Key moments

- Wednesday saw Donald Trump announce 10% baseline tariffs on imports that are set to affect major U.S. trade partners.

- Some countries are grappling with higher tariffs. China’s levy has reached 54% in total, while Japan and the European Union are facing tariffs of 24% and 20%, respectively.

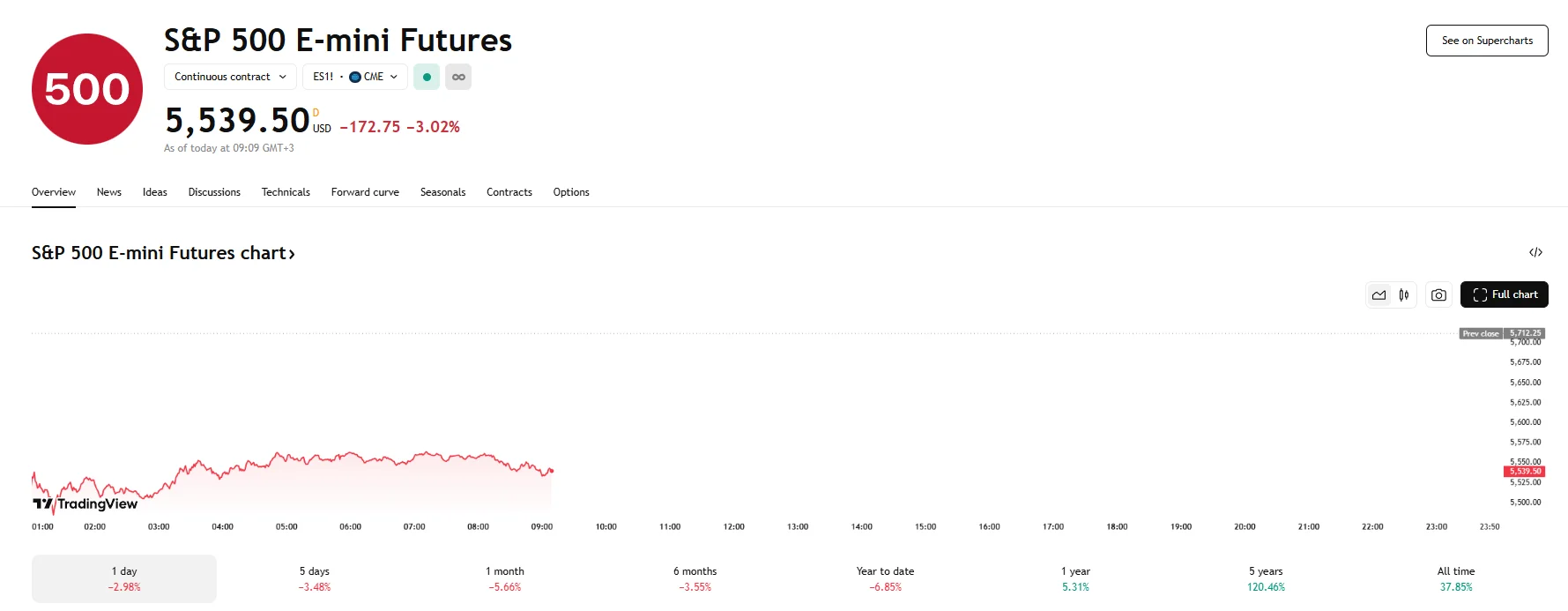

- U.S. markets reacted sharply, with futures tied to major U.S. indices experiencing declines.

Newly Announces Duties Rock Global Markets

President Trump’s Wednesday declaration of a 10% tariff imposition on the majority of goods entering the United States, coupled with significantly higher duties aimed at numerous global trading partners, shook international markets. The announcement, delivered from the White House Rose Garden, sparked immediate concern among economists and political leaders worldwide.

The most substantial tariffs were aimed at China, as the country was hit with a cumulative 54% duty, comprising a newly imposed 34% levy added to the existing 20%. This aggressive move against the world’s second-largest economy prompted immediate vows of retaliatory measures from Beijing. Traditional allies were also targeted; Japan confronts a 24% tariff, while the European Union faces a 20% levy. The base 10% tariffs are scheduled to take effect on April 5th, with the elevated reciprocal rates following on April 9th. President Trump justified the tariffs as a response to perceived unfair trade practices against the U.S., asserting that the new measures would stimulate domestic manufacturing.

The market’s initial optimism, which had briefly pushed stocks higher in anticipation of a less severe tariff announcement, quickly evaporated as the full scope of Trump’s policy became apparent. The reaction from financial markets was severe, with Dow Jones e-mini futures experiencing a 2.23% decrease on Thursday. Nasdaq 100 e-mini futures also plummeted, taking a nearly 3.5% plunge, and S&P 500 e-mini futures fell by 3%.

After-hours trading declines reflected investor fears of a looming trade war and its potential to destabilize the global economy. Companies with substantial international supply chains, particularly those reliant on Chinese manufacturing, saw sharp declines in their stock values. Apple, for instance, witnessed a significant drop. Other major firms, including Tesla, Amazon, Nike, and Walmart, also experienced substantial losses.

President of the European Commission Ursula von der Leyen expressed deep concern, predicting severe global economic consequences. Although the EU will pursue diplomatic efforts to amend the tariffs, Ursula von der Leyen pledged to implement countermeasures if no agreement is reached.

While Canada and Mexico were notably excluded from these new tariffs, they still bear existing 25% duties on various goods. Even within the Republican party, apprehension has surfaced regarding the administration’s trade strategy. Shortly following the tariff declaration, the Senate passed a bill to repeal tariffs on Canadian goods, though its prospects in the House remain uncertain.