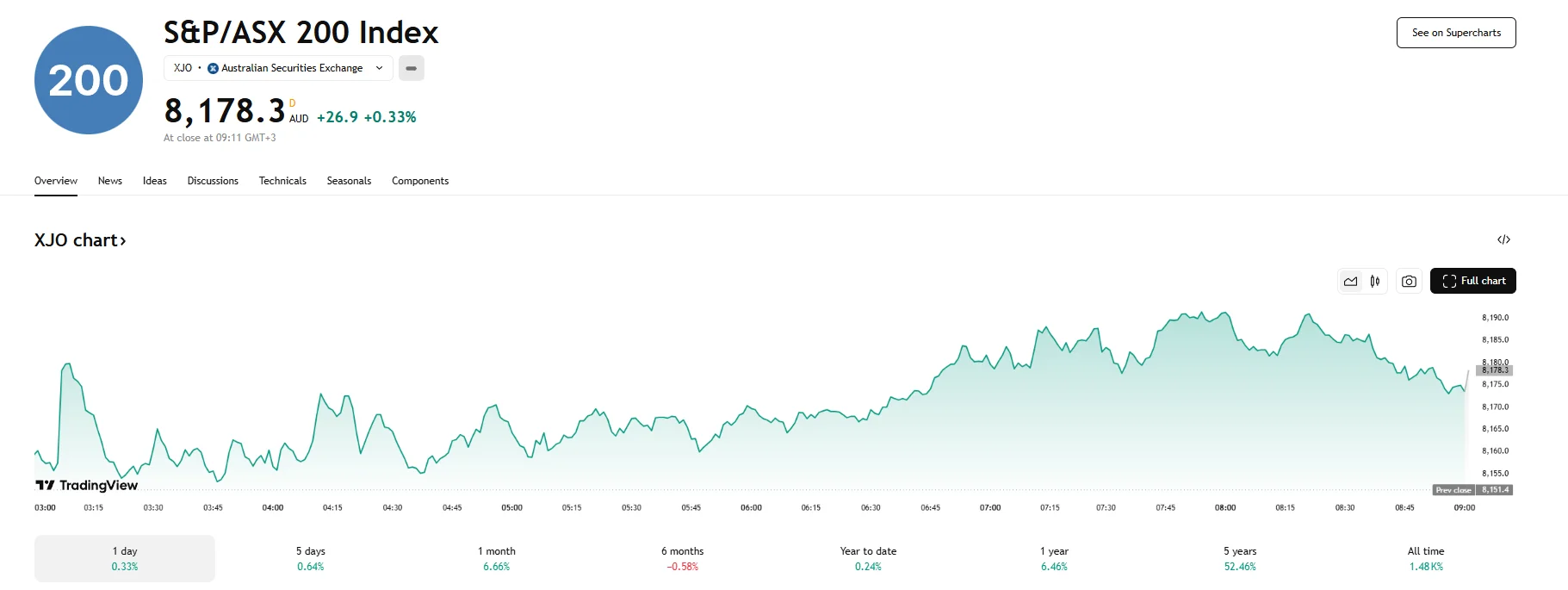

- ASX 200 rose 0.3% to 8,178.3 on Wednesday, recovering from two days of losses.

- The People’s Bank of China will implement rate cuts and a lower reserve requirement, injecting 1 trillion yuan into the economy.

- The US and China are scheduled to meet in Geneva for trade talks.

Australian Equities Close With Gains

Australian equities closed with gains on Wednesday, buoyed by expectations that upcoming trade talks between the US and China, along with fresh stimulus from Beijing, could help reinvigorate China’s slowing economy. The S&P/ASX 200 climbed by 26.9 points to end the day at 8,178.3. Energy stocks led the pack, with nine of the eleven sectors finishing in positive territory, helping the market recover from recent losses. The top performer was financial giant Zip Co Limited, as its stock jumped 13%. Temple & Webster Group advanced as well, climbing by 7.95%, while AUB Group Limited (ASX: AUB) climbed 6.03%.

Investors Watch US-China Developments

Market sentiment was lifted as traders looked ahead to trade discussions between US and Chinese representatives set to be held later this week in Switzerland. According to a Bloomberg report, the goal is to address the major tariffs that have remained a point of contention between the two nations. Saxo Markets’ Charu Chanana cautioned that although optics were reassuring, it was still too soon to foresee meaningful progress in the US-China trade negotiations due to their complexity.

China Moves to Bolster Its Economy

Wednesday also witnessed the People’s Bank of China announce measures intended to stimulate the economy. Governor Pan Gongsheng said the central bank is planning to reduce the seven-day reverse repurchase rate by 10 basis points to 1.4%.

In addition, the reserve requirement ratio for banks will be cut by 50 basis points. This will mark the injection of around 1 trillion yuan, equivalent to approximately $214 billion, of liquidity into the Chinese financial system. These steps come in response to heightened economic pressure following the implementation of higher US tariffs on Chinese goods. Factors surrounding the Chinese economy have a prominent effect on Aussie market sentiments due to the close trade relations between Australia and China.

Australian Economic Signals Mixed

In Australia, recent payment volume data published by the Reserve Bank of Australia suggests a modest uptick in consumer activity. Card transactions using domestically issued cards totaled AU$91 billion ($58.9 billion) in March. This marked a 1.2% increase compared to February’s 0.7% gain. However, industrial production declined in April, weighed down by lingering fears linked to trade policy and upcoming elections.