Key moments

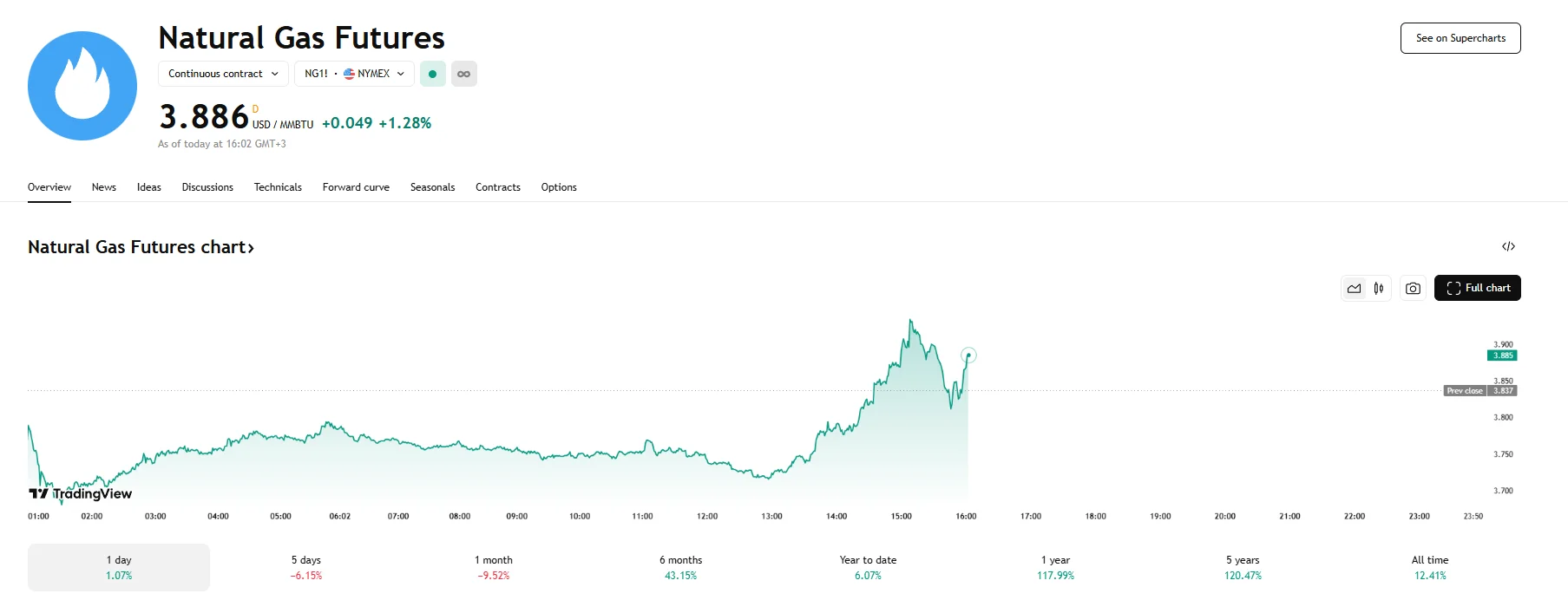

- US natgas futures managed to climb above the $3.80 threshold.

- West Texas Intermediate futures experienced a marked decrease on Monday, reaching $60.86 after a 1.82% fall.

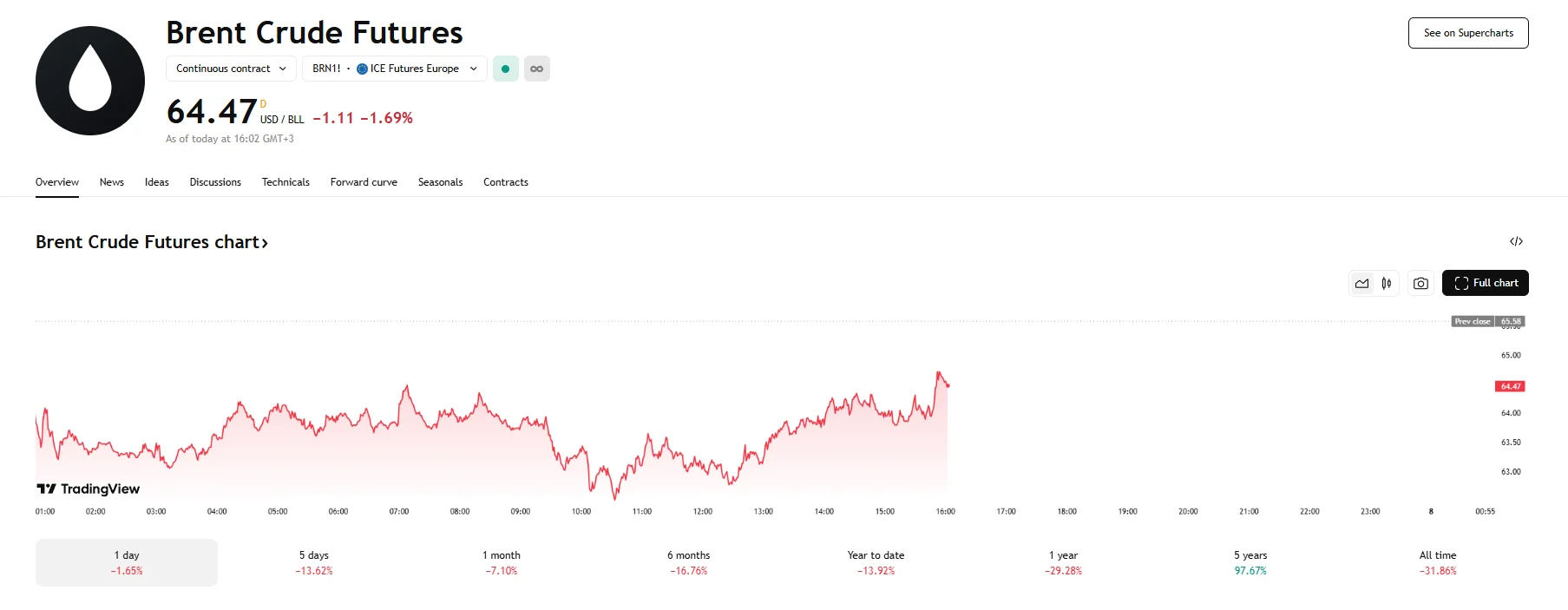

- Brent also saw a substantial decline, dropping by 1.69% to $64.47.

Recession Fears Weigh Heavily on Crude Oil, Natural Gas Demonstrates Resilience

United States natural gas futures experienced a volatile trading session, initially plummeting to a seven-week low beneath the $3.70 threshold before rebounding. US natural gas features registered a 1.28% increase and reached $3.886 per million British thermal units (MMBtu).

The earlier dip in natural gas prices can be attributed to growing concerns that an impending global recession, fueled by intensifying international trade disputes, would curtail overall energy consumption. While the latest data from the Energy Information Administration (EIA) indicated that natural gas storage levels remain below the historical average despite recent injections, the prevailing macroeconomic anxieties appeared to outweigh these supply-side fundamentals in the early part of the trading day.

Furthermore, while liquefied natural gas (LNG) exports reached a record high in March and overall output peaked recently, forecasts suggesting near-normal temperatures through mid-April may have also contributed to the initial downward pressure by tempering near-term heating demand expectations.

In stark contrast to natural gas’s late-day recovery, the crude oil market faced significant downward pressure. West Texas Intermediate (WTI) crude oil futures experienced a notable slump, falling by 1.82% to $60.86 per barrel. Similarly, Brent crude futures also witnessed a substantial decline, slipping by nearly 1.70% and breaching the $65 mark. This synchronized downturn in both benchmark crude oil prices pushed them to levels not witnessed since 2021.

The primary catalyst behind this crude oil sell-off was, once again, the mounting apprehension regarding a full-blown global trade war and its potential to trigger a widespread economic recession. The recent intensification of trade tensions, particularly the tariff tensions involving the US and China, has rattled investor confidence and fueled worries about a significant reduction in the global demand for crude oil. Major financial institutions like Goldman Sachs and Morgan Stanley have also lowered their oil price forecasts, reflecting the growing pessimism surrounding the commodity’s near-term prospects.