Key moments

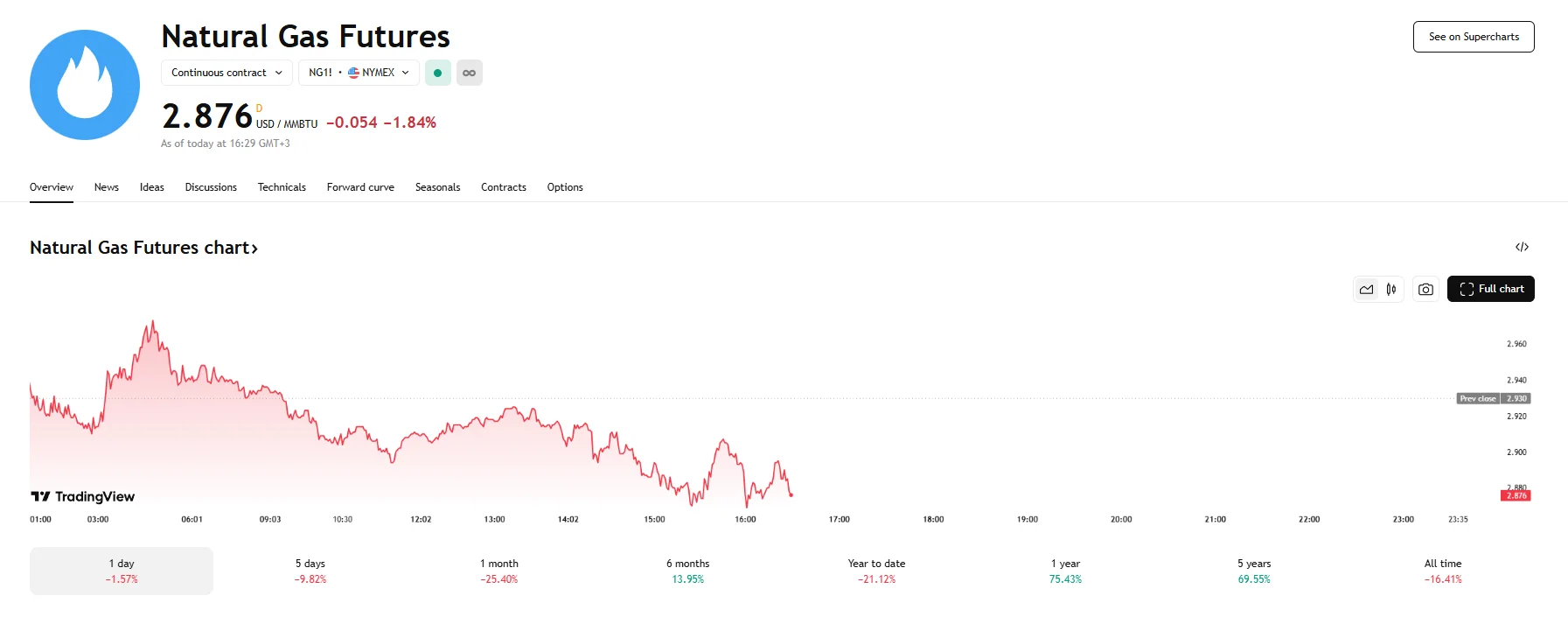

- US natural gas futures plummeted by 1.84% on Friday, sinking to $2.87.

- Oversupply concerns were among the main factors exerting downward pressure on the natural gas benchmark.

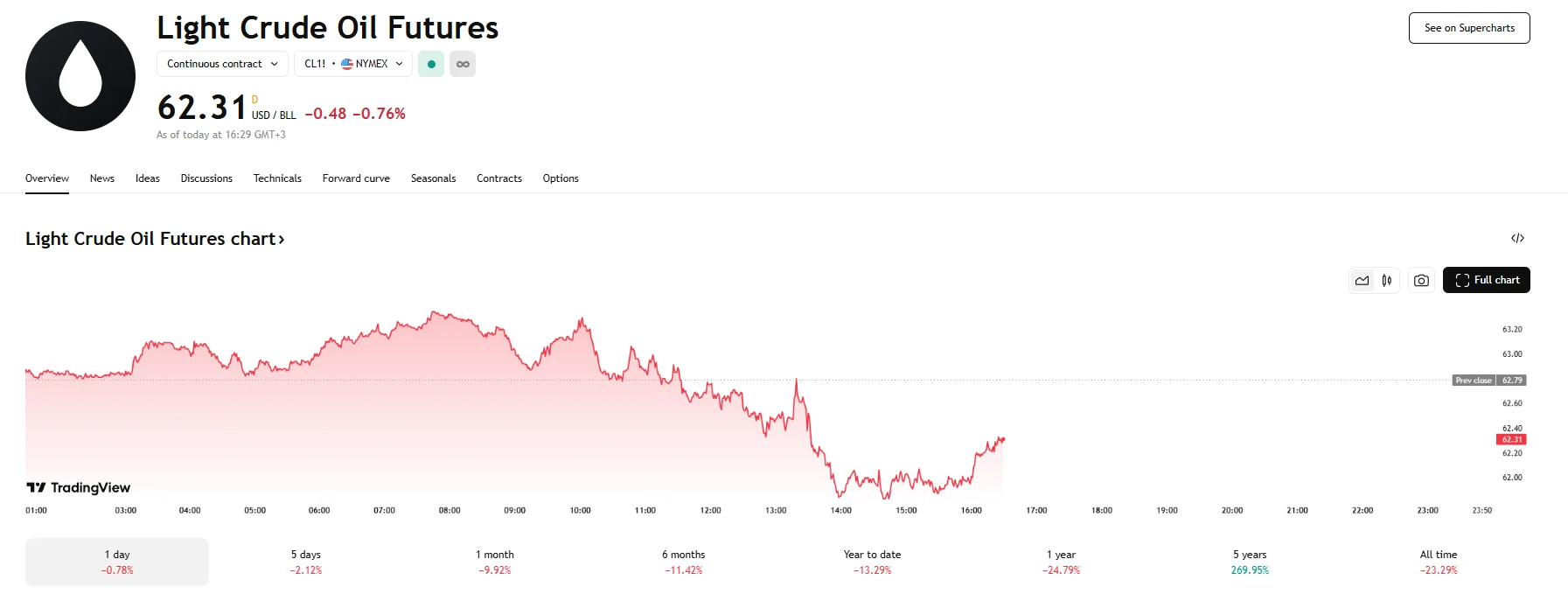

- Crude oil futures also suffered, as Brent and WTI fell 0.76%.

Energy Markets Under Pressure, Natgas Hits Bottom, Oil Edges Lower

Friday witnessed a significant downturn in the US natural gas market, with futures contracts falling by 1.84% to $2.87 per million British thermal units. This marked the lowest price for natural gas in over five months. The decline was primarily driven by an overabundance of supply. Unseasonably mild weather across substantial portions of the United States has curtailed demand for heating. Moreover, a recent report from the Energy Information Administration (EIA) revealed a larger-than-anticipated increase in natural gas inventories.

The EIA’s weekly data indicated an increase in natural gas held in storage, which stood at 88 billion cubic feet. This figure exceeds the 70 billion cubic feet that analysts had predicted. This surplus in stored gas further amplified concerns, pushing prices lower. Furthermore, the unexpected build-up adds to the existing pressure from consistent and robust domestic natural gas production, which has remained near historical highs.

The flow of natural gas into the US from Canadian pipelines has contributed to the overall abundance of supply, making it increasingly difficult for the market to find a stable equilibrium. Consequently, injections into storage facilities continue to outpace seasonal norms despite a slight moderation in the most recent addition due to localized cooler temperatures.

Adding to the negative sentiment in the energy complex, crude oil futures also experienced a decline on Friday. Both the international benchmark Brent crude and the US benchmark West Texas Intermediate (WTI) saw their futures contracts decrease by 0.76%. This synchronized downward movement reflected broader concerns within the oil market, primarily centered around the potential for increased inventories and a weakening outlook for global economic growth in the context of ongoing international trade uncertainties. Brent crude futures fell to $65.15 per barrel, while WTI crude futures reached $62.31.