Key moments

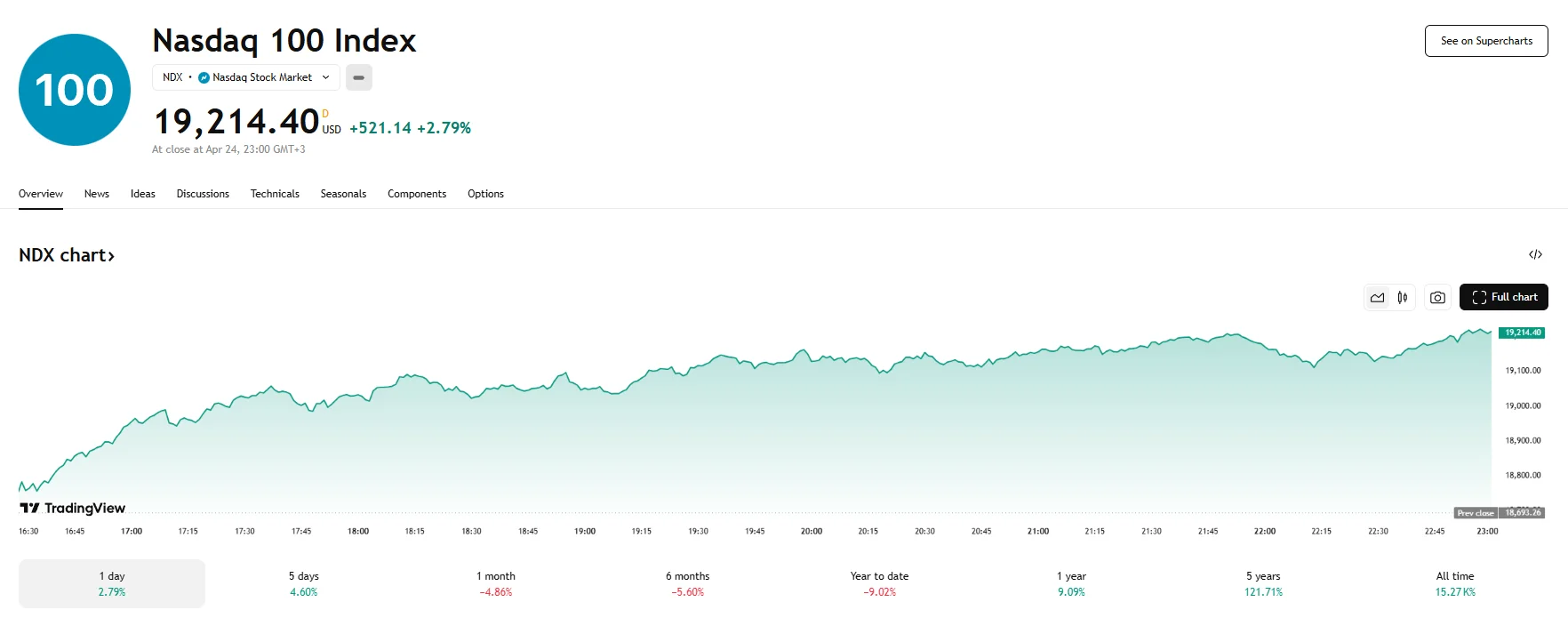

- Thursday witnessed widespread enthusiasm across US markets, with most major Wall Street indices climbing more than 2%. The Nasdaq 100 achieved the strongest gains, rising 2.79% to 19,214.40.

- Hopes surrounding the easing of trade conflicts, along with strong Q1 financial reports, served to bolster market sentiment.

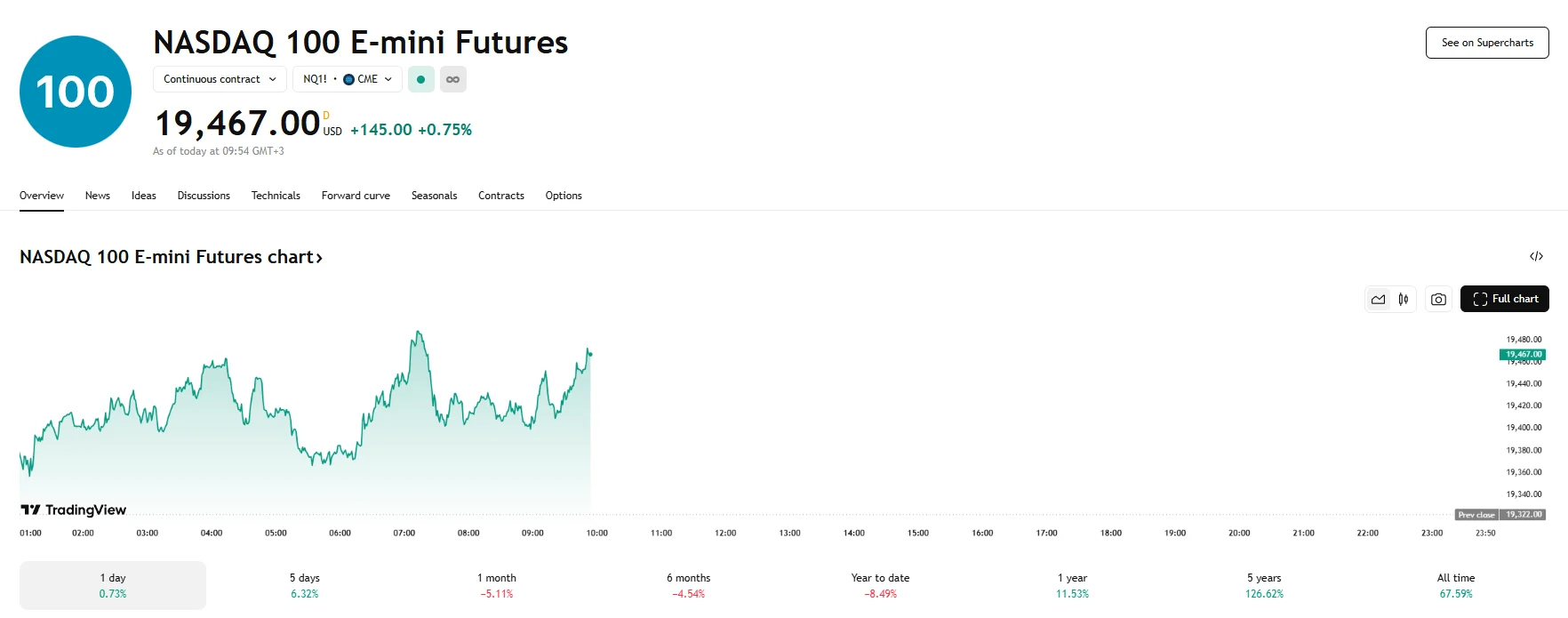

- On Friday, both S&P 500 and Nasdaq 100 e-mini futures rose over 0.5%. Dow futures managed to edge up by 0.24%.

Wall Street Indices Jump Amid Trade Optimism and Earnings

US stock markets concluded Thursday’s trading day with substantial upward momentum, buoyed by a confluence of factors that instilled renewed optimism among investors. The S&P 500 demonstrated significant strength, registering a notable gain of 2.03%. The Nasdaq 100 experienced an even more pronounced surge, leaping by over 500 basis points to close at 19,214.40, marking a 2.79% increase. Similarly, the broader tech-focused Nasdaq Composite index advanced by 2.74%, translating to a climb of more than 400 basis points. While the Dow Jones Industrial Average also participated in this widespread rally, it recorded a more modest gain of 1.23%.

Several elements appeared to be fueling this robust market performance. A key driver was the softening rhetoric surrounding trade tensions, particularly between the United States and China. Earlier in the week, there were indications that the current administration was considering a more conciliatory approach to trade with Beijing, potentially involving a reduction in existing tariffs on Chinese goods. Although China downplayed the immediacy of any such negotiations or agreements, the mere suggestion of a less confrontational stance appeared to soothe investor anxieties that had been weighing on the market. The technology sector, which has been particularly sensitive to the ebbs and flows of the US-China trade relationship, responded positively to these signals as many tech companies rely on global supply chains.

Several prominent companies, including Chipotle, PepsiCo, and Merck, had previously cautioned that tariffs were likely to lead to increased costs, raising concerns about potential downward revisions to future earnings forecasts across various sectors. However, positive financial reports from some major players, particularly in the technology space, seemed to offset some of these concerns and provide a further lift to the market. Thursday saw the stocks of Nvidia rise almost 4% for instance, while Microchip Technology enjoyed a major value increase of 12.38%. There were exceptions, however, with IBM shares dropping 6.58%.

The positive momentum from Thursday’s session continued on Friday. S&P 500 e-mini futures indicated continued optimism, rising by 0.68%, while Nasdaq 100 e-mini futures also pointed towards further gains, climbing by 145 basis points amid a 0.75% gain. Dow stocks showed muted activity initially, fluctuating around the flat line, but later rose by 0.24%.