Key moments

- US exports to China have been hit with a higher tariff of 125%.

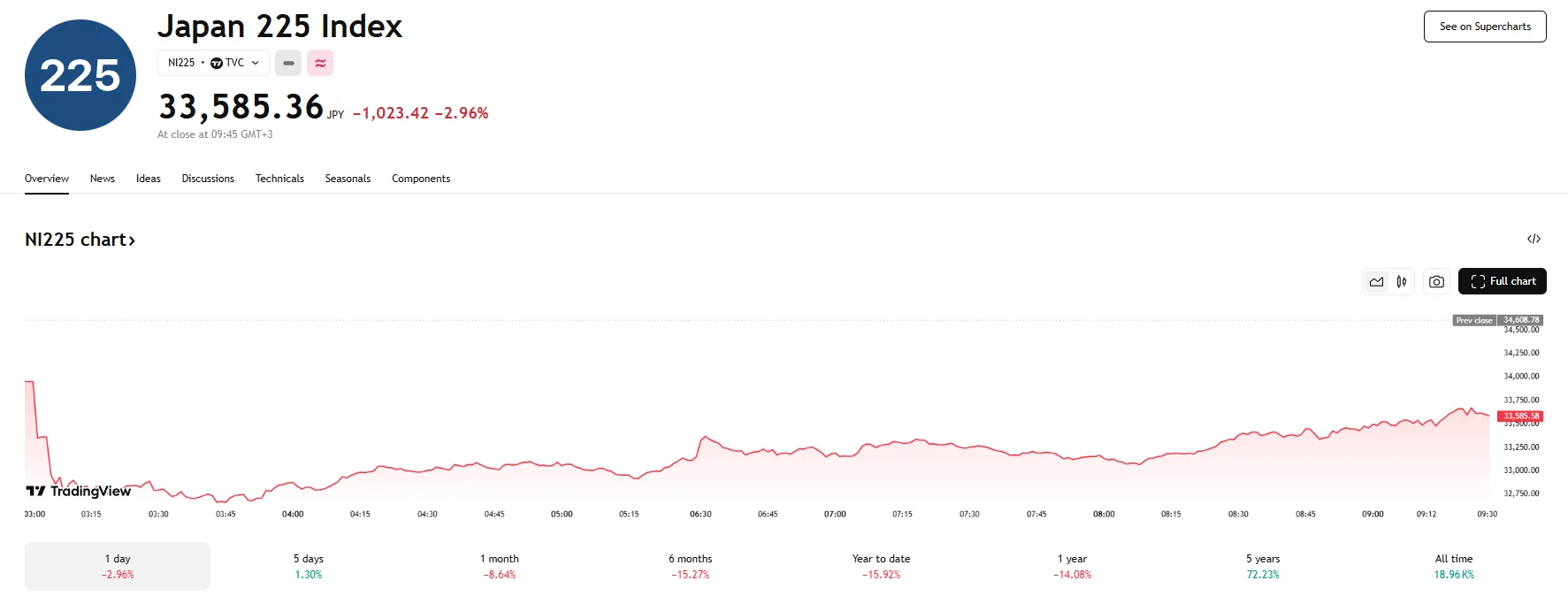

- Nikkei 225 shed over 1,000 basis points on Friday, while the ASX 200 fell 0.82%. Korean stocks also dropped by 0.50%.

- The Hang Seng and SSE indices bucked this trend. The former gained 1.13%, while the latter rose 0.45%.

Trade War Woes Weigh on Asia-Pacific Markets

Friday witnessed a divergent performance across Asia-Pacific stock markets as investors grappled with the latest developments in the trade conflict between the United States and China. Beijing announced a significant tariff hike to 125%, which will affect goods originating from the US, a direct response to Washington’s move to increase its own duties on Chinese products to a substantial 145%.

Japan’s benchmark Nikkei 225 index experienced a significant downturn, losing over 1,000 basis points during Friday’s trading session. The index ultimately closed with a loss nearing 3%, reflecting investor anxiety over the potential economic consequences of the heightened trade tensions, particularly how they will affect Japan’s export-oriented economy. Similarly, Australia’s S&P/ASX 200 index concluded the trading by falling 0.82%, while South Korea’s KOSPI index also registered a decline of 0.50%.

However, it appears some investors were not as pessimistic about the tariff tensions, with both the Hong Kong Hang Seng Index and mainland China’s SSE Composite index registering modest gains. The Hang Seng Index managed to rise 1.13%, reaching 20,914.69. Meanwhile, the Shanghai Stock Exchange Composite Index ended Friday’s session with an increase of 0.45%, suggesting a degree of resilience in these markets despite the overarching trade concerns.

Analysts noted that the mixed performance likely reflects varying levels of exposure and perceived vulnerability to the US-China trade dispute among different economies and investor sentiments regarding potential mitigating factors, such as possible stimulus measures or a future easing of tensions. The contrasting movements highlight the complex and nuanced reactions within the Asia-Pacific region to the ongoing trade war between the world’s two largest economies.