Key moments

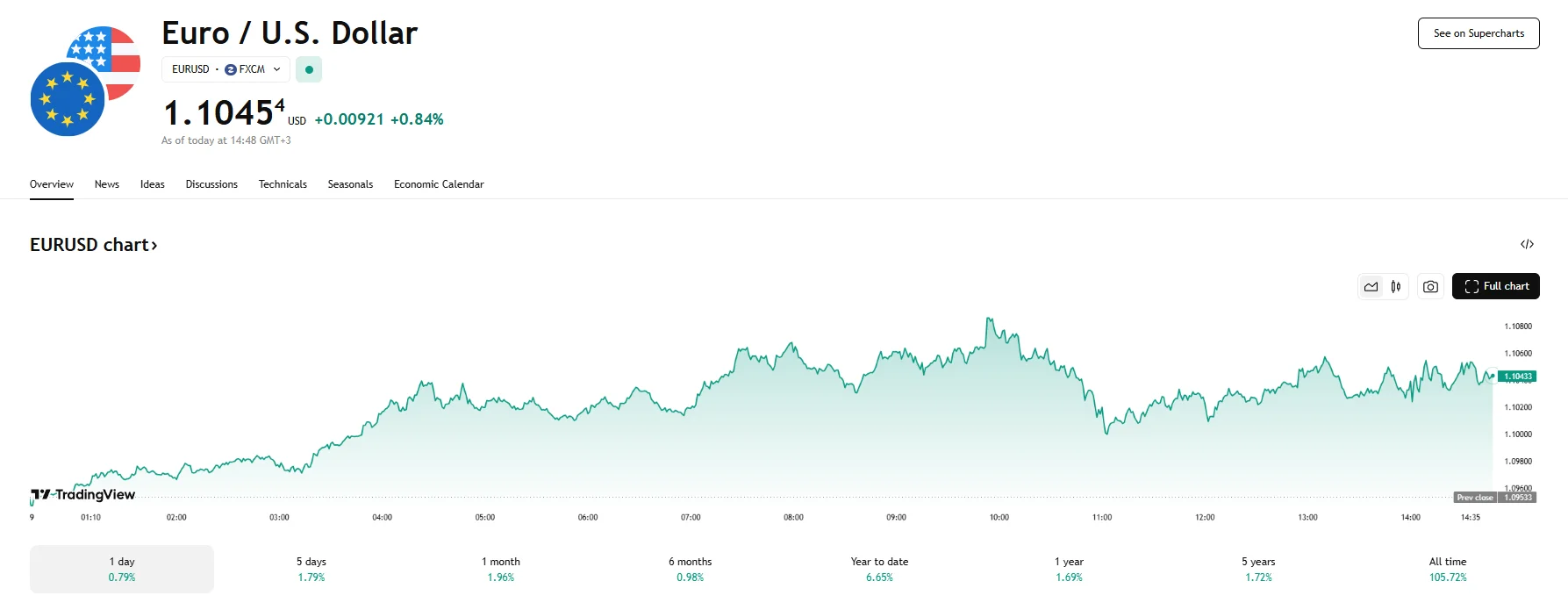

- The EUR/USD climbed 0.84% to 1.1045 on Wednesday.

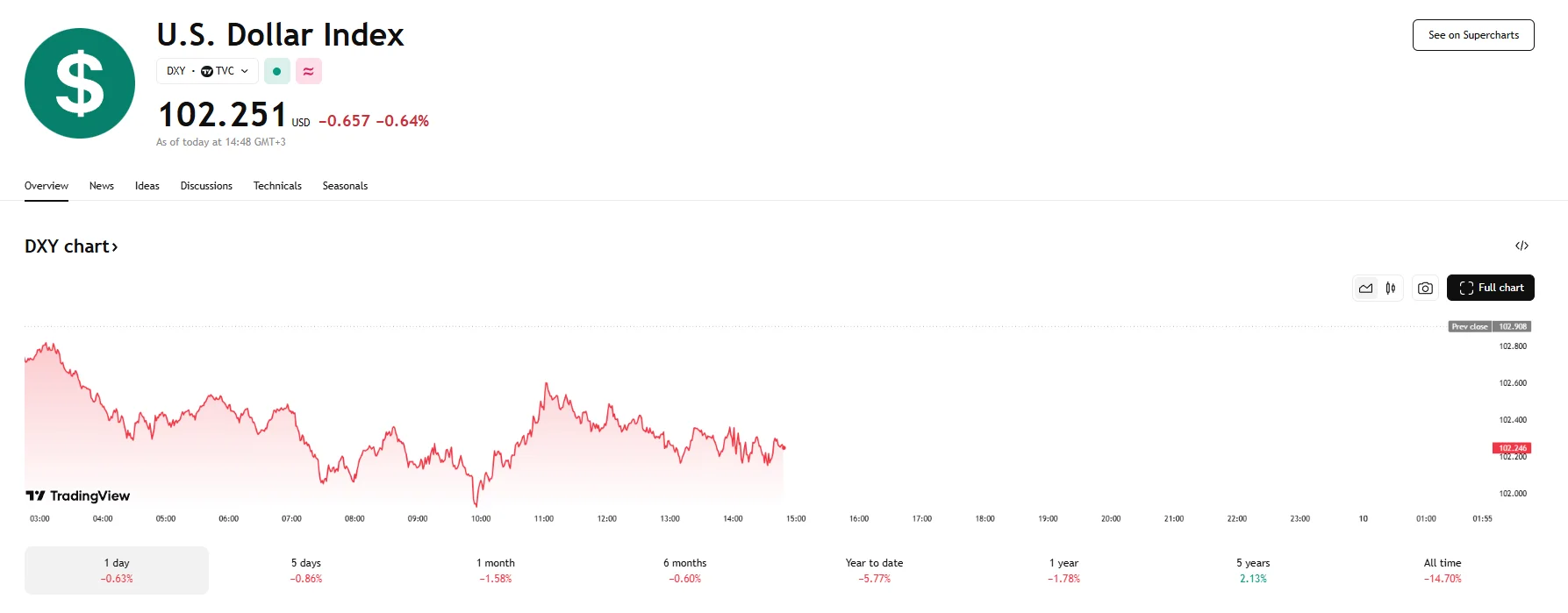

- The US Dollar Index dropped below 102.300 amid a 0.64% decrease.

- As tariff hikes on goods imported to the US took effect, investors began selling US Treasuries en masse.

Tariff Tensions Exert Pressure on the US Dollar, US Treasuries Under Fire

On Wednesday, the euro appreciated by a notable 0.84% against the US dollar to reach a level of 1.1045. This upward movement of the EUR/USD pair occurred amidst the unfolding fallout from the implementation of US tariffs, which exerted considerable downward pressure on the greenback. The US Dollar Index reflected this weakness, declining by 0.64% and continuing to trade below the 103 threshold.

The implementation of the latest round of US tariffs, including the significant 104% levy on imports from China, has sparked concerns among investors regarding the potential for a slowdown in global economic growth and an increased risk of a recession within the United States. This shift in market sentiment prompted a rotation away from traditional safe-haven assets, such as US Treasuries and the dollar, as investors reassessed the stability and attractiveness of US assets in the face of escalating trade tensions. This, in turn, resulted in the yield on the benchmark 10-year US Treasury bond seeing a notable rise past 4.5%.

The movement in longer-dated US Treasuries was even more pronounced. The 30-year Treasury yield surged to the 5% mark, a peak not seen in several years. This dramatic decrease in demand for US government bonds suggests a growing unease among investors about the long-term economic implications of the ongoing trade disputes and the potential impact on the US economy.

Blue Edge Advisors portfolio manager Calvin Yeoh characterized the situation in the US Treasury market as a “fire sale” in comments to Bloomberg. He further emphasized the unusual magnitude and volatility of the market movements, stating that he had not witnessed such significant price swings since the height of the pandemic-induced market chaos in 2020.