Key moments

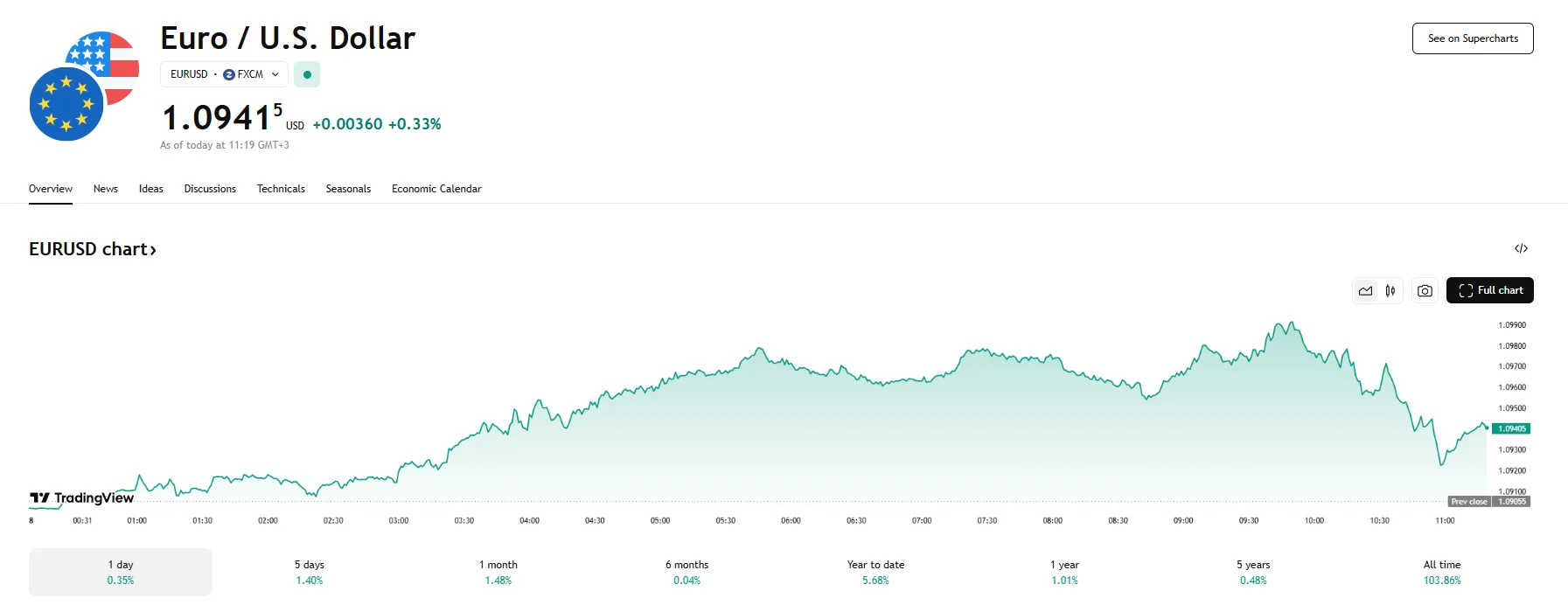

- The EUR/USD rose 0.33% on Monday, climbing past 1.0940.

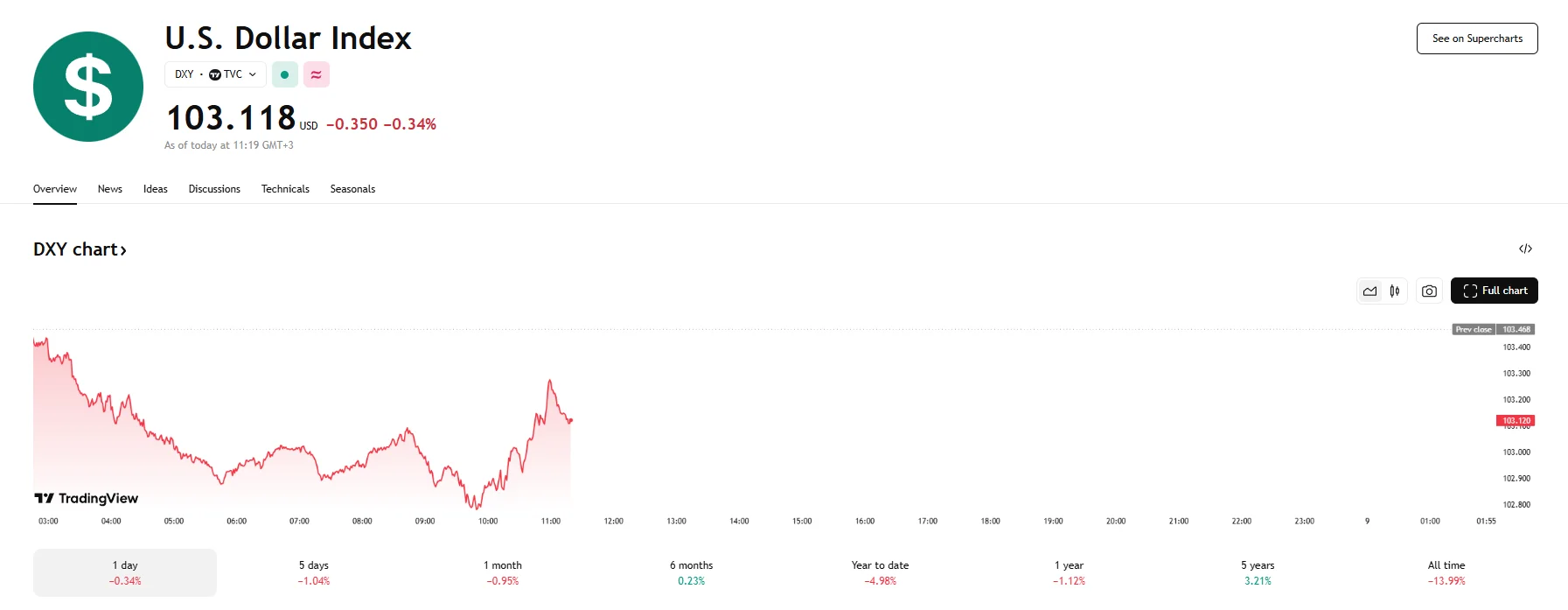

- The US Dollar Index is down over 0.30%.

- The European Union Commission has announced its plans to implement reciprocal tariffs against the US, set at 25%.

EUR/USD Steady Despite Tariff Tensions as EU Eyes 25% Retaliation

Navigating a landscape thick with tariff tensions, the exchange rate between the euro and the US dollar has managed to appreciate above the 1.0940 threshold. This upward movement for the European currency coincided with a weakening of the US dollar on global markets. The US Dollar Index, a measure of the greenback’s strength against a basket of major currencies, experienced a decline of 0.34% to 103.118. This shift in investor sentiment has potentially been influenced by the unfolding trade dispute between the United States and the European Union.

The EUR/USD pair’s upward momentum interrupted a brief two-day period of losses, indicating renewed buying interest in the euro. A significant factor contributing to this currency market dynamic is the European Union Commission’s unveiled strategy to impose reciprocal tariffs on diamonds, tobacco, and a range of goods imported from the United States. The proposed levies stand at 25% and target various sectors. This move comes as a direct response to tariffs previously announced by Washington on European steel, aluminum, and other products. The EU Commission’s proposal is scheduled for a crucial vote among member states on Wednesday, April 9th.

While the European Union has publicly stated its preference for a negotiated resolution, offering a “zero-for-zero” tariff approach on certain industrial goods, this proposal was dismissed by the Trump administration. Trump’s continued commitment to his tariff policies has further fueled concerns about a protracted trade conflict.

It should be noted that certain items that were initially considered by the EU, such as bourbon, wine, and dairy products, were removed from the final duty proposal. This move was likely the result of fears about counter-retaliation from the United States on key European exports, namely a 200% tariff on European alcohol that Trump threatened should the EU’s tariffs affect whiskey imports from the US.

The upcoming vote by EU member states will be a critical juncture, potentially setting the stage for further currency market volatility and influencing the future trajectory of the EUR/USD exchange rate as well as the health of European stocks and the US dollar. Investors will be closely scrutinizing the outcome of this vote and any subsequent responses from the United States.