Key moments

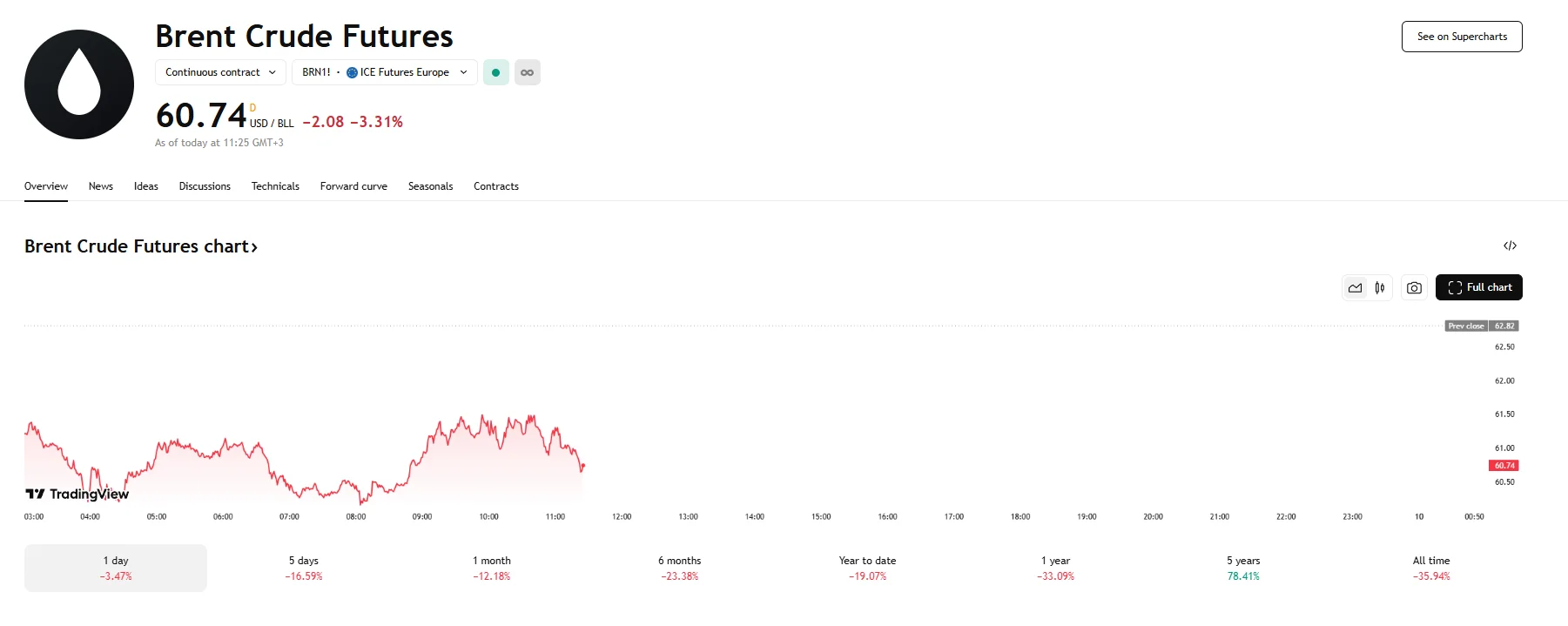

- Brent crude futures suffered a significant 3.31% decrease on Wednesday.

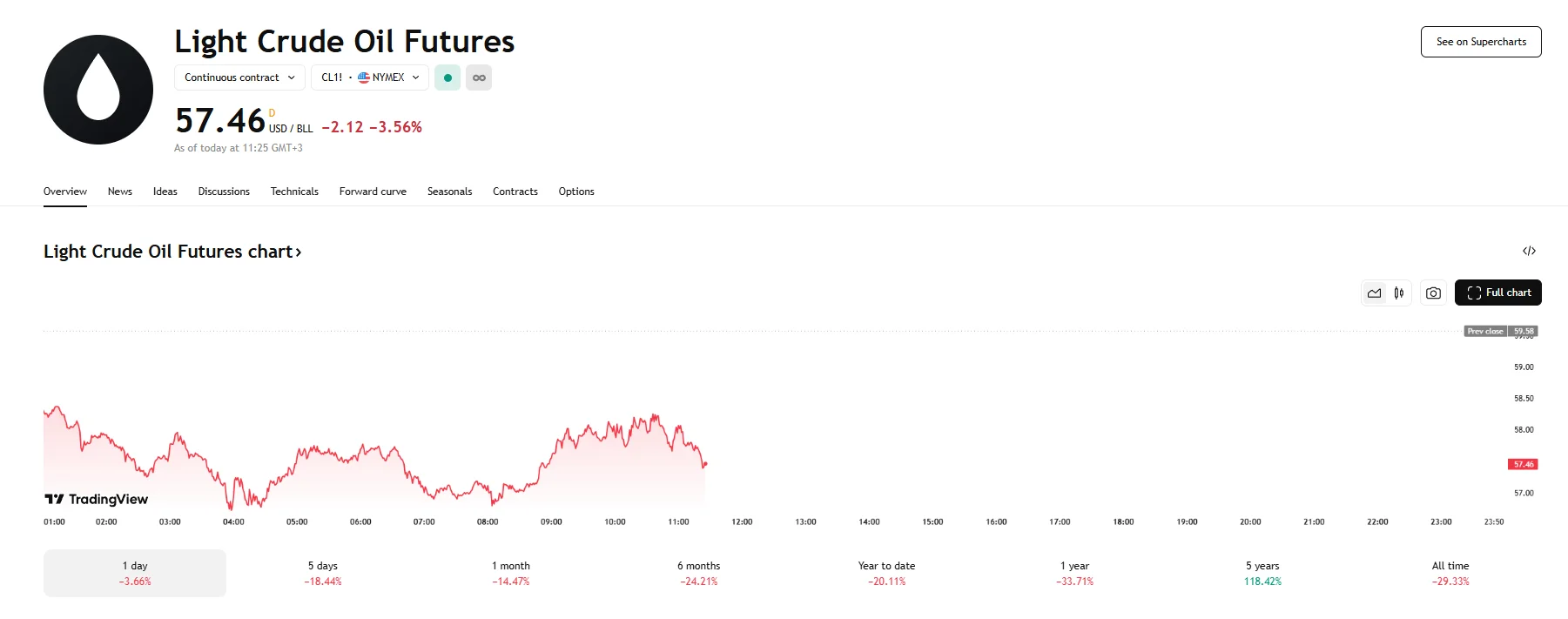

- WTI crude futures fell sharper, dropping 3.56% to $57.46 after earlier fluctuations saw prices slide below $57.

- Oil prices sank on concerns that ongoing trade war escalation could lead to a recession.

Brent and WTI Futures Plummet Amid Economic Jitters

Wednesday witnessed a significant downturn in the crude oil market, with Brent and WTI crude futures experiencing substantial losses. The former registered a notable decline of 3.31%, reflecting growing anxieties among investors regarding the potential impact of escalating global trade tensions on future energy demand.

The West Texas Intermediate (WTI) crude futures also experienced a sharp fall, losing 3.56% of their value to reach $57.46 per barrel. Earlier in the trading session, WTI prices had even dipped below the $57 mark, the lowest figure since early 2021. This marked the most rapid price decrease for WTI in several years as markets reacted to the unfolding economic landscape.

A primary driver behind this pronounced decline in oil prices was the intensification of the trade dispute between the United States and China. The announcement of a substantial 104% tariff on Chinese goods by the US administration fueled fears of a significant contraction in trade activity between the two nations, which are also the world’s largest consumers of oil. This anticipated reduction in trade volume has led to concerns about a corresponding decrease in global oil demand, thereby exerting downward pressure on prices.

Adding to the negative sentiment were increasing worries about a global recession. The imposition of widespread tariffs is set to raise the cost of goods, potentially dampening economic growth and consequently reducing the demand for energy resources like crude oil.

Furthermore, recent actions by key players in the oil market have also played a role in the price decline. Recently, the Organization of the Petroleum Exporting Countries (OPEC) made the decision to accelerate the scheduled reversal of members’ previously implemented reductions in oil output. This consensus to increase supply, coupled with the growing concerns about weakening demand due to the trade war, has further exacerbated pessimism among crude oil traders.