Key Moments:

- Chinese authorities informed AstraZeneca of a potential $8 million fine stemming from unpaid import taxes. The company said the taxes in question appear tied to imports of its breast cancer drug Enhertu.

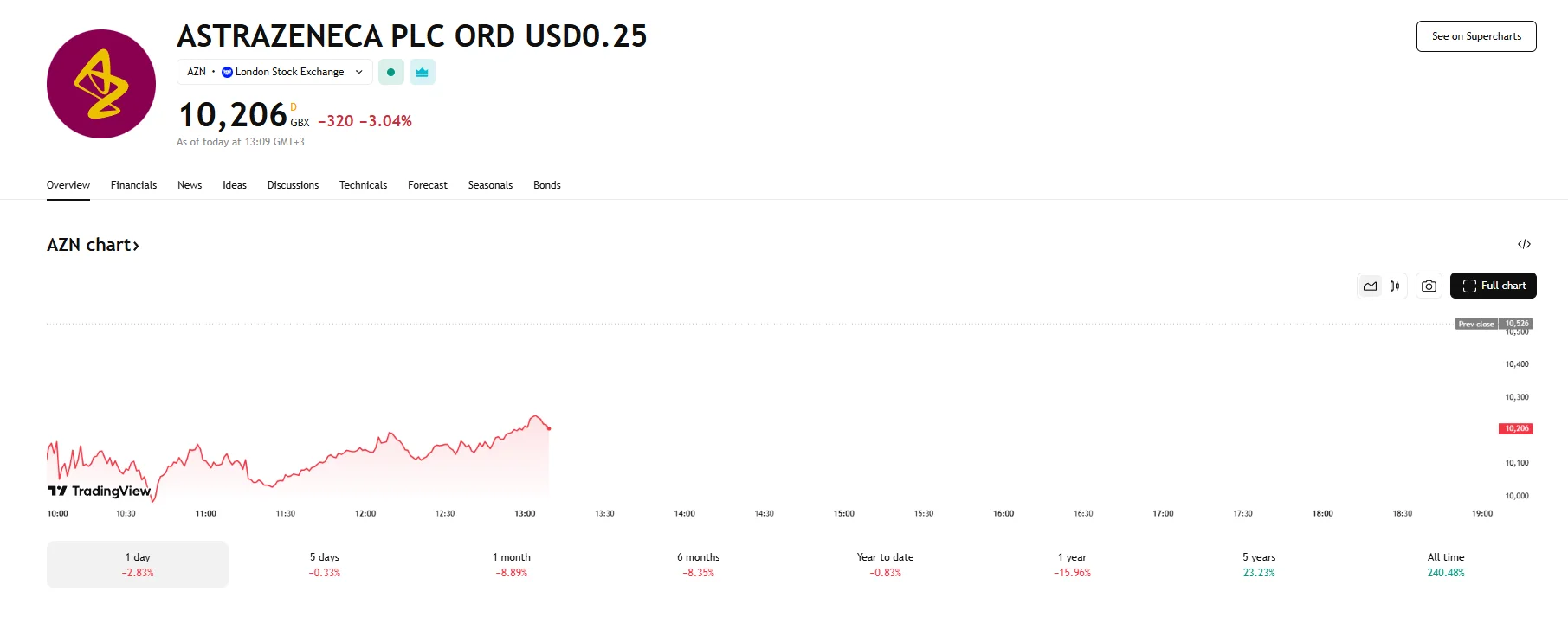

- The company’s stock fell 3.04% on Tuesday.

- Core earnings beat forecasts at $2.49 per share in Q1, but revenue fell short at $13.59 billion.

Scrutiny in China Intensifies

AstraZeneca revealed on Tuesday that it could face a fine as high as $8 million related to alleged unpaid import duties in China, a market that stands as the pharmaceutical firm’s second-largest globally. The admission adds to the company’s ongoing challenges in China, which include a lingering scandal connected to last years’ arrest of the president of AstraZeneca’s Chinese branch.

According to the company, officials in Shenzhen issued an opinion asserting that AstraZeneca may owe approximately $1.6 million in unpaid import taxes. If violations are confirmed, authorities could impose a penalty ranging from one to five times that amount. AstraZeneca stated that the inquiry pertains specifically to import taxes tied to its breast cancer therapy, Enhertu.

AstraZeneca also addressed a different investigation involving potential misuse of personal information. According to authorities, there had been no evidence of misuse or infringement.

Ongoing Regulatory Risks Across Multiple Products

This is not the first time this year AstraZeneca has faced scrutiny from Chinese regulators. In February, the company disclosed it could be subject to an additional penalty of up to $4.5 million, a consequence of import tax issues concerning its oncology treatments Imfinzi and Imjudo. At the time, AstraZeneca warned that the probe might expand to include Enhertu.

Financial Snapshot: Mixed Q1 Performance

Despite regulatory hurdles abroad, AstraZeneca posted stronger-than-expected Q1 earnings of $2.49 per share for the three-month period ending March 31. Analysts had forecast lower results. However, the company’s revenue for the quarter totaled $13.59 billion, falling short of market expectations.

Shares Slip 3%

AstraZeneca’s LSE listing fell on Tuesday, registering a notable 3% decline to £10.2. This fall can be attributed to both the revenue results and the latest developments surrounding the company’s regulatory woes in China.