Key moments

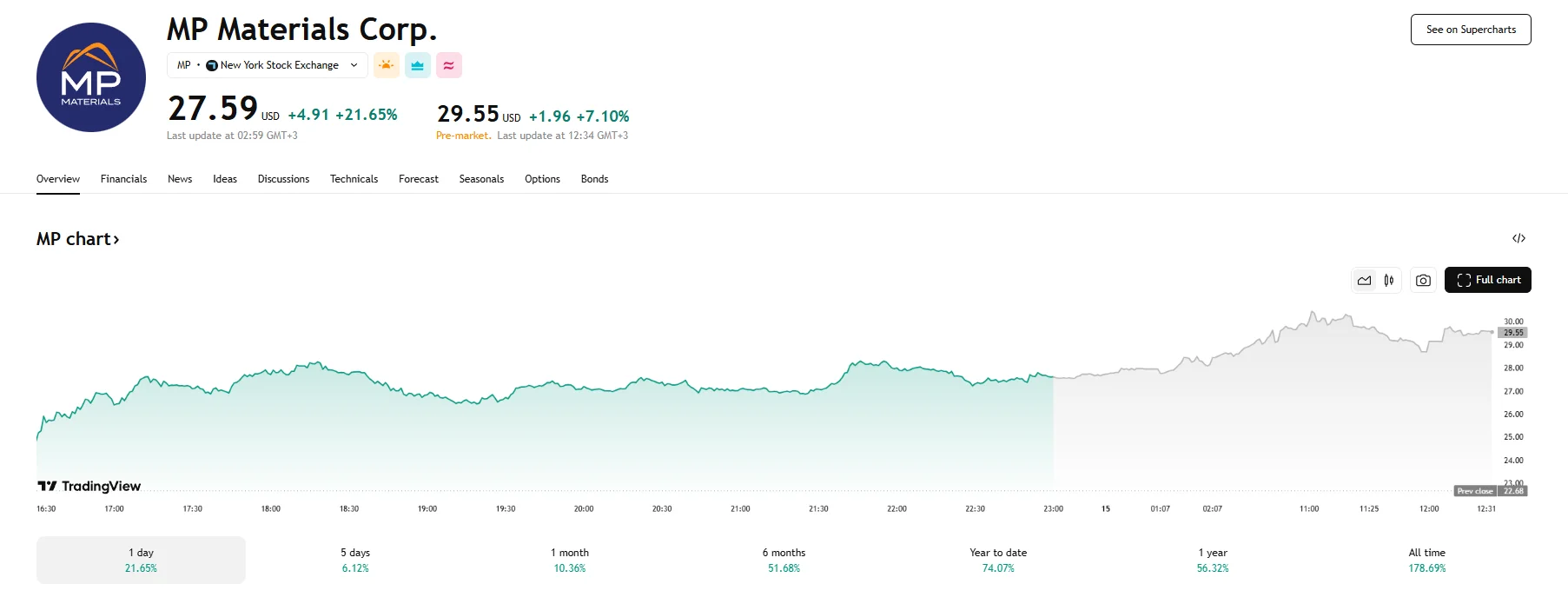

- MP Materials saw its stock rise 21.65% on Monday, with the closing price almost hitting $28.

- The momentum did not cease on Tuesday, as the share price gained a further 7.10%.

- China is canceling rare earth metal exports to the US. Market participants now expect demand for MP Materials’ output to rise, which fueled the rapid ascent of its value.

China’s Rare Earth Export Freeze Propels MP Materials

MP Materials’ stock value skyrocketed on Monday, with shares soaring by an impressive 21.65% to close the trading session at $27.59. This significant upward movement reflected a surge in investor confidence, primarily driven by geopolitical developments impacting the critical rare earth minerals market. The rally continued into Tuesday, with the stock price climbing an additional 7.10% during pre-market hours, breaching the $29 mark.

China’s recent decision to halt exports of rare earth minerals to the United States appears to have been the primary catalyst behind this substantial surge in investor interest. This move by Beijing, reportedly in response to strained trade relations and reciprocal tariffs, has sent shock waves through industries reliant on these crucial materials for manufacturing a wide array of high-tech products. The elements in question, a group of 17 specialized metals, are essential components in the production of magnets used in electric vehicles, smartphones, and numerous other electronic devices. Companies centered around defense technologies also rely on rare earth materials.

China is a prominent supplier of rare earth minerals, with the country accounting for approximately 90% of the world’s refined production. The sudden cessation of exports has, therefore, created a critical supply concern for US-based manufacturers. In this context, MP Materials, which operates the only active rare earth mining and processing facility in the United States, stands to be a major beneficiary. The company’s unique position as a domestic source of these vital metals has placed it firmly on investors’ radars.

Furthermore, there are reports circulating regarding a potential executive order from the US administration aimed at stockpiling critical metals, including those sourced from the Pacific Ocean. This has further bolstered positive investor sentiment surrounding MP Materials.