Key Moments:

- Lufthansa’s quarterly adjusted EBIT loss hit €722 million ($822.14 million), aligning with expectations. However, transatlantic demand from the US rose by approximately 25% in March.

- The company reaffirmed its 2025 operating target despite geopolitical uncertainties.

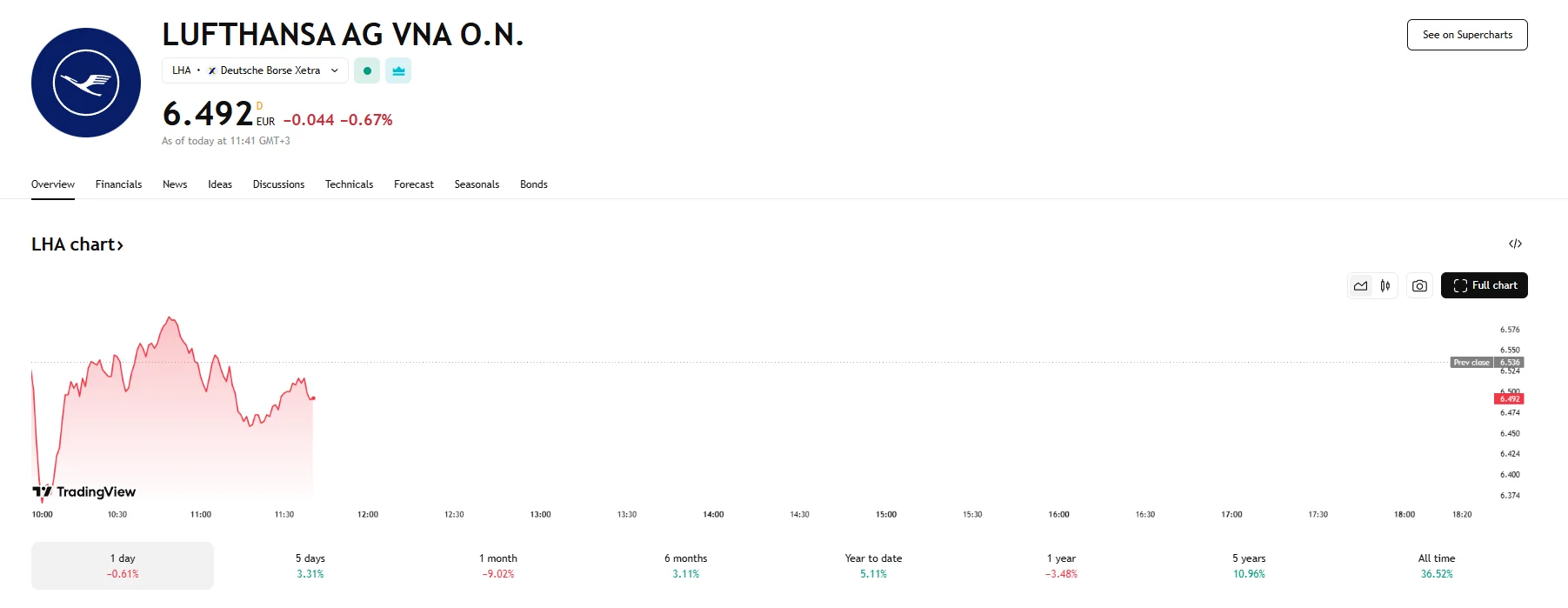

- A slight 0.67% decrease brought Lufthansa’s stock to roughly €6.5 during Tuesday’s trading.

First-Quarter Financial Results

Deutsche Lufthansa’s latest financial report revealed an adjusted loss before interest and taxes (EBIT) totaling €722 million. The figure was broadly consistent with internal estimates collected by the company. While this result reflects continued difficulties in restoring profitability, it suggests that Germany’s flagship airline remains within its expected financial performance parameters.

| Metric | Q1 2025 |

|---|---|

| Adjusted EBIT | €722 million loss |

| USD Equivalent | $822.14 million loss |

| Currency Exchange Rate | $1 = €0.8782 |

Steady Outlook Despite Global Headwinds

Lufthansa announced Tuesday it is maintaining its forecast for 2025, signaling confidence in future earnings performance despite growing trade tensions that could impact international travel patterns, particularly across the Atlantic.

CEO Carsten Spohr stated that, notwithstanding the prevailing geopolitical uncertainties, the airline remains steadfast in its trajectory for expansion. Furthermore, Spohr expressed a positive outlook for the upcoming summer season and affirmed the company’s commitment to its optimistic projections for the entirety of 2025.

Stock Dips Amid Concerns

Tuesday’s trading session witnessed a slight downward adjustment in the valuation of Lufthansa’s stock. Shares experienced a marginal decline of 0.67% to approximately €6.5. This descent followed a more pronounced dip, which saw the stock drop below the €6.4 threshold.

Tariff Concerns Cloud Aviation Sector

The broader airline industry is navigating heightened uncertainty fueled by escalating global economic concerns and US trade policy developments under President Donald Trump. Delta Air Lines recently withdrew its own 2025 financial guidance, citing pressure from ongoing tariff threats. Air France-KLM hinted earlier this month that it may cut economy ticket prices to shore up transatlantic demand. Meanwhile, UK-based Virgin Atlantic also reported weakening demand on routes from the US to Britain.

Transatlantic Route Remains Central

Long-haul flights between the US and Europe remain vital to many global carriers, including Lufthansa, due to their robust profitability and strong demand trends. According to Lufthansa, passenger traffic from the United States to Europe climbed by around 25% year-over-year in March. However, the airline also acknowledged that macroeconomic risks require vigilance and agility in managing capacity. In response, the company has established a task force that will track developments and adjust flight capacity based on shifts in demand.

Ongoing Efforts to Revitalize Core Operations

Lufthansa is leaning heavily on strong transatlantic performance as it faces internal and external challenges. Negotiations over employee compensation and rising labor expenses are exerting pressure on profitability in its core airline unit. At the same time, competition in key Asian markets from Chinese carriers is tightening, prompting the carrier to explore new revenue streams.

As global uncertainties weigh heavily on aviation demand forecasts, Lufthansa’s ability to adapt its transatlantic operations will likely be pivotal to reaching its longer-term financial objectives.