Key moments

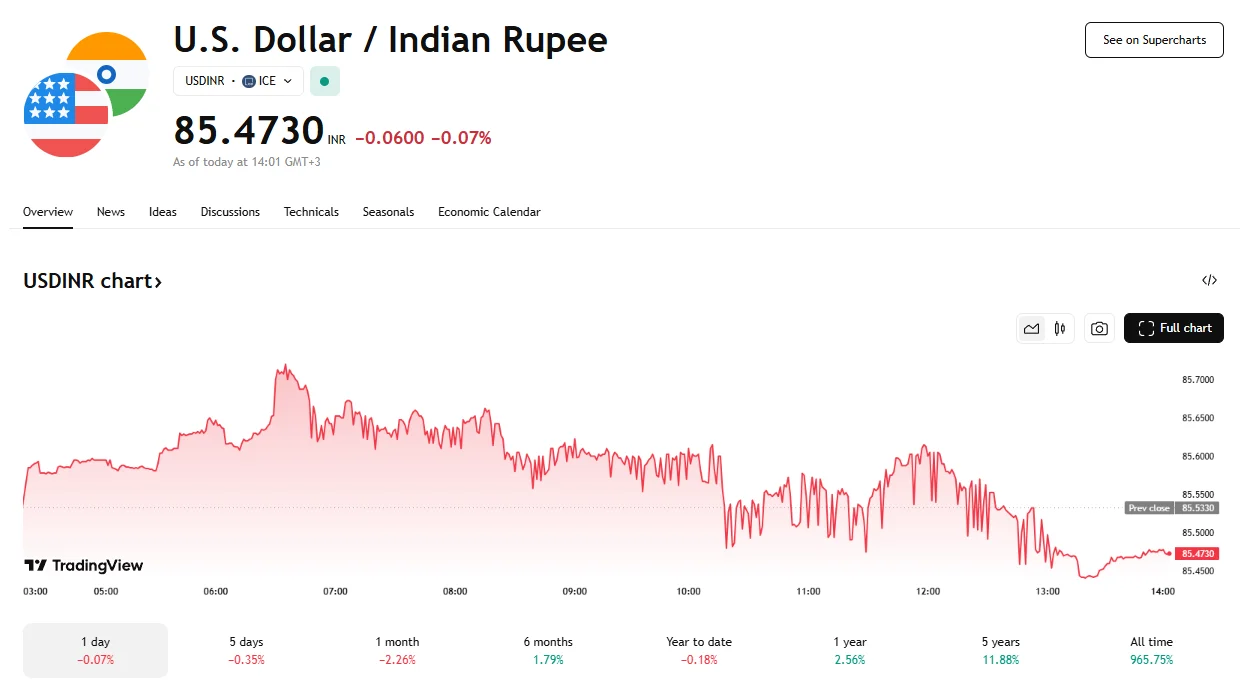

- Wednesday saw the USD/INR pair experience notable volatility, dipping to a 13-week low of around 85.40.

- Following the plunge, the pair rose to 85.47.

- President Trump’s upcoming tariff announcement has sparked significant currency fluctuations across the forex market.

Tariff Fears Drive Volatility

USD/UNR experienced a period of volatility on Wednesday, sliding to a 13-week low of 85.40. This marked a downturn of 2.27% over the preceding four weeks. However, the pair subsequently rebounded slightly, edging near 85.50, thereby mitigating its daily losses to a marginal 0.07%.

This fluctuation occurred amid heightened market anticipation as traders await U.S. President Donald Trump’s scheduled announcement of new tariffs. However, analysts at J.P. Morgan Private Bank suggested that India’s economy possesses sufficient domestic strength to withstand the impact of U.S. tariffs better than many other emerging markets. They also noted that a bottoming-out of economic momentum was anticipated.

The rupee’s recent performance had been notably strong, with the currency rallying by approximately 2% against the dollar over the preceding two weeks, effectively reversing its year-to-date losses. Simultaneously, the Reserve Bank of India’s (RBI) upcoming policy meeting on April 9th remained a focal point for market participants.

The RBI cut interest rates by 25 basis points in February, and the bank has been making consistent efforts to inject liquidity into the banking system, amounting to roughly $64 billion in recent months. These moves were viewed as a measure to facilitate the transmission of rate cuts into the broader economy, and according to a recent Reuters poll, economists are largely in agreement that further rate cuts will follow in April and August.

As for the U.S. Dollar Index, it continues trading above 104.000, but anticipation of Trump’s “Liberation Day” tariffs generated a sense of unease when it comes to forex trading and other corners of the market. Analysts at MUFG Bank suggested that the announcement of sweeping tariffs, particularly those targeting major trading partners with rates of up to 25%, could trigger a significant “risk-off” reaction.